US Dollar Outlook

Currencies / US Dollar Jul 05, 2017 - 12:02 PM GMT I just listened to an interview with Martin Armstrong on YouTube about what to expect from the world financial arena. As much as I respect him, I cannot agree with what he says concerning (1) the direction of the US Dollar and (2) its impact on equities. Of course, his research is far deeper than mine, so I defer on that count. However, The best analysis that I have is that the USD may continue to decline (should I say collapse?) in the near term. That does not bode well for either domestic stocks or bonds.

I just listened to an interview with Martin Armstrong on YouTube about what to expect from the world financial arena. As much as I respect him, I cannot agree with what he says concerning (1) the direction of the US Dollar and (2) its impact on equities. Of course, his research is far deeper than mine, so I defer on that count. However, The best analysis that I have is that the USD may continue to decline (should I say collapse?) in the near term. That does not bode well for either domestic stocks or bonds.

While I do agree with him that higher rates mean a stronger dollar, I don’t see the bond market, especially the Long Bond, paying much attention to the Fed’s rate hikes at this time.

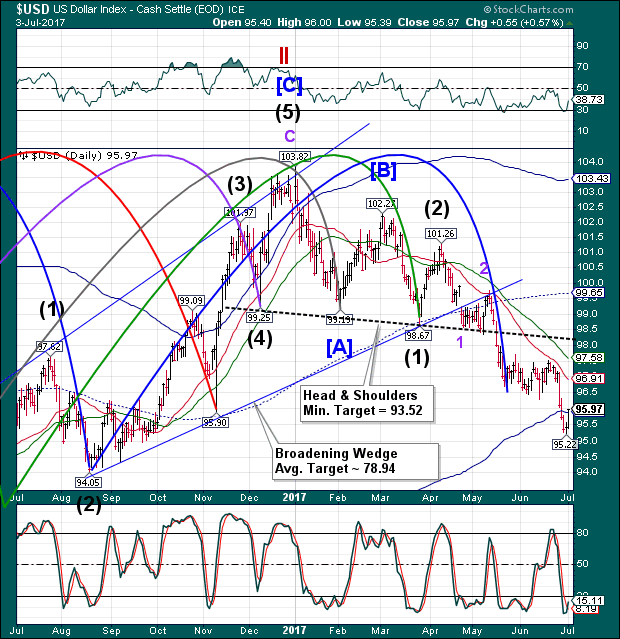

In fact, my analysis suggests that the Long Bond continuing its rally through the end of July, and possibly into late September. At that time the collapse in bonds (Wave III) begins. In the meantime, we have a potential Wave III in the USD having its first low near July 25, with another potential low by mid-October. Then the US Treasury is projected to run out of cash, spiking interest rates and the USD. Cash may then flow back into equities.

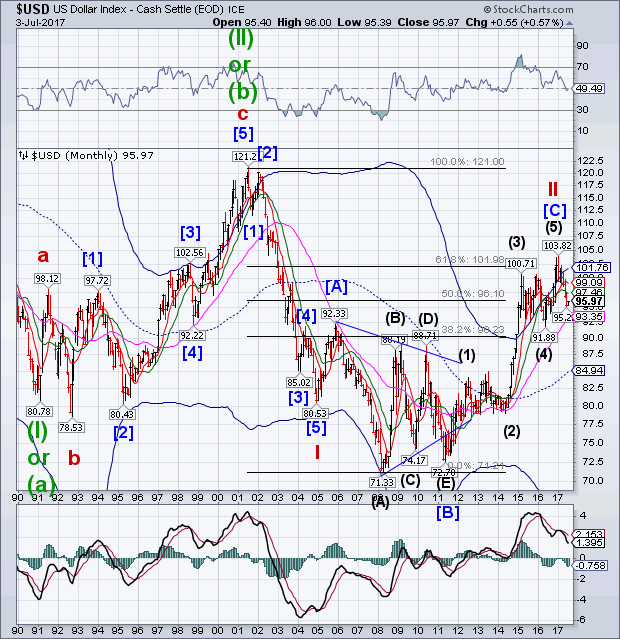

Last week I showed the SPX denominated in Euros at a Head & Shoulders neckline. The crossing of the neckline supports my thesis that the USD may plummet in the world currency markets, taking the SPX with it. If the decline can stop above 85.00, then there is a chance that the USD may go much higher this fall.

However, the Broadening Wedge suggests a much lower target. In addition the long neckline also serves as a lip of an inverted Cup with Handle with a target near 60.00. Because of this, I am not yet certain whether we have completed Wave 3 of (3) or just began it.

This month will be interesting, to say the least. I hope I can continue to provide guidance through the summer.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.