Imminent Bank Failures- Credit Crisis Worst is Yet to Come

Stock-Markets / Credit Crisis 2008 Aug 23, 2008 - 05:28 AM GMT The deepening toll from the global financial crisis could trigger the failure of a large US bank within months, a respected former chief economist of the International Monetary Fund claimed Wednesday, fueling another battering for banking shares.

The deepening toll from the global financial crisis could trigger the failure of a large US bank within months, a respected former chief economist of the International Monetary Fund claimed Wednesday, fueling another battering for banking shares.

Professor Kenneth Rogoff, a leading academic economist, said there was yet worse news to come from the worldwide credit crunch and financial turmoil, particularly in the United States, and that a high-profile casualty among American banks was likely.

“The US is not out of the woods. I think the financial crisis is at the halfway point, perhaps. I would even go further to say the worst is to come,” Prof Rogoff said at a conference in Singapore.

Earlier this year, the FDIC stated that possibly 100 banks would fail this year. So far, only 8 have failed. Could the deluge come in the third or fourth quarter? The Conference Board of Leading Economic Indicators fell .7 in July , more than triple the forecast taken in a poll by Bloomberg. Separate reports today showed the number of Americans collecting unemployment insurance remained near a five-year high last week and manufacturing in the Philadelphia region shrank for a ninth straight month. This is not a good outlook for the economy.

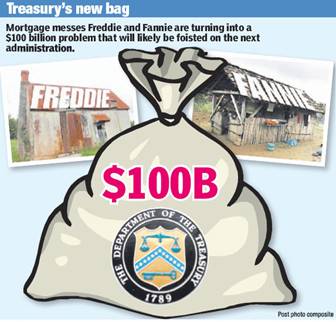

$100,000,000,000.00 needed to bail Fannie and Freddie out of trouble.

During the past week, investor confidence in Fannie Mae and Freddie Mac has dwindled amid rising speculation that government intervention is inevitable. Share prices have plunged, as Wall Street watches for any sign that the two companies are no longer able to roll over their debt. Fannie has about $120 billion of debt maturing through Sept. 30, while Freddie has $103 billion, according to figures provided by the government-chartered companies and data compiled by Bloomberg.

In a debt sale this week, Freddie Mac paid yields that had the highest spread on record over U.S. Treasuries. In Aug. 20 trading, Fannie Mae slumped 27 percent and Freddie Mac dropped 22 percent, extending its losses to 90 percent for the year. Fannie Mae declined $1.61 to $4.40, the lowest since 1989, in New York after falling as low as $3.95. Freddie dropped 92 cents to $3.25, the lowest level since 1990, and earlier in the day fell to $2.95.

The reason? Fannie Mae and Freddie Mac may need to raise as much as $100 billion in order to cover potential losses on their mortgage portfolios - a goal that might prove impossible to achieve, an analyst predicted.

Good-by stockholders…hello, Uncle Sam! Uh…I mean, taxpayers!

Slouching to Armageddon.

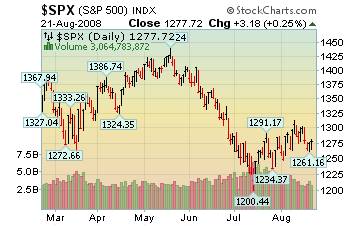

The Dow and S&P 500 rose on Thursday as surging oil prices drove up energy shares, though fresh fears of more credit losses on Wall Street kept gains modest and pushed the Nasdaq into negative territory.

The Dow and S&P 500 rose on Thursday as surging oil prices drove up energy shares, though fresh fears of more credit losses on Wall Street kept gains modest and pushed the Nasdaq into negative territory.

At Thursday's close, the S&P 500 Index was only 6% above the July low. This failure to thrive in the markets means that the lows will be tested again very soon. This is one rally to sell into, rather than hope for a miracle.

Are bond investors crazy to buy treasuries?

It has been observed in the past that, when stocks declined, bonds rallied, and vice-versa. The correlation between the cyclical patterns is getting too close for comfort to be able to make that call today.

It has been observed in the past that, when stocks declined, bonds rallied, and vice-versa. The correlation between the cyclical patterns is getting too close for comfort to be able to make that call today.

Carolyn Baum lays out the reasons that investors are buying treasuries today. Unfortunately, they may be a bit premature. The chart suggests much lower bond prices and higher yields sometime in the future. Anyone trying to reduce risk by buying anything but the shortest-term treasury bills may be asking for a beating from the market.

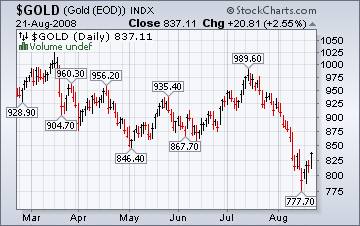

Gold has rallied, but the damage may be done.

Gold futures closed at their strongest level in almost two weeks Thursday, and other metals prices rallied, propelled higher by the U.S. dollar's tumble against other major currencies and strength in oil prices amid rekindled fears about the financial sector.

Gold futures closed at their strongest level in almost two weeks Thursday, and other metals prices rallied, propelled higher by the U.S. dollar's tumble against other major currencies and strength in oil prices amid rekindled fears about the financial sector.

Those of you who follow my comments know that 845-850 is a critical area for gold. The break two weeks ago did critical damage to gold's outlook. Today it was retesting that area. If it cannot rise above $850 per ounce, the chances are good for an even deeper decline.

The Nikkei is really on the edge.

Japan stocks fell for a third day, sending the Topix to the lowest in almost five months, on concern financial companies won't be able to raise needed cash and HSBC Holdings Plc said credit costs at domestic banks will rise.

Japan stocks fell for a third day, sending the Topix to the lowest in almost five months, on concern financial companies won't be able to raise needed cash and HSBC Holdings Plc said credit costs at domestic banks will rise.

Folks, we are only one bad day away from a major breakdown in stocks worldwide. The credit crisis has already spread to Japan and Europe .

Chinese shares gain on Wednesday, lose on Thursday…

…this is much ado about nothing. What should be pointed out is that the share prices on the Shanghai Exchange are now at the level that they were in 2006. And there may be more declines to come, but not before a potential rally in the Shanghai index. I still cannot tell whether it will be a substantial rally or not, but Shanghai is due for some relief.

…this is much ado about nothing. What should be pointed out is that the share prices on the Shanghai Exchange are now at the level that they were in 2006. And there may be more declines to come, but not before a potential rally in the Shanghai index. I still cannot tell whether it will be a substantial rally or not, but Shanghai is due for some relief.

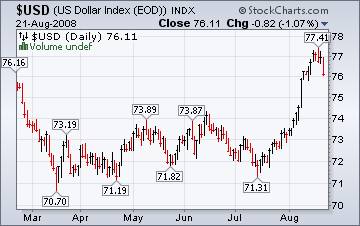

Is the rally over?

The answer may be more intriguing than you think. In short, no. The rally is due to recommence in the next few days. And it may not be over for several months, yet. The dollar bears are still hopeful for the next decline will wipe out the rally like a bad dream. Folks, that is not the earmark of a failure in the market. Remember, the bull climbs a wall of worry. There is still too much worry that the dollar will collapse. That sentiment must be totally crushed before the next serious decline takes place.

The answer may be more intriguing than you think. In short, no. The rally is due to recommence in the next few days. And it may not be over for several months, yet. The dollar bears are still hopeful for the next decline will wipe out the rally like a bad dream. Folks, that is not the earmark of a failure in the market. Remember, the bull climbs a wall of worry. There is still too much worry that the dollar will collapse. That sentiment must be totally crushed before the next serious decline takes place.

Intergenerational financial planning.

Seniors with liquid cash and who are looking for better returns on their money are adopting a new planning tactic, according to a local realtor/auctioneer. They are withdrawing their funds from the stock market and bank accounts and purchasing foreclosed properties at auction for their children and grand-children. The arrangement can be as simple as drawing up a land contract on which the younger generation pays for the house to more complex trust arrangements. The benefit to the retirees is an income stream that is more generous than bank accounts and even some bond funds...and possibly more reliable, too. There is always the issue of the property still falling in value, but it is probable that the largest hit in value has already been taken by the bank. The benefit to the next generation is they have an affordable property to own.

Seniors with liquid cash and who are looking for better returns on their money are adopting a new planning tactic, according to a local realtor/auctioneer. They are withdrawing their funds from the stock market and bank accounts and purchasing foreclosed properties at auction for their children and grand-children. The arrangement can be as simple as drawing up a land contract on which the younger generation pays for the house to more complex trust arrangements. The benefit to the retirees is an income stream that is more generous than bank accounts and even some bond funds...and possibly more reliable, too. There is always the issue of the property still falling in value, but it is probable that the largest hit in value has already been taken by the bank. The benefit to the next generation is they have an affordable property to own.

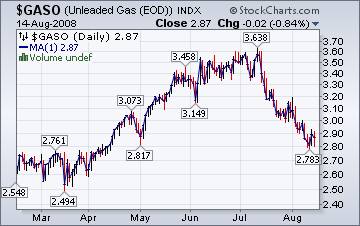

Why Oil won't go below $100?

Last week, falling oil prices looked unstoppable. The last few days have seen a halt in that slide. Still with prices well below the record set in July and a shaky world economy threatening demand, the question remains: How low can oil go?

Last week, falling oil prices looked unstoppable. The last few days have seen a halt in that slide. Still with prices well below the record set in July and a shaky world economy threatening demand, the question remains: How low can oil go?

Many analysts say oil is unlikely to go much lower than $100 a barrel, and it has to do with the rising cost of production. My reply to that is oil companies will still produce, but probably at a loss. There is a tremendous fixed cost that must be paid, even with cheaper products.

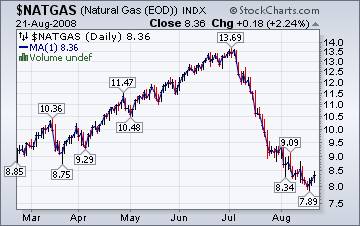

How do you spell relief?

The Energy Information Agency's Natural Gas Weekly Update tells. “ A reprieve from the summer heat in many areas of the country helped push spot prices lower on the week. The dampening of space-cooling demand in Florida , which was largely the result of Tropical Storm Fay, and the limited threat to offshore production areas contributed to price declines across much of the country. Furthermore, favorable weather conditions in high gas-consuming areas of the Northeast led to some significant price declines in that region on the week.”

Your ability to live the good life on plastic may be over.

For the past several years, the average inflation-adjusted total pay of American workers hasn't been increasing. That means we haven't been building a foundation for increases in our living standard. You might be tempted to say that by definition our living standard couldn't have increased, but that's not quite right. Even with stagnant real incomes, we can always live a little better every year through borrowing and pretending that our living standard is still rising, just as it was for decades.

For the past several years, the average inflation-adjusted total pay of American workers hasn't been increasing. That means we haven't been building a foundation for increases in our living standard. You might be tempted to say that by definition our living standard couldn't have increased, but that's not quite right. Even with stagnant real incomes, we can always live a little better every year through borrowing and pretending that our living standard is still rising, just as it was for decades.

Since credit card debt has been growing much faster than the economy - more than 8% in last year's third and fourth quarters and over 7% in May (the most recent month reported)- people are apparently using it as a substitute for income. Thus, for the past year or so we have still maintained the standard-of-living illusion.

The squeeze has already started, which is why Congress is in the process of passing the Credit Cardholders' Bill of Rights, which would prevent issuers from changing rates and terms without warning, among many other provisions. But bottom line, the credit card money window is going to start closing - and soon.

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.