Will the Electric Car Revolution Sink Platinum and Palladium?

Commodities / Platinum Aug 20, 2017 - 12:26 PM GMTBy: Arkadiusz_Sieron

Everyone has probably heard about the upcoming electric car revolution whose vanguard is Tesla Motors led by Elon Musk. The electric car is actually nothing new – the first vehicles were produced as long ago as in the 1880s. However, the mass production of cheaper gasoline vehicles triggered by Henry Ford put electric cars into limbo for decades. But this can change quickly thanks to the rapidly falling costs.

Everyone has probably heard about the upcoming electric car revolution whose vanguard is Tesla Motors led by Elon Musk. The electric car is actually nothing new – the first vehicles were produced as long ago as in the 1880s. However, the mass production of cheaper gasoline vehicles triggered by Henry Ford put electric cars into limbo for decades. But this can change quickly thanks to the rapidly falling costs.

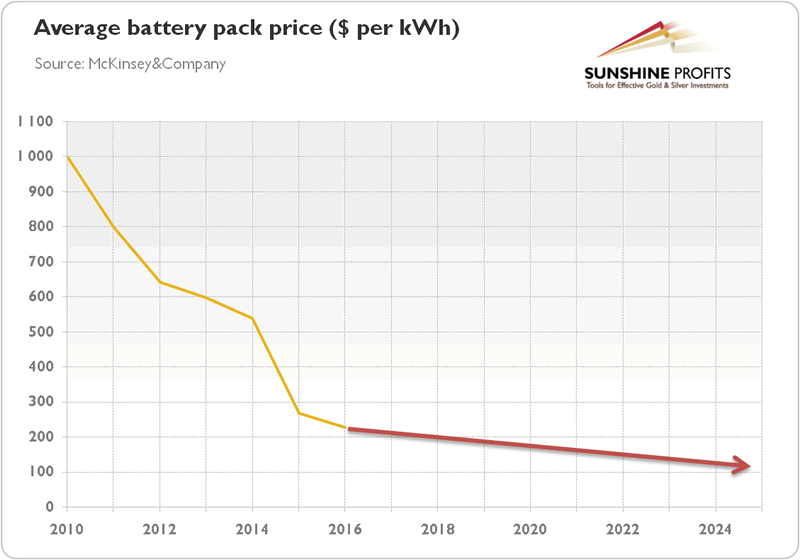

As one can see in the chart below, the price of a battery pack declined from $1000 per kWh in 2010 to $227 in 2016. The price of a Tesla battery pack is believed to be even lower now, at about $190. When battery pack prices fall below $100 per kWh, which is likely to happen around 2025, the sales of electric vehicles may soar, as such learning curves imply that electric cars will be cheaper to buy than traditional vehicles in most countries.

Chart 1: The average EV battery pack price ($ per kWh) since 2010.

Until then, the range and charging anxiety should be also overcome through a comprehensive charging network – once that happens, mass adoption should quickly follow. And investors should remember that although up-front costs are still higher, the per-mile fueling cost and maintenance costs are lower (most repairs are caused by the internal combustion engine), which should additionally support the shift toward electric cars.

Indeed, electric cars will account for 14 percent of global car sales by 2025, according to the UBS, while the Bloomberg argues that electric vehicles will reach 54 percent of new car sales by 2040. Stanford University economist Tony Seba is even more optimistic about electric vehicles: he believes that all cars will be electric (or hybrid electric) by 2025. Anyway, the age of electricity has begun: although electric vehicles account now for only a few percent of the automotive market (but in Norway electric or hybrid cars represented half of new registrations in the country so far in 2017) and there are still many problems, such as lithium-ion production capacity and the costs of batteries, plunging battery prices would accelerate the shift into electric cars.

The conclusion is clear: the relative performance of gasoline and diesel cars is much less important than the ongoing trend towards electric vehicles, as market shares both of diesel and gasoline vehicles are set to decline in the future. The gasoline vehicles will suffer less, but they will be harmed too. Hence, the dominant demand source for both platinum and palladium is likely to enter a secular bear market. Thus, don’t hold your breath waiting for a rebound in platinum, as it was historically undervalued relatively to palladium. During paradigm changes historical relationships break up. It is more probable that palladium will follow platinum after a while than vice versa, as the automotive demand for the former metal will also decrease, but later and by a smaller percentage. Assuming that the Bloomberg’s forecast is realized, the global market share of diesel vehicles will plunge by about 75 percent until 2040 (from about 20 percent to 5 percent), while the global market share of gasoline share will sink only about 50 percent, from about 80 percent to 40 percent.

One could say that since the automotive sector accounts for about 80 percent of demand for palladium and for about 40 percent of demand for platinum, the former metal may actually be hit harder in the long-run. However, it would be the case under a scenario of flat total automotive sales. But with the 33-percent expected increase in new light duty vehicle sales overall by 2030, platinum is likely to suffer more. One thing is clear: although there may be some short-term volatility, neither platinum nor palladium look as attractive as a long-term investment as does gold.

While the platinum-group metals (we mean here platinum, palladium, but also rhodium) are likely to be the biggest losers (according to the UBS, the demand for them would decline by 53 percent in the world with only electric cars), other metals will benefit from the revolution. Clearly, lithium demand will soar, as most electric vehicles use lithium ion batteries (however, investors should remember that lithium is relatively abundant, while scientists are already working on solid-state batteries which do not have to rely on lithium). The same applies to cobalt and manganese. The production of each of these metals is expected to rise more than 100-fold from 2015 to 2023, while the demand for graphite, nickel and aluminum are forecasted to soar about 65 times in that period. The market in rare earth elements, neodymium in particular, could also rise.

The gold market and silver market should not be significantly impacted by the upcoming changes in the automotive sector, unless silver-zinc technology becomes the standard for electric car batteries. However, electric car revolution could affect the silver demand indirectly, through making solar energy more competitive (charging an electric vehicles could optimize the use of solar electricity). This is important because solar panels use silver for the electrical conductivity.

There is one important caveat to our analysis: predicting technological revolutions is prone to error. The pace of transition to the electric cars may be quicker than expected, but may be also slower due to the lithium-ion batteries’ energy density limitations or range reasons. And the negative impact on the platinum-group metals may be less severe, as the electric revolution will not displace traditional powertrains, which uses platinum or palladium autocatalysts in the medium and heavy truck markets. Another issue is that only electric battery vehicles are the threat for precious metals, while hybrid cars still need them (and at the end of 2016 the latter accounted for about 40 percent of all electric cars). Finally, we cannot exclude that the fuel cell technology, which uses a lot of precious metals, will not develop sufficiently to support the demand for platinum or/and palladium. Hence, although the long-term implications of the electric car revolution for the precious metals market seem to be huge, the near and medium-term the impact may be limited.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.