Four Maps That Show How Russia Could Strike Back Against US Sanctions

Politics / Russia Aug 05, 2017 - 04:02 PM GMTBy: John_Mauldin

BY GEORGE FRIEDMAN, XANDER SNYDER, EKATERINA ZOLOTOVA : The US Congress has passed new sanctions targeting Russia’s energy companies.

BY GEORGE FRIEDMAN, XANDER SNYDER, EKATERINA ZOLOTOVA : The US Congress has passed new sanctions targeting Russia’s energy companies.

Recognizing that a vital sector in its economy has even less chance of relief than it once had, Russia has retaliated. It has reduced the number of diplomats it has in the US and has seized property used in Russia by US diplomats.

Energy sales are an important source of revenue in Russia. But it’s more than that. For Russia, energy is also an instrument of geopolitical power. They give Moscow considerable influence over the countries dependent on Russian energy exports.

If Russia retaliates further against the US, its energy supplies—especially those it sends to Europe—may be its best option to do so.

A Look at Europe’s Dependence on Russian Energy

The European Union imports 53% of the energy it consumes.

This includes 90% of its crude oil and 66% of its natural gas—a higher percentage than most other regions of the world, including North America, East Asia (but not Japan), and South Asia. All told, energy accounts for 20% of all EU imports.

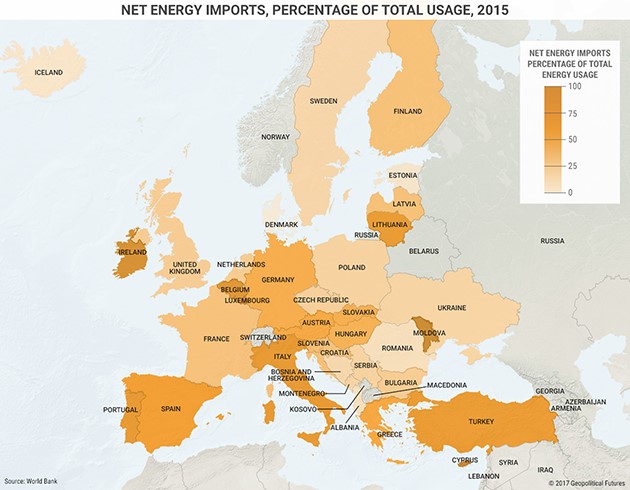

However, some countries rely more on energy imports than others (see the map below).

Most European countries import more than 30% of the energy they consume. Norway provides roughly 35% of these imports, while Russia provides roughly 40%.

Germany, which boasts the largest economy in the EU, imports more than 60% of the energy it consumes, and France, which boasts the third-largest economy, imports about 45%.

Some Eastern European countries are even more dependent on foreign energy.

Hungary, Austria, and Slovakia import approximately 60–65% of their energy needs. Bulgaria, the Czech Republic, and Romania, however, import less (37%, 32%, and 17%, respectively). In the Baltics, Lithuania imports roughly 75% of the energy it consumes. Latvia imports 45% and Estonia imports 9%.

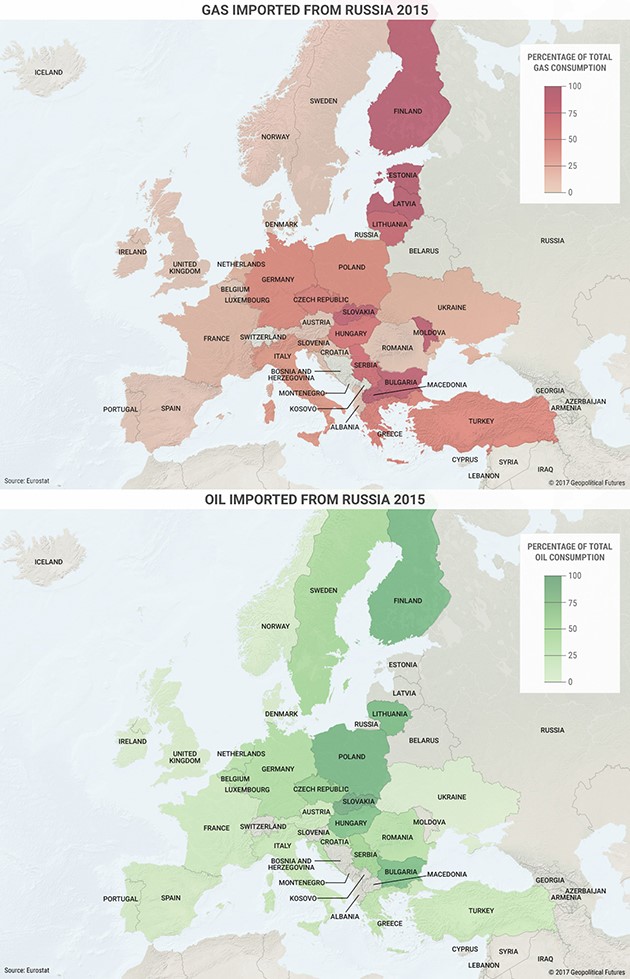

Most of this energy comes from Russia.

In fact, Russia provides more than 70% of the oil and natural gas used in Bulgaria, Latvia, Lithuania, Hungary, Slovakia, and Finland. It provides 62% of the natural gas and 56% of the oil used in the Czech Republic, and 53% of the natural gas and 90% of the oil used in Poland.

Russia’s Biggest Leverage Against the West

Cultivating this dependency is a conscious move on behalf of Russia.

Russia’s core security imperative is to maintain a buffer space between it and Western Europe that would help it repel any invasion.

Russia is not as powerful as it used to be, but it has developed economic leverage that allows it to exert pressure over countries that could pose a danger to it by threatening their energy security.

Aware of potential ramifications, these countries started to diversify their energy sources. Poland and Lithuania have begun to import liquefied natural gas from the United States.

Multiple Interests That Don’t Align

France and Germany—leaders of the European Union—illustrate how Russian energy can shape foreign policy.

France may rely heavily on foreign energy, but most of its oil and natural gas comes from Algeria, Qatar, Saudi Arabia, and Libya—not Russia. France can therefore afford to be more aggressive and supportive of sanctions against Russia.

Not so with Germany, which receives 57% of its natural gas and 35% of its crude oil from Russia. Berlin must therefore tread lightly between its primary security benefactor, the US, and its primary source of energy, Russia.

This is one reason Germany has been such an outspoken critic of the recent US sanctions, which penalizes businesses in any country that collaborate or participate in joint ventures with Russian energy firms.

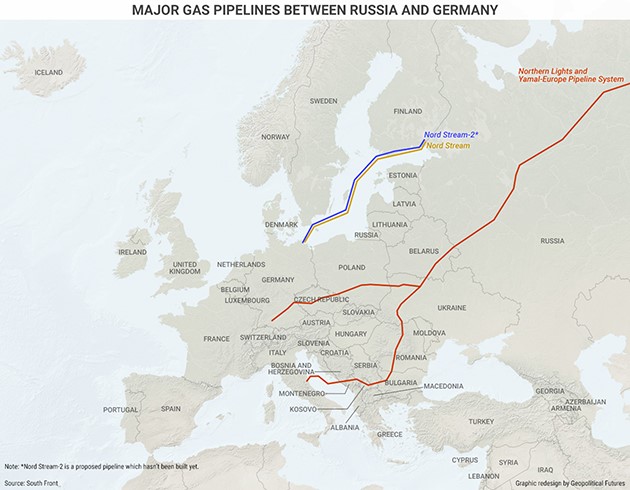

Germany supports the construction of Nord Stream 2, a pipeline that would run through the Baltic Sea, bypassing Ukraine—the transit state through which Germany currently receives much of its energy imports.

The pipeline would help to safeguard German energy needs, since it would allow Russia to punish Ukraine by withholding shipments of natural gas without punishing countries such as Germany further downstream.

But there is only so much Russia can do. Its geopolitical interests in Ukraine, for example, align with Germany’s energy interests. Germany would benefit from Nord Stream 2 by getting a new natural gas route, and Russia would benefit by gaining more leverage over Ukraine.

But Washington wouldn’t want Moscow to halt energy flows through Ukraine at its leisure. The US needs to try to manage the Ukraine situation in a way that prevents a greater general German-Russian alignment.

Plus, Russia cannot bully the United States with its energy exports. Washington doesn’t need them. But Russia could influence US allies if it chose to retaliate more than it already has.

Since the US is far more powerful than Russia, divide and conquer may be Moscow’s best bet.

Grab George Friedman's Exclusive eBook, The World Explained in Maps

The World Explained in Maps reveals the panorama of geopolitical landscapes influencing today's governments and global financial systems. Don't miss this chance to prepare for the year ahead with the straight facts about every major country’s and region's current geopolitical climate. You won't find political rhetoric or media hype here.

The World Explained in Maps is an essential guide for every investor as 2017 takes shape. Get your copy now—free!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.