Is It Worth Investing in Palladium?

Commodities / Palladium Jul 21, 2017 - 01:23 PM GMTBy: Arkadiusz_Sieron

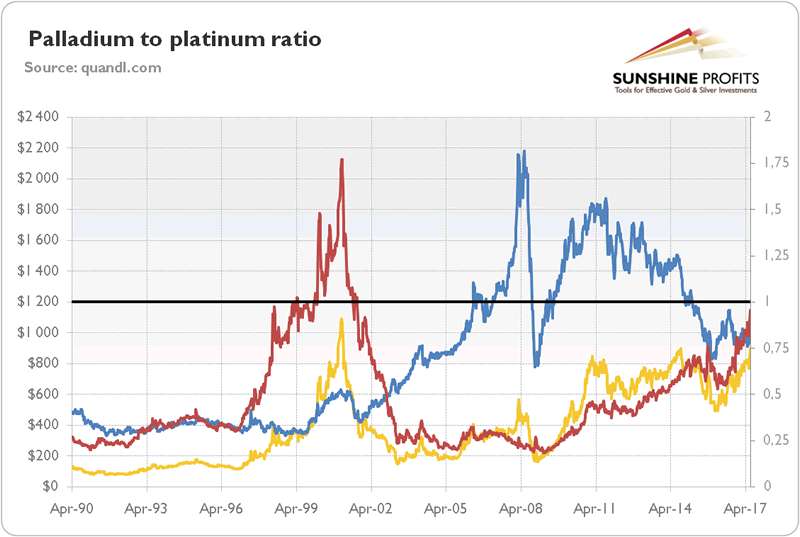

Palladium is another element with great importance to the modern economy, but it’s often overshadowed by the other more famous and expensive precious metals. As the chart below shows, palladium has been generally cheaper than platinum – its more expensive substitute in industrial use and jewelry.

Palladium is another element with great importance to the modern economy, but it’s often overshadowed by the other more famous and expensive precious metals. As the chart below shows, palladium has been generally cheaper than platinum – its more expensive substitute in industrial use and jewelry.

Chart 1: The palladium to platinum ratio (red line, right axis), the price of palladium (yellow line, left axis, P.M. London Fix, weekly average), and the price of platinum (blue line, left axis, P.M. London Fix, weekly average).

However, the palladium to platinum ratio has been approaching parity. Does that mean it is the appropriate moment to invest in palladium? Let’s deal with that question, examining the supply and demand dynamics of this chemical element with the symbol Pd and an atomic number of 46.

Supply

The annual mining production in 2016 amounted to only about 6.7 million ounces. It came mainly from Russia (41percent) and South Africa (38.1 percent). Meanwhile, recycling added about 2.5 million of ounces. It means that the total supply was 9.2 million ounces.

The above-ground stocks of palladium vary from 7 million to 26 million ounces, which corresponds to from 1 up to 4 years of mining production. The existence of large stocks of palladium may explain why market deficits did not translate into higher prices.

The total supply of palladium is projected by Johnson Matthey to rise 1 percent in 2017, as an 8.6 percent rise in recycling (due to a continued recovery in the number of vehicles being scrapped in North America) is likely to more than offset a 1.9 percent decline in primary supplies (due to lower sales from Norilsk Nickel’s inventory). Hence, the supply side of the palladium market would not be supportive for the price of the metal.

Demand

In 2016, total demand for palladium amounted to 9.4 million ounces. It was made up of three core segments: automotive (84.3 percent), industrial (20.6 percent), and jewelry (2 percent). As one can see, the shares do not add up to unity, as investment’s contribution was negative (investors liquidated 0.65 million ounces from their ETF holdings). Similarly to platinum, palladium is primarily an industrial metal with the dominant part of demand coming from automotive catalyst use.

However, in contrast to platinum, demand for palladium in jewelry has almost disappeared (although palladium is an essential part of ‘white gold’), while investments have remained in negative territory. Instead, the share of automotive demand is much higher, so the palladium market is even more dependent on the situation in the automotive sector.

Moreover, while platinum is mainly used in catalytic converters in diesel cars, palladium is adopted primarily in gasoline cars. This implies that platinum depends more on the European market, while palladium reigns in North American and Asian. And since the latter is cheaper, it displaces ‘little silver’ from the market.

According to Johnson Matthey, global demand for palladium will rise in 2017 by 7.6 percent to 10.1 million of ounces, thanks to the 3.6 percent increase in automotive demand (the sales of gasoline cars is likely to increase, as well as palladium loadings), the 4.6 percent rise in industrial demand (palladium is mainly used in electrical, chemical and dental sectors), and the reduced outflows from the ETFs (given two years of heavy selling, ETF liquidation should slowdown). Thus, the demand side of the palladium market should support the price of the metal this year.

Market Balance and Price Outlook

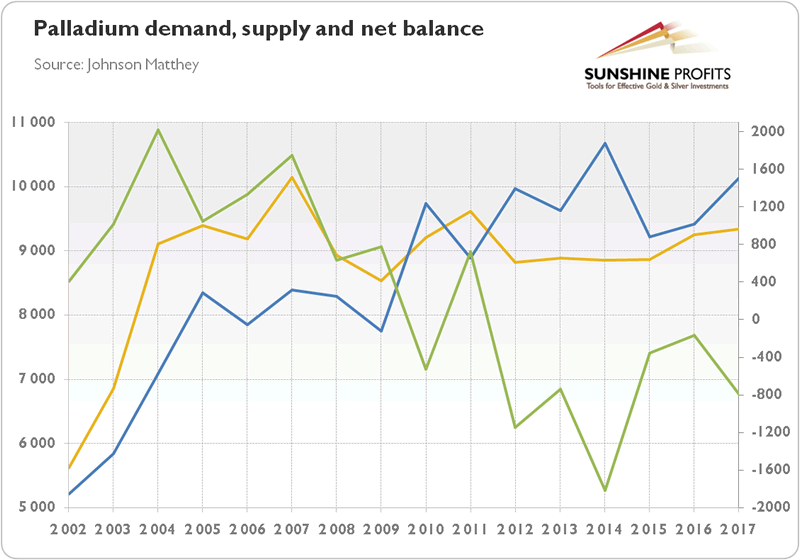

Given only the tiny rise in the supply of palladium and more decisive jump in demand for that metal (caused by higher auto demand and less disinvestment), the market deficit should widen to about 0.8 million of ounces in 2017, as one can see in the chart below.

Chart 2: Palladium demand (blue line, left axis, in thousands of ounces), palladium supply (yellow line, left axis, in thousands of ounces), and the net balance (green line, right axis, thousands of ounces) from 2002 to 2017 (the values for 2017 are projected).

Therefore, the price of palladium should be supported in the near future. We know that the above-ground stocks of palladium are relatively plentiful (and may be greater than the market expects), but market deficits at such heights cannot last indefinitely – and when the market eventually tightens, prices will need to rise, although it may take a while to deplete stocks.

Another bullish factor for palladium is the shift away from platinum toward more palladium in the automotive industry, although the price rally could undermine palladium’s competitiveness, especially since platinum is about twice as effective as palladium in catalytic converters (hence, given that platinum is trading with only a small premium over palladium, investors may turn to the former at some point in the future). The revival of global GDP growth bodes well for palladium prices, but if reflation falters, the outlook for palladium will deteriorate. And the rising share of electronic cars is another, although long-term, threat for the palladium market.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.