Gold Consolidates On 2.5% Gain In July After Dollar 5 Monthly Decline

Commodities / Gold and Silver 2017 Aug 05, 2017 - 09:27 AM GMTBy: GoldCore

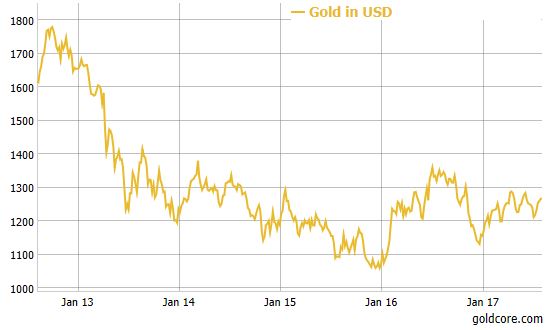

– Gold consolidates on 2.5% gain in July as the dollar has fifth monthly decline

– Gold consolidates on 2.5% gain in July as the dollar has fifth monthly decline

– Trump administration and vicious “civil war” politics casting shadow over America and impacting dollar

– All eyes on non farm payrolls today for further signs of weakness in U.S. economy

– Gold recovers from 1.7% decline in June as dollar falls

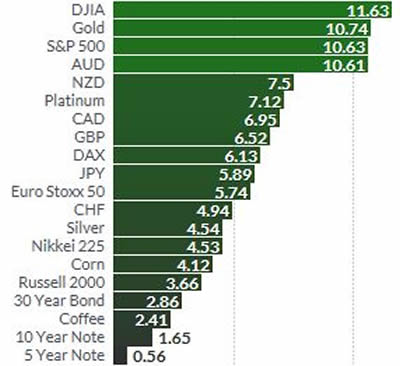

– Gold outperforms stocks and benchmark S&P 500 YTD

– Gold gains 10.8% versus 10.6% gain for S&P – led by frothy tech sector (see performance table)

– Gold outperforms stocks globally – Euro Stoxx 50 up 5.7% ytd, FTSE up 4.8% and Nikkei up 4.5%

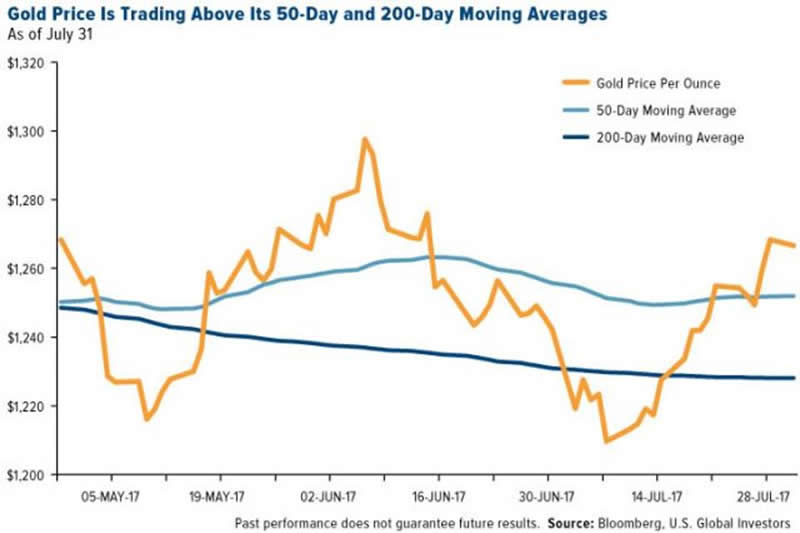

– Gold’s technicals increasingly positive; now trading above its 50-day & 200-day moving averages & looks set to target $1,300 again

Gold held steady today in Asian and European trading and was flat for the week, consolidating near the $1,270 per ounce level and the 2.5% gain seen in July.

It remains close to a seven-week high hit this week, as the dollar remains weak and vulnerable near multi-month lows after five consecutive months of declines.

The dollar index, which tracks the greenback against a basket of six major peers, is languishing near 15-month lows hit earlier this week.

“All eyes” are again on the monthly U.S. nonfarm payrolls data due today amid continuing very high levels of U.S. and global political uncertainty.

Traders awaiting July’s employment repor for clues about the health of the U.S. economy after recent data highlighted risks to the downside. This is underlining how difficult it will be for the U.S. Federal Reserve to raise interest rates – even from these historically low levels in the current range between 1% and 1.25%.

The complete mess that is the Trump administration and U.S. politics was underlined again this week.

Robert Mueller, the U.S. Special Counsel, has convened a grand jury investigation in Washington to examine allegations of Russian interference in last year’s contentious election and has started issuing subpoenas, according to sources familiar with the situation said on yesterday.

The dollar looks very vulnerable to further falls. Trump and the Republicans have seen repeated failures. These include overhauling healthcare. Now there is multiple congressional and federal investigations into President Donald Trump’s campaign.

This is casting a shadow over his first six months in office and the vicious “civil war” politics that the U.S. finds itself in is casting a shadow over U.S. politics and America’s place in the world.

Gold is performing very well this year and yet sentiment remains poor with little media coverage of gold’s robust performance year to date.

Gold has outperformed stocks and the benchmark S&P 500 YTD with gains of 10.8% versus a 10.6% gain in the S&P 500. Much of the gains are due to surge in prices in the increasingly frothy tech sector.

Indeed, gold is outperforming stocks globally – the Euro Stoxx 50 is up 5.7% ytd, the FTSE up 4.8% and the Nikkei up 4.5%.

Silver gained 1% in July and is 5% higher so far this year.

Gold’s technicals look very good and it now trading above its 50-day and 200-day moving averages and looks set to target $1,300 again this month.

A daily or weekly close above $1,300 per ounce should see gold make quick gains and challenge the intermediate high of $1,361/oz seen 13 months ago. Next levels of resistance are $1,380 and $1,416.

A failure to breach $1,300 in the coming days and weeks could see gold fall back to test very strong support at $1,200 per ounce.

Gold Prices (LBMA AM)

04 Aug: USD 1,269.30, GBP 964.92 & EUR 1,068.37 per ounce

03 Aug: USD 1,261.80, GBP 952.41 & EUR 1,064.96 per ounce

02 Aug: USD 1,266.65, GBP 956.83 & EUR 1,069.56 per ounce

01 Aug: USD 1,267.05, GBP 957.76 & EUR 1,072.30 per ounce

31 Jul: USD 1,266.35, GBP 965.59 & EUR 1,079.06 per ounce

28 Jul: USD 1,259.60, GBP 961.96 & EUR 1,075.45 per ounce

27 Jul: USD 1,262.05, GBP 960.29 & EUR 1,076.53 per ounce

Silver Prices (LBMA)

04 Aug: USD 16.70, GBP 12.71 & EUR 14.07 per ounce

03 Aug: USD 16.47, GBP 12.50 & EUR 13.91 per ounce

02 Aug: USD 16.67, GBP 12.60 & EUR 14.09 per ounce

01 Aug: USD 16.74, GBP 12.67 & EUR 14.17 per ounce

31 Jul: USD 16.76, GBP 12.77 & EUR 14.29 per ounce

28 Jul: USD 16.56, GBP 12.66 & EUR 14.15 per ounce

27 Jul: USD 16.79, GBP 12.77 & EUR 14.34 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.