Global Economic Rebalancing Signals US Dollar Bull Market

Currencies / US Dollar Aug 22, 2008 - 12:04 PM GMTBy: Black_Swan

Key News

Key News

• The U.K. economy stagnated unexpectedly in the second quarter, ending the nation's

longest stretch of economic growth in more than a century. (Bloomberg)

British pound futures 60 min: News of stagnation not taken well. Ouch!

• The Nikkei average sank 0.7 percent to its lowest close in almost five months. (Reuters)

• Investors pulled their money out of Russia in the wake of the Georgia conflict at the fastest

rate since the 1998 rouble crisis, new figures showed on Thursday. (FT)

Key Reports Due (WSJ):

Quotable “Hatred of the producers of wealth still flourishes and has become, in fact, the racism of the intelligentsia.”

FX Trading – That giant sucking sound and the daisy chain of dollar bullishness I used to work for a man named Ross Perot back in the early 80’s, during my corporate finance life. You may remember Mr. Perot; he was a colorful character to say the least. But as odd as he was at times, I do admire the man as he built himself from nothing, worked hard, and cared deeply about his country. He went on to national fame by creating his own political party and running for President.

He also gained fame for the phrase, “That giant sucking sound you hear is jobs leaving the US and heading to Mexico,” which is how he described the impact of the NAFTA Treaty. Of course, he was right. And the sound got even louder thanks to our jobs for corporate profits exchange with China. In the financial markets today, we hear a different kind of sucking sound, but it’s growing louder by the day; it’s the sound of global capital draining from the global economy.

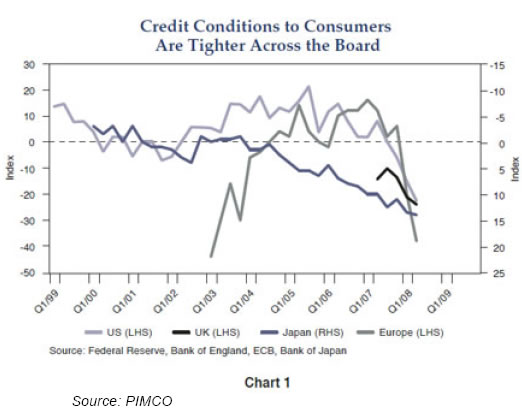

A friend forwarded the latest PIMCO piece penned by Paul McCulley and Saumil Parikh titled, The Narrowing Ecologies of Global Growth. In the piece they presented a chart that I think tells the story:

I have referred to this as the Big Four major economies heading south at the same time. Others have termed it the global economic race to the bottom. But needless to say, I think it has one important implication longer term, even if we can pull off a very difficult dollar correction nearterm— this draining of global capital is US dollar bullish.

It is the center to the periphery back to the center money flow:

The developed world still provides the capital for the rest of the world. Think of it as the center to the periphery i.e. credit created in the most efficient and deepest capital markets is used to fund investment (risky and otherwise) to markets outward on the periphery that don’t have their own domestic capital markets ready and available to do the job. Therefore, when money starts to move out of the periphery (that which is still left possibly after systemic shock) and back to the center as it is now during this global delivering period, the dominant receiver of this flow back to the center is the US capital market. Thus, receding global credit is dollar bullish. The supply of the world’s money, the US dollar, is falling. That is a big net positive for the buck.

Now of course the other implication is the impact of the Big Four’s declining demand as it impacts the demand for commodities. Logically (a word that can always get us into trouble in a world that can be dominated by illogical players for long periods of time), one would think there is little chance of current prices for energy and industrial metals (and gold) to be sustained. And if these commodities were hiding places for money fearing a dollar meltdown, that would be another net positive for the dollar.

And sticking to the commodities, oil in particular, we are gaining more confidence in our theory/guess that maybe the fall in crude means a rapid closing of the “Oil – Dollar Carry Trade.” (We explained the “Oil – Dollar Carry Trade” in detail in a Currency Currents about a month or so ago, if you would like a copy of that please let us know.) Closing of dollar borrowing by countries to buy high priced oil is yet another net positive for the dollar.

And of course, last but not least, interest rates.

If global demand is tanking. If global credit is receding. If commodities prices fall. Then we are confused how this great inflationary environment is going to overwhelm us.

We believe there is far greater danger from global deflation in a world of continuous debt repudiation. The central banks can pump all they want, but if the financial institutions are using the money to save themselves and consumers are shoring up their own balance sheets and business see fewer decent capital investment prospects, then this money is not stimulative.

In this world, we expect central banks to aggressively cut interest rates—most all of the major economy banks that is. They will be playing catch‐up with the US Fed. And of course, this means the seemingly very negative US dollar yield differential gap could close quite quickly. And you guessed it; an improving dollar yield differential is a powerful net positive for the dollar.

And of course last but not least is the impact on credit from the world’s largest depository of collateral for loans—the stock market. Falling stocks speed the process of credit draining from the economy, and it has broader psychological impact to boot. Institutions and individuals lose a key source of wealth and major source of collateral value to support existing loans. Financial institutions already in “save thy self mode” are calling loans more quickly; falling stocks will reinforce this trend.

Looking at a chart of the Dow Jones World Stock Index Weekly we’d guess a major top is in place and we are clearly entering a major bear market.

In short, any cratering of stocks will speed this daisy chain of global macro interlinked events that in the minds of many will turn out to be perversely dollar positive.

We are already hearing howls from those that say it isn’t fair. It isn’t fair the US dollar could benefit by being the cause of much of the problems now in the global economy. But the same crowd never thought of fair as the world’s money was funding risky asset investments and blowing bubbles of dubious wealth in its wake around the globe.

The chart above is that of the famous US Current Account Deficit. Though there is no, I repeat, no correlation between the dollar and the US Current Account Deficit, for reasons we have not the time to cover this morning, there has been an interesting correlation between stock market crashing and improvements in this series.

And of course, those dark grey vertical bars which represent official recessions also seem correlated to improvements in the US Current Account. Why? It’s because the dollar IS the world’s money. And when the world’s money packs up and goes home, the world loses its major source of credit. And when credit goes away in our global financial system, bad things happen.

So, if your 401-k melts down to worthless territory, just remember all those financial commentators who told you the US must get its current account under control—it’s causing all the problems.

Well ladies and gentlemen we think we just may be in the midst of what the economists wanted—global rebalancing. US exports grew faster than did China over the last 12 months. The US Current Account is improving. The US consumer is buying less and saving more. Commodities prices are about to breakdown in a big way. And inflation will be squeezed out of the developed world economies no matter what the central banks decide to do.

Maybe rebalancing is what is needed to cleanse a global financial system chock full of malinvestment. But we think it will be a very painful process. But we also think it will usher in a major long-term bull market in the US dollar.

Have a great weekend.

Jack Crooks

Black Swan Capital LLC

http://www.blackswantrading.com/

Black Swan Capital's Currency Snapshot is strictly an informational publication and does not provide individual, customized investment advice. The money you allocate to futures or forex should be strictly the money you can afford to risk. Detailed disclaimer can be found at http://www.blackswantrading.com/disclaimer.html

Currency Currents is available for only $49 per year. Just visit the sign-up page on our website to subscribe: http://www.blackswantrading.com/Currency_Currents.html

Black Swan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.