Global Financial Crisis 10 Years On: Gold Rises 100% from $650 to $1,300

Commodities / Gold and Silver 2017 Aug 23, 2017 - 04:47 PM GMTBy: GoldCore

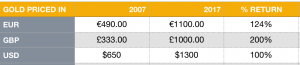

– Gold up over 100% in major currencies since financial crisis

– Gold up over 100% in major currencies since financial crisis

– Gold up 100% in dollars, 124% in euros and surged 200% in sterling

– Gold has outperformed equity, bonds and most assets

– Gold remains an important safe-haven in long term

Gold prices from August 9th 2007 to August 9th 2017

It has been ten years since the global financial crisis began to take hold. At the time few would have known that BNP Paribas’ decision to freeze three hedge funds was the signal for the deepest recession in living memory and a near-collapse of the financial system.

As the French bank blamed a “complete evaporation of liquidity” on its decision the ECB flooded its the market with billions of euros of emergency cash as it worked to prevent a seizure in the financial system.

Very few realised how much the financial and investment landscape was set to change.

In the proceeding decade we have seen unprecedented intervention by central banks which in turn has created a punishing financial landscape for savers and investors.

For those who were unfortunate to experience bank bailouts first hand or a collapse in a housing market, an instant lesson was learnt about the importance of protecting your savings.

That would have been a savvy lesson to learn. Any investors feeling the ripples of the financial crisis and looking to protect their wealth may well have looked to gold as an option. By adding gold to their portfolio they would currently be looking at some extremely healthy returns.

For those who were slower on the uptake of portfolio protection, they still would have benefited from gold’s decade climb and its performance alongside other major asset classes.

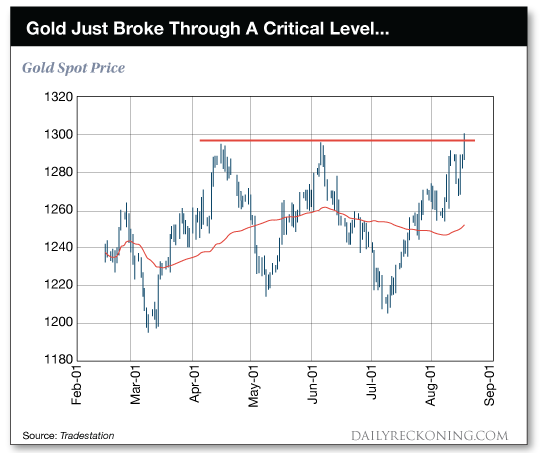

Gold’s decade long climb

Gold continues to be dismissed by the mainstream as an important asset-class for investors. However the decade long-climb for the precious metal is example enough of it’s strong performance against a backdrop of financial and political turmoil.

The yellow metal has outperformed a number of key assets and is up at least 100% in major currencies.

Gold price up by over 100% in major currencies

Gold priced in sterling, euro and (US) dollar is up by at least 100%. Gold in a sterling a whopping 200%.

In contrast many major asset classes have not performed to the same extent, or met expectations.

For example, MSCI’s main world equity index might currently be on course for its longest monthly winning streak since 2003, but this is only 22% above levels in 2007.

Plus, as central banks actively stockpiled bonds, yields on 10-year government debt benchmarks have more than halved.

In the decade since the financial crisis gold has been one of the top performing assets. The table below shows the best performing asset classes in the last ten years.

It is clear to see that gold (when priced in sterling) has outperformed the majority of bonds and many equities (when priced in dollar and euro). The precious metal has held its own throughout a decade of financial confusion and distress.

This should come as no surprise to gold investors who are aware of gold’s ability to act as a long-term safe haven during times of crisis.

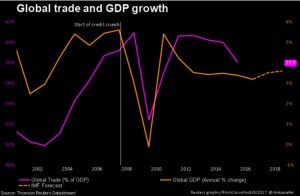

What is most interesting about the last ten years however is that the mainstream media and politicians are keen to promote the idea that the crisis is over. Yet, in many instances the situation is the same or, arguably, worse.

The financial environment is still an unattractive one for the average investor and saver.

A huge amount of leverage remains in the system, stocks are at unsustainable highs and geopolitical risks grow by the day.

It is clear to see that the global recovery is not the win that so many governments wish us to believe.

Was cash king?

For many savers, the idea of investing in markets following the financial crisis may have seemed too risky. Instead they may have opted to hold cash than they would have previously.

In times of crisis many argue that cash is king. This has certainly been evident in the short-term. However those who decided to hold cash over the last decade, as a form of insurance, will be hurting today.

A saver putting away £5,000 each year into the average UK savings account over the last decade would have only seen their savings grow by a stomach-churning 1.2% to £50,619.

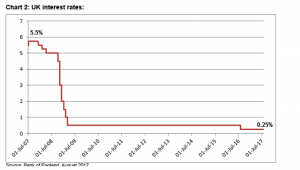

Cash has been significantly devalued thanks to ongoing monetary easing programs by central banks. Savers have also lost out massively due to record low interest rates.

Low interest rates have been good news for borrowers. Rates have been low for so long that we are now faced with a generation of borrowers who have never experienced an interest rate rise.

For the UK we have not see interest rates above 5.5% for over ten years. This is great for those looking to get on the housing ladder or borrow for university but this will not be the norm.

Savers who have already been pushed through low rates may soon see further punishment once rates begin to rise and borrowers can no longer service their debts. How banks will cope is a question few people are able to answer.

Low interest rates are not the only impact from the financial crisis on cash savers. Negative rates are the true issue along with bank bail-ins of which few people are aware.

To see more on how well gold has performed next to cash, see our recent coverage.

Counterparty risk: the only lesson to be learnt

Gold has stood strong and held its own in the face of pumped up asset classes, low interest rates and increased risk. This is largely thanks to its sovereignty in the marketplace.

As we have repeatedly stated gold carries little counterparty risk and serves as a form of financial insurance whilst the walls of both the political and financial system grow increasingly weak.

It is a myth that the worst of the financial crisis is over. The trigger to the collapse may well be different to that which took place a decade ago but the situation is very similar. Gold’s long-term rise and strong performance is not over as sadly the financial and geopolitical crises are still ongoing.

Gold Prices (LBMA AM)

23 Aug: USD 1,286.45, GBP 1,004.33 & EUR 1,091.68 per ounce

22 Aug: USD 1,285.10, GBP 1,000.71 & EUR 1,091.95 per ounce

21 Aug: USD 1,287.60, GBP 999.82 & EUR 1,096.52 per ounce

18 Aug: USD 1,295.25, GBP 1,004.34 & EUR 1,102.65 per ounce

17 Aug: USD 1,285.90, GBP 998.12 & EUR 1,096.74 per ounce

16 Aug: USD 1,270.15, GBP 985.13 & EUR 1,082.29 per ounce

15 Aug: USD 1,274.60, GBP 986.92 & EUR 1,084.05 per ounce

Silver Prices (LBMA)

23 Aug: USD 17.06, GBP 13.32 & EUR 14.48 per ounce

22 Aug: USD 17.02, GBP 13.27 & EUR 14.48 per ounce

21 Aug: USD 17.02, GBP 13.20 & EUR 14.48 per ounce

18 Aug: USD 17.15, GBP 13.30 & EUR 14.60 per ounce

17 Aug: USD 17.02, GBP 13.23 & EUR 14.55 per ounce

16 Aug: USD 16.68, GBP 12.96 & EUR 14.25 per ounce

15 Aug: USD 16.89, GBP 13.12 & EUR 14.38 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.