Ethereum vs. Tangibleum: Why Cryptocurrencies Can Never Replace Physical Gold

Currencies / BlockChain Aug 03, 2017 - 03:17 PM GMTBy: HAA

Shannara Johnson : On June 11, 2017, Bitcoin reached its all-time high of $3,025.47… followed by a 27.7% plunge only four days later.

Shannara Johnson : On June 11, 2017, Bitcoin reached its all-time high of $3,025.47… followed by a 27.7% plunge only four days later.

By July 12, it had lost a total of $12 billion off its value within a month.

Ethereum, another popular cryptocurrency, increased its market share from a mere 5% at the beginning of the year to a breathtaking 30% in June, only to plummet 65% from its record-high by mid-July.

One man who wouldn’t be surprised in the least by this insane level of volatility is Raoul Pal, founder of the monthly investment publication Global Macro Investor and Real Vision television. He is convinced that Bitcoin and other cryptocurrencies are in a bubble and will blow up someday, because “anything that moves exponentially always does.”

A self-proclaimed former Bitcoin “evangelist,” Pal sold his entire position when the currency hit the $2,000 range, for a tenfold return on his investment. Now, he said in an interview at the recent Strategic Investment Conference in Orlando, Florida, he’s watching from the sidelines.

Here are the main problems with Bitcoin as Pal sees them:

1. Bitcoin is not a reliable store of value.

Bitcoin, by design, is limited to 21 million currency units. This arbitrary limit is what makes its value go up as more and more units are being mined. Turns out, though, the cryptocurrency is running into problems as it becomes too popular for its own good.

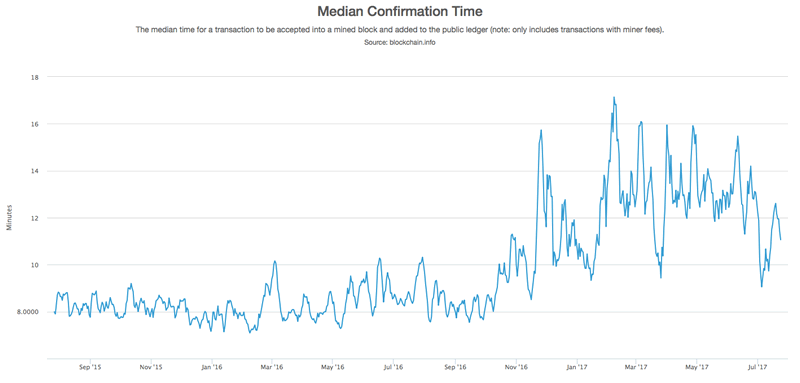

Bitcoin transactions have skyrocketed in the past years, but since they are being processed in 1MB-size “blocks,” the system has become so sluggish that a purchase might take hours to confirm.

Source: blockchain.info

As a result, rivaling factions in the Bitcoin community have proposed two different software updates to solve the conundrum, but the chances of finding a unanimous solution are slim.

Here’s where Bitcoin’s most coveted trait—the lack of central oversight—might become its downfall, because who will make the decision which method to adopt?

Apparently, the two factions are so at odds that some people call it a “civil war in the blockchain community.”

Raoul Pal does not approve of any of the two proposed alterations: “Now they’re talking about the hard forks changing it, and even if they don’t, the fact that they could, what does that mean in the future? Suddenly, we get to 21 million Bitcoins and they go, ‘No, we were only joking, we’ll print another 21 million.’”

Which, of course, would be the death knell for Bitcoin’s credibility.

How that compares to gold:

Unlike Bitcoin’s, the scarcity of physical gold is not an arbitrary one. Its availability is naturally limited by the number of new gold discoveries and the number of mines being built.

During gold price slumps like the one we saw from 2011 to 2016, very few mining companies will take on the arduous task of building a new mine, which can take five to eight years and several billion dollars, and assumes huge political and regulatory risk.

In gold bear markets, only the highest-grade gold can be mined economically and exploration budgets are slashed, further exacerbating the cycle. As a consequence, gold supply shrinks in years of low prices… and is slow to pick up again as the price rises.

According to figures from a 2013 gold report by Visual Capitalist, all the gold that has been mined throughout human history would fit into a 66-foot cube. Another mind-blowing number: the average grade of gold deposits is 1.01 gram of gold per metric ton of ore (1.01 g/t). That’s the weight of a paperclip or a quarter teaspoon of sugar.

Only 4.5% of all gold deposits in the world have more than 10 g/t. The highest-grade known deposit in the world—the Tau Tona deposit in South Africa—is 28 g/t.

2. Bitcoin is not the only fish in the pond anymore.

Aside from direct competitors like Ethereum, Pal points out that the Indians have already shifted to a cashless society. “This was the great Western Union/Swift payment system we were going to dump on Bitcoin. Well, India went and did it for 1.1 billion people. It’s 50 times faster than Bitcoin, and it’s rolled out and working now.”

If anybody can do it—and do it better and faster—then maybe it’s not that interesting, he concludes.

It looks like cryptocurrencies are becoming a dime a dozen. So far in 2017, there have been about 20 initial coin offerings (ICOs) per month. An ICO is the cryptocurrency equivalent of an IPO in stocks. That means approximately 140 new cryptocurrencies have been launched in 2017… and we’re not even at the end of the year.

Nonetheless, investors are still throwing money at these ICOs. If you had any doubt that cryptocurrencies may be in a bubble, this is a pretty convincing figure.

How that compares to gold:

Even though there are other precious metals like silver, platinum, and palladium, gold has no real competition.

Silver, for example, is typically a byproduct of other mining (gold, copper, zinc, and lead) and not as valuable as gold. To carry around $10,000 in silver would require a suitcase, whereas the same amount in gold fits conveniently into your pocket. And unlike silver, which has many industrial applications in which it gets used up, most of the gold that has ever been mined is still in existence.

Why is gold more popular than platinum or palladium? My guess is that it’s easy to identify by color, whereas the other two could be mistaken for silver. Also, platinum scratches more easily than 14-karat gold and therefore isn’t well suited for certain types of jewelry like rings.

Since antiquity, gold has always been the top choice in cultures where precious metals represented the medium of exchange—and it’s still the top choice as a crisis hedge around the globe.

3. Bitcoin’s blockchain technology will soon be like the Internet—everyone has it.

Looking at the recent developments in blockchain technology, says Pal, big corporations and industry sectors would rather develop their own private ledger systems than using Bitcoin’s public one. It’s entirely possible, he says, that a bunch of insurance companies might get together and create the “insurance blockchain.”

“The Bitcoin community always thinks everybody needs to be on this public ledger,” Pal says. “They don’t realize that they’re a solution looking for a problem. That’s not what everybody needs.”

And as more and more blockchain systems get rolled out, the technology, says Pal, will go the way of broadband and cloud computing, “where you have so many people competing that the value of blockchain technology goes to zero.”

Some investment pros believe that Bitcoin still has a long way to climb once hedge funds rush in—maybe reaching another fivefold return from Bitcoin’s June heights. Pal is skeptical, though: “I don’t know any hedge fund managers who would want to buy into an exponential move.” In any case, he says, “I don’t have the mindset to trade a bubble.”

How that compares to gold:

We already saw that gold is rare enough to be a true store of value. There’s no danger of it becoming ubiquitous, even if a dozen super-high-grade deposits were discovered tomorrow.

And here’s another important point I made in a recent article: If ever the lights go out—for example, due to an electromagnetic pulse, either as an act of war or through a strong solar flare—Bitcoin and Ethereum will vanish instantly. The physical gold you stashed away, on the other hand, will still be there and ready to use as needed.

Get a Free Ebook on Precious Metals Investing

Historically, precious metals prices rise in the fall months, so right now is a good time to add some physical gold at lower prices to your portfolio. But before you buy, make sure to do your homework first.

The informative ebook, Investing in Precious Metals 101, tells you which type of gold to buy and which to stay away from… how to spot common scams and mistakes inexperienced investors fall prey to… the best storage options… why pooled accounts aren’t safe places… and more. Click here to get your free copy now.

© 2017 Copyright Hard Assets Alliance - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable,

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.