The Peak of Globalization and The Reason Trump Won

Politics / Global Economy Aug 20, 2017 - 12:45 PM GMTBy: Harry_Dent

Fareed Zakaria just put out a special show on why Trump won: He got the rural white vote in unprecedented margins – like 80% plus. Even before Election Day, we put out an infographic explaining why Trump could win despite the polls. Still, even I was a little surprised when he won!

Fareed Zakaria just put out a special show on why Trump won: He got the rural white vote in unprecedented margins – like 80% plus. Even before Election Day, we put out an infographic explaining why Trump could win despite the polls. Still, even I was a little surprised when he won!

I bring this up again now, not to bash Trump, but to highlight the demographic and cyclical explanation behind his victory. And to show that the events that brought Trump into power aren’t done stirring things up. There’s a lot more to come. Trump is only the beginning…

My father was a major political strategist at the state and national level. In fact, he was the architect of the “Southern Strategy.” He got Nixon elected in 1968 with a campaign that touted a vote for Wallace (the strong third-party candidate in the conservative South) was a vote for Humphrey, one of the more liberal candidates ever. He used his uber-conservative senator ally, Strom Thurmond, who he managed his campaigns for over a decade, to counter the southern conservative voters to back Nixon as a counter to Humphrey.

My father told me when I was a kid, that it wasn’t the average voter that decides elections. Rather, it was the swing vote – 15% to 20% – what he called the “all-star wrestling fans.” And don’t think this was meant as an insult. He loved watching the wrestling shows. He loved the drama and the everyday entertainment. I never saw him laugh as much as when he was watching.

I found later in my demographic research that 16% of people regularly watch all-star wrestling… that was an “aha” moment for me.

Globalization Has Reached its Peak

We have been documenting for many years that the top 20%, and more so the top 1% and 0.1%, have been dominating the income and wealth gains since the 1990s, much as they did in the early 1900s into the 1929 peak. Back then, the top 1% controlled 50% of the wealth.

This is simply not sustainable! You can’t have the generals advancing without the troops.

That peak in stocks and the economy in late 1929 led to the Great Depression… and as few have fully noticed, the middle class rose out of that deflationary crisis because it favored them over the upper class for decades, especially from 1945 forward.

And that same pattern will repeat this time around as well, according to my 80-Year Four-Stage Economic Cycle, which shows that we entered the Economic Winter Season in 2008. Central banks have been desperately stimulating to counter the effects of this season ever since. However, they can’t and won’t win this battle against the fundamental trends.

Debt and financial asset bubbles always favor the upper class that owns most of those financial assets. But when those bubbles burst, the rich get hit the hardest, even more than the everyday people, even though they’re the first to lose their jobs. The deflation that follows a burst bubble lowers the cost of living for everyday people and the upper class loses the most in financial assets that deflate.

Everyday people still feel the effects from wage competition with the likes of Asia and immigrants (legal and illegal). I’ve shown in many Economy & Markets articles and Leading Edge issues how the middle and lower middle class have lost in their real wage gains since 2000. This is why these people were (and remain) so angry, and why many voted for Trump.

This is the beginning of the next Civil War, as I outline in more depth in my up-and-coming book Zero Hour. It’s due out mid-November.

The red states and blue states can’t agree on political policies or much of anything else, and there’s a real chance we may see this country split. Europe faces the same potential, map-shattering, change, as does much of the rest of the world.

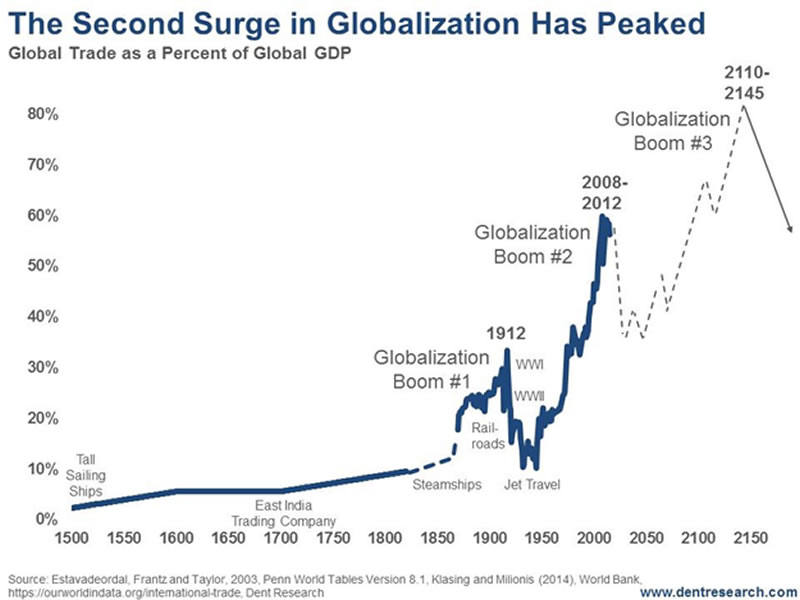

Globalization is peaking, and could retreat for a few decades, like it did from 1913 to 1945.

It’s been a major driver of growth since World War II. Look at this chart of global trade since the 1500s. It accelerated from the mid-1800s into World War I, then retreated for decades!

Now people are revolting again.

The everyday person isn’t revolting as much against the wealth of the rich as they are against the impacts of globalization…

The question now is: Is this the end of globalization, or just the pause that refreshes. I answer that question in Zero Hour. Be sure to get your copy when it’s released.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2017 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.