Bitcoin Price Close to All-time High

Currencies / Bitcoin Jul 26, 2017 - 02:39 PM GMTBy: Mike_McAra

The recent surge in Bitcoin is associated with the technical details of the currency and an agreement which avoids a fork for the time being. In an article on Business Insider, we read:

The recent surge in Bitcoin is associated with the technical details of the currency and an agreement which avoids a fork for the time being. In an article on Business Insider, we read:

Bitcoin has recovered somewhat from the drop in value seen last Sunday, with the price of the cryptocurrency reaching $2,701 at the time of this writing.

The stabilization seems to be the result of Bitcoin miners reaching an agreement on the enactment of the Bitcoin Improvement Proposal.

This agreement means the avoidance of a user-activated softfork (UASF), the possibility of which caused significant unease among investors.

This might just as well be the case since the uncertainty among potential investors might have receded. This might mean that investor confidence is back. Also, the implementation of the Bitcoin Investment Proposal 91 (BIP 91) might translate into increased interest in Bitcoin as it might alleviate the current problems with network capacity. On the other hand, this information might already be in the price. At the same time, we’re seeing stories on Bitcoin in mainstream media. This is a bearish indication as it suggests that a lot of the people potentially interested in Bitcoin might already be in the market and the buying power might be limited.

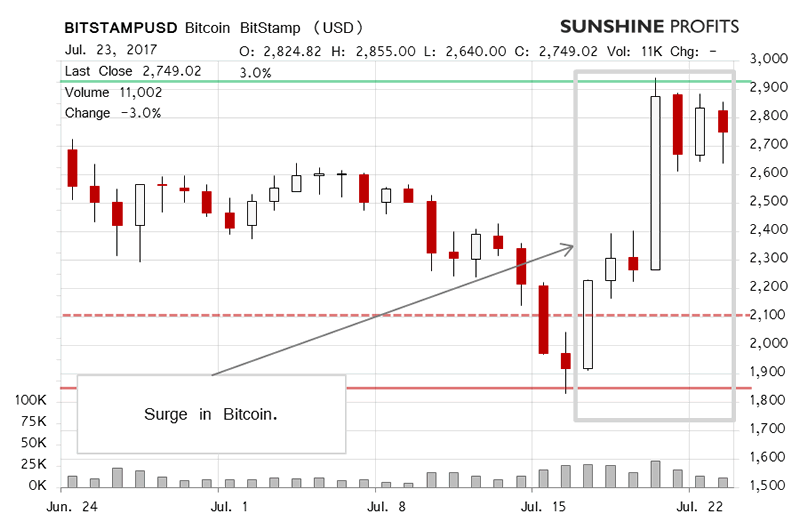

Extreme Move up

On BitStamp, we see the recent extreme move up, which brought Bitcoin close to $2,900. Recall our recent comment:

The rebound has continued so far (...) and our stop-loss was taken out earlier today. At the moment of writing these words, Bitcoin is not only above the 38.2% retracement ($2,182) but also above the 23.6% one ($2,487). This is a bullish development, at least at first sight, and the volume has been relatively strong so far. Not explosive, perhaps, but strong enough to make this move a plausible beginning of yet another move up.

What we wrote previously remains up to date. Bitcoin is still above the 23.6% retracement level. So far, the recent surge has bullish indications as Bitcoin tested the 50% retracement and very quickly shot up to the upside. We’re now quite close to the all-time high and the way Bitcoin is traded at this level (if it is reached) might be very important for the currency.

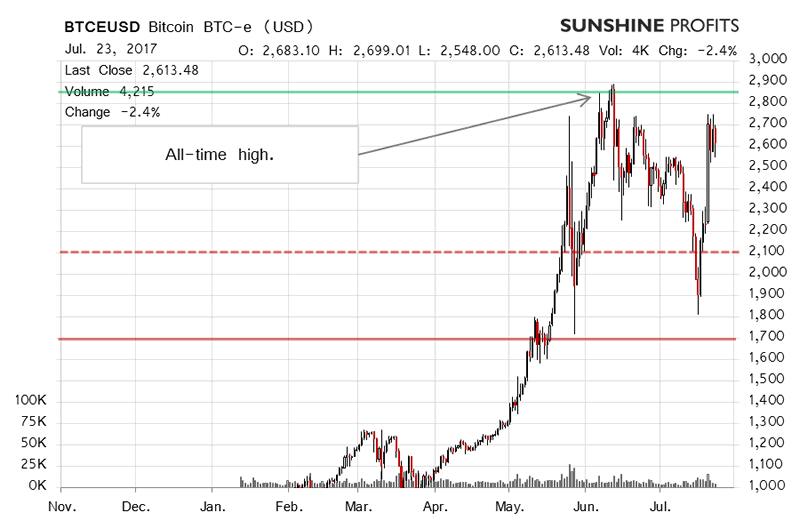

Important Territory

On the long-term BTC-e chart, we see the magnitude of the recent move to the upside. In our recent comments, we wrote:

We see a move below the 23.6% retracement level ($2,415). This is the first level that might trigger a much more serious decline, in our opinion. At the same time, the breakdown is not confirmed at the moment of writing these words and the volume on which the move has been unwinding hasn’t been particularly strong. All this means that we might actually be in the first stage of a significant slump. On the other hand, the risk of a bounce back to the upside is quite considerable. If we see a confirmed move down below 23.6%, we might have a shorting opportunity on our hands. (…)

This was followed by a move below the 38.2% retracement ($2,126) and even a brief move below the 50% one ($1,890). The fact that we saw an almost immediate rebound from this level and a move above the 38.2% and 23.6% levels in a matter of days is a very bullish indication. There’s one caveat here. The situation might seem bullish but we haven’t seen a confirmed move above the 23.6% level. So, the situation might change in a matter of hours now. Additionally, the current move is even more violent in terms of price than the recent all-time high was. With the volatility we’re seeing now, we wouldn’t be surprised to see a move to $3,000 and a re-test of the all-time high. At the same time, one daily close below 23.6% could turn the situation on its head to quite bearish. As such, we prefer to wait for an additional confirmation before considering a hypothetical position.

No change here as well. Right now, we might just as well see a move to the all-time high or even above it. How Bitcoin reacts to such a potential move could tell us a lot about the next couple of weeks/months.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.