The 3 Assets to Add to Your Stocks Portfolio in This Rate Tightening Cycle

Companies / Investing 2017 Aug 23, 2017 - 05:23 AM GMTBy: John_Mauldin

BY STEPHEN MCBRIDE : I’m surprised how things can turn upside down in a year, even twice.

BY STEPHEN MCBRIDE : I’m surprised how things can turn upside down in a year, even twice.

Exactly a year ago, in the wake of Brexit, the US 10-Year Treasury rate fell to an all-time low of 1.36%. At that point, bond yields—which move inversely to their price—had been declining for eight years with no end in sight.

Then Trump won the US election; another unexpected twist. An uptick in inflation and a series of rate hikes followed shortly afterward, and the 10-year yield has risen 67% from its lows.

While it’s not the best time to increase your allocation to bonds, there are a few asset classes that are likely to thrive in this tightening cycle.

#1 Healthcare Stocks

Healthcare was the worst-performing S&P 500 sector in 2016 and ended the year in the red. However, since the beginning of 2017, the sector is up 16.2%.

And the future looks bright.

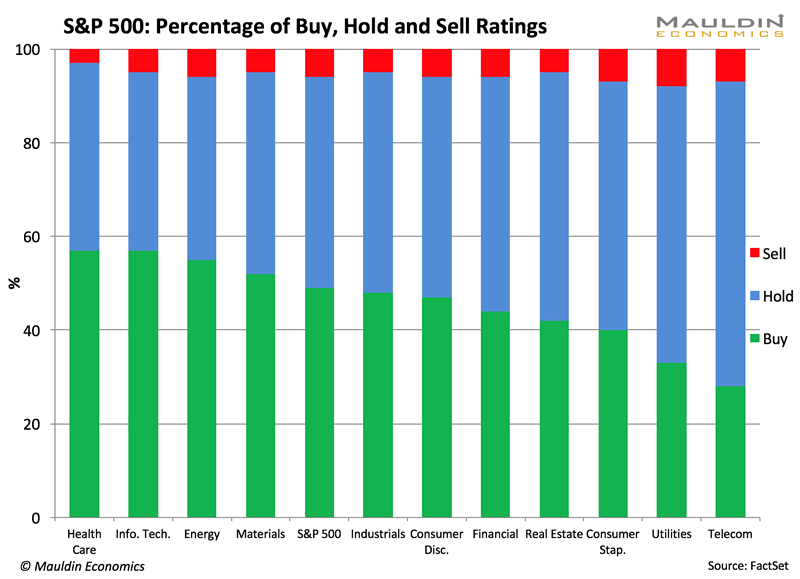

In their latest Earnings Insight report, FactSet found that of all the sectors, healthcare received the most bullish ratings from analysts for Q3 2017.

Another healthcare “bull” is Steve Cohen, a billionaire hedge fund manager who has achieved annual average returns of 30% for two decades. His firm’s latest quarterly SEC filing shows healthcare stocks made up 19% of the portfolio.

So, why are investors bullish on healthcare stocks after years of underperformance?

One reason is the rising interest rate environment.

According to BCA Research, since 1970, the sector has always outperformed the market during hiking cycles.

Fidelity Investments also found that healthcare has consistently outperformed in late-stage expansions. Given that we are in the ninth year of this expansion, it certainly can be considered “late stage.”

Besides top-down factors, the sector also has superior earnings-per-share growth—a driver of long-term equity returns.

#2 Europe

Just a year ago, Europe looked like the last place you’d want to put your money in. The UK had voted to leave the EU, top German and Italian banks were wobbling, and populist sentiment reigned on the Continent.

Most of those risks have subsided—at least for now. While everyone was applauding the uptick in US growth after the election, Europe recorded higher growth in 2016.

Ditto with stock indices.

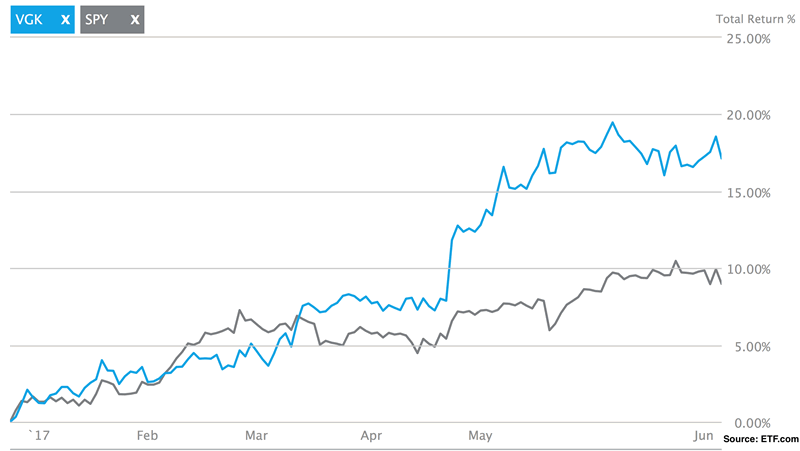

After the election, most investors have flocked to US equities. And it was the right move. From the election until December 31, the S&P 500 gained 8.2%. However, since the beginning of 2017, the Vanguard FTSE Europe ETF (VGK)—the main ETF for the European market—is up twice as much as the SPDR S&P 500 ETF (SPY).

And now Europe’s performance has drawn the interest of major money managers—which is a bullish signal in and of itself.

In March, JPMorgan stated it was overweight Europe due to solid economic momentum and fading political risk. In a recent outlook, Credit Suisse said Europe was its “most preferred region,” citing attractive valuations as the reason.

Despite improving fundamentals and strong performance, EU stocks remain relatively undervalued. For example, the Shiller P/E ratio is 55% lower for EU stocks than for their US counterparts.

Given the positive outlook and rising prices in Europe—and with the S&P 500 flat since March—investors are likely to start pouring money into Europe.

#3 Peer-to-Peer Lending

Another asset class that has enjoyed a recent resurgence is peer-to-peer (P2P) lending.

The P2P sector has grown rapidly in recent years and is a great source of fixed income for investors. P2P investors are currently averaging 7.3% returns on 36-month loans. Even those who took the most conservative approach saw returns of 5%.

What started as peer-to-peer has grown into a marketplace for some of the world’s largest financial institutions. The likes of Goldman Sachs and Morgan Stanley now account for over 70% of new capital. Goldman recently launched its own lending platform named Marcus, making it the first major bank to do so.

Aside from the outsized returns investors can earn, P2P also offers diversification benefits.

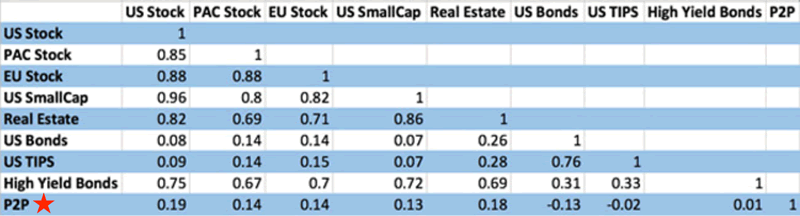

The grid below shows the correlation of different assets to the US stock market. An investment with a correlation of 1 would exactly track the volatility of the US stock market. As you can see below, P2P lending’s correlation to the US stock market is just 0.19.

Of course, P2P lending comes with its own set of cautions. As P2P investing really only started to gain momentum in 2009, the platforms are largely untested in a serious and sustained economic downturn.

Given this and the fact that P2P loans are unsecured, you must be fully aware of how to enter this market and steer your way through it.

Free Report: The New Asset Class Helping Investors Earn 7% Yields in a 2.5% World

While the Fed may be raising interest rates, the reality is we still live in a low-yield world. This report will show you how to start earning market-beating yields in as little as 30 days... and simultaneously reduce your portfolio’s risk exposure.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.