Stock Market Levitation Continues... For Now

Stock-Markets / Stock Market 2017 Jul 27, 2017 - 01:54 PM GMT A closer look at the SPX shows that one more probe higher completes the Wave pattern. This morning’s SPX futures may have done the job already, but we await the open to see the result in the cash Index. There is a possible target where Wave v equals Wave I at 2492.42.

A closer look at the SPX shows that one more probe higher completes the Wave pattern. This morning’s SPX futures may have done the job already, but we await the open to see the result in the cash Index. There is a possible target where Wave v equals Wave I at 2492.42.

ZeroHedge reports, “The levitation continues with S&P futures pointing to - what else - another higher open while European stocks swung between gains and losses on the busiest earnings days of the year (85 of the Stoxx 600 report) which has seen European pharma giant AstraZeneca plunge 15%, the most on record, after its flagship lung cancer trial Mystic failed to show benefits, while Deutsche Bank slumped 4% on a 12% plunge in FICC revenue. Asian shares rose spurred by results and alongside a surge in China's small-cap ChiNext index which surged 3.6%, its biggest one day gain since last August, after earnings reports revealed that the Chinese "National Team" aka PPT had bought 2 ChiNext shares.”

NDX, on the other hand, isn’t as clear. It is forming an Ending diagonal pattern that may complete at 6000.00 or possibly 6025.00. The NDX futures show a probable Wave (iii) of [v] in the making this morning that is already approaching 5990.00. This would be a typical blow-off that registers as a throw-over above the 2-hour Cycle Top resistance at 5064.55.

VIX futures are down, but well above yesterday’s low.

Investopedia reports, “Investors are shocked after learning that a trader made the largest bullish wager in living memory on the VIX (CBOE Volatility Index), after the so-called fear gauge recently fell to its lowest level since 1993, according to The Wall Street Journal. By purchasing both call and put options, an investor set up a complex wager that could result in a maximum profit of $265 million and a maximum loss of $257 million, calculations provided by commodity trading advisor Dunn Capital Management reveal. “

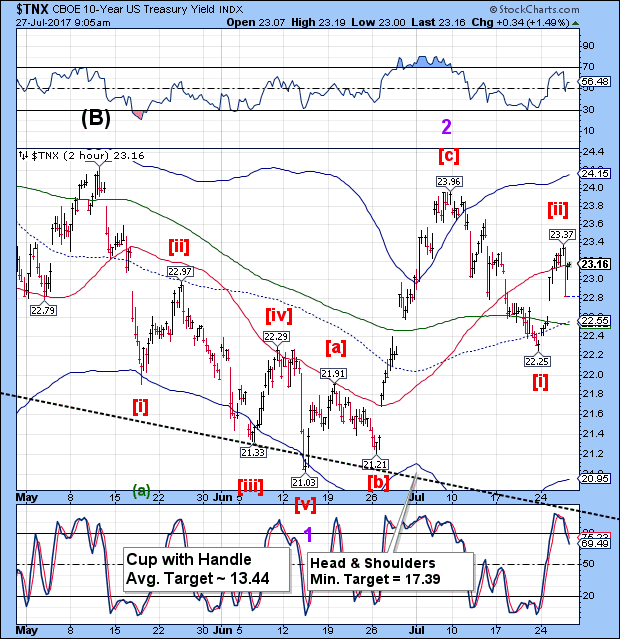

TNX bounced his morning. It appears that there may be more to this retracement. TNX has rallied back above its Short-term resistance at 23.16, suggesting another probe higher to complete the retracement rally.

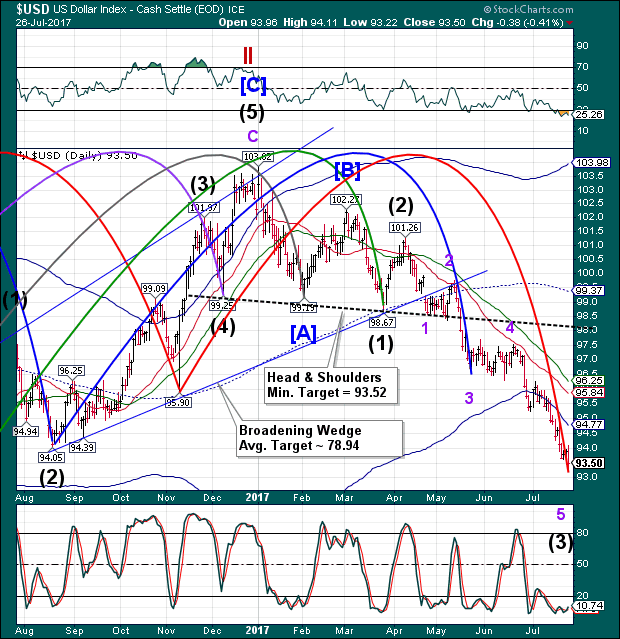

The USD is bouncing this morning, but Cycles tend to extend while beneath their Cycle Bottom. Those conservative bond investors should now be in cash. However, aggressive investors may wish to monitor the USD for yet another probe lower. A bounce to the Cycle Bottom at 94.77 may impel the USD even lower.

The speculators are crowding in on the short side which will make the rebound all the more powerful.

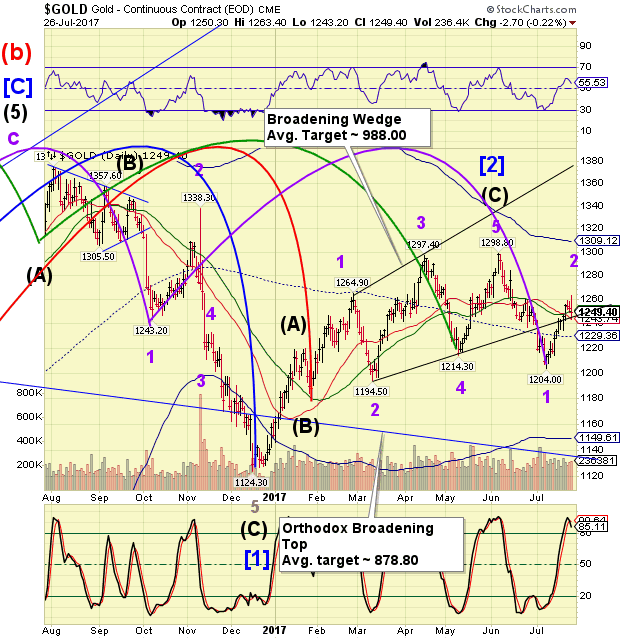

Gold futures are making a new retracement high this morning. It may extend through the end of the week and possibly early next week.

The next Master Cycle low is due at the end of August.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.