A Former Lehman Brothers Trader: It’s Time To Buy Brick And Mortar Retailers

Companies / Retail Sector Jul 17, 2017 - 04:58 PM GMTBy: John_Mauldin

BY JARED DILLIAN : Everyone thinks it is only a matter of time before Amazon puts every department store, every mall, every brick-and-mortar retailer out of business. Amazon gets an infinity market cap and everyone else gets zero.

BY JARED DILLIAN : Everyone thinks it is only a matter of time before Amazon puts every department store, every mall, every brick-and-mortar retailer out of business. Amazon gets an infinity market cap and everyone else gets zero.

Sound familiar?

That’s the accepted wisdom.

Is Amazon a great business? Yes.

Is a department store a bad business? Probably.

Does Amazon get 100% market share, with department stores getting zero? Probably not.

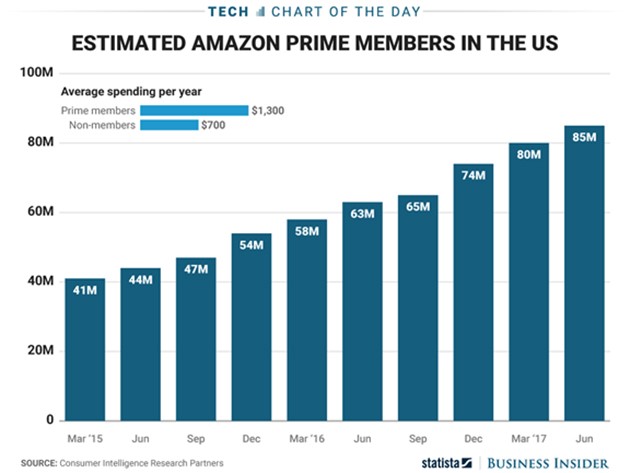

Amazon has over 80 million Prime subscribers in the US. It’s not quite saturated, but it’s getting close.

Source: Business Insider

I admit to being a Prime member, a late adopter.

It is pretty cool. Stuff shows up on my doorstep in two days, for free. The huge poker chip set I just ordered probably weighs about 40 pounds—free shipping! And I get all the Prime movies and TV shows.

But here is my thesis: Amazon will grow and grow, but there will always be a role for physical retailers. A reduced role, for sure, but there will always be a role.

From a capital markets standpoint, now might be the time to put on the trade.

The Bottom of Brick and Mortar

This is when I started thinking that we've reached a bottom in physical retailers.

Last week, ProShares—a $27 billion ETF manager—registered to list some double short leveraged ETFs on brick-and-mortar retailers!

Ding!

In my experience, specialty ETFs like this are usually listed at the worst possible times. Plus, you know my thoughts on leveraged ETFs. When 2x short leveraged ETFs are being listed on physical retailers… it is probably time to buy physical retailers.

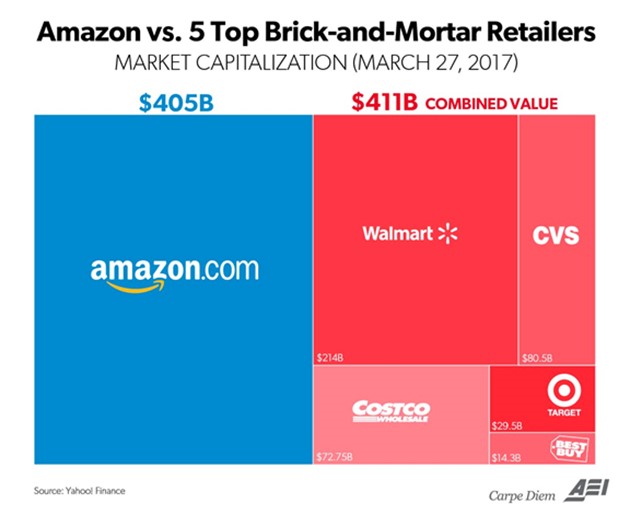

The graphic from AEI below is a couple of months old. Since then, Amazon’s market cap has soared to $481 billion. Meanwhile, Macy’s market cap has fallen to a little under $6.5 billion.

Source: Yahoo Finance

Amazon is worth around 75 times more than Macy’s? That doesn’t seem right.

I hope by this point I have you thinking.

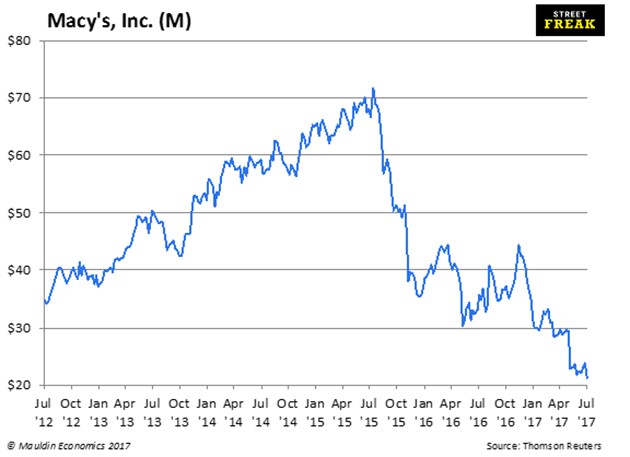

I am no Macy’s fan. It is a pretty terrible business, it sells middlebrow stuff in middlebrow locations. Although its online business is actually not bad.

I used to buy ties at Macy’s, back in 2001. People laughed at those ties. I no longer buy ties at Macy’s.

But look—at a $6.5 billion market cap, Macy’s is reaching distressed levels…

That means we have to put our distressed investor hat on, pick this business apart, and see if there is value—in all parts of the capital structure. Maybe we don’t like the stock, but maybe we like the bonds, for example.

And, Staples was bought by private equity recently for about 0.4 times revenue. Apply that standard to Macy’s and you get to a $10 billion valuation. They’re still kicking.

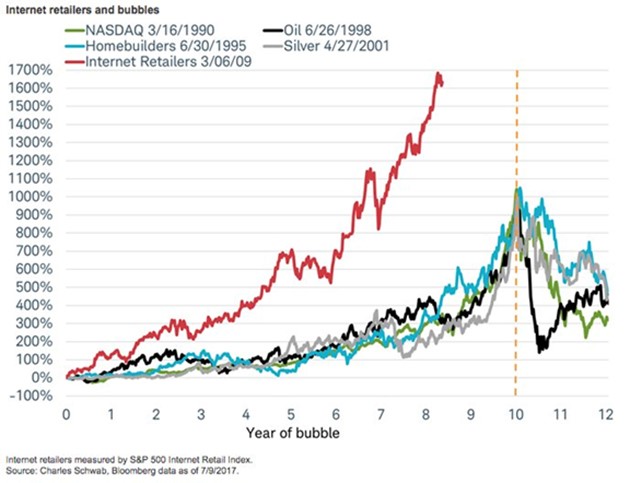

Plus, there’s an argument that this whole Internet retailing thing is just a giant bubble, according to the chart below.

Source: @bySamRo

How Do You Play It?

This is a smart trade, but it is also a dangerous trade unless you are smart.

There are two ways to do this:

1) Be a distressed investor: Look at the worst-case scenario, look at all parts of the capital structure, and find value.

2) Be a quant: Buy a basket of physical retailers, sell a basket of Internet retailers, and wait for them to converge.

The worst way to play it is just to naively buy Macy’s (or another retailer) and hope for the best.

Furthermore, I think it’s time to go dumpster-diving in mall REITs.

One final remark. As you look around for ideas, invest in things that would get you laughed off the set of CNBC. I assure you, if I went on Fast Money and pitched Macy’s as a long idea, I would get laughed off the set.

Those are the best trades.

Get Thought-Provoking Contrarian Insights from Jared Dillian

Meet Jared Dillian, former Wall Street trader, fearless contrarian, and maybe the most original investment analyst and writer today. His weekly newsletter, The 10th Man, will not just make you a better investor—it’s also truly addictive. Get it free in your inbox every Thursday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.