Central Bankers Just Lit the Fuse on a $217 TRILLION Debt Bomb

Interest-Rates / Global Debt Crisis 2017 Jul 02, 2017 - 08:00 PM GMTBy: Graham_Summers

As we noted yesterday, the world’s Central Banks have begun sending signals that the price of money in the financial system (bond yields) is going to be rising.

As we noted yesterday, the world’s Central Banks have begun sending signals that the price of money in the financial system (bond yields) is going to be rising.

Why is this a big deal?

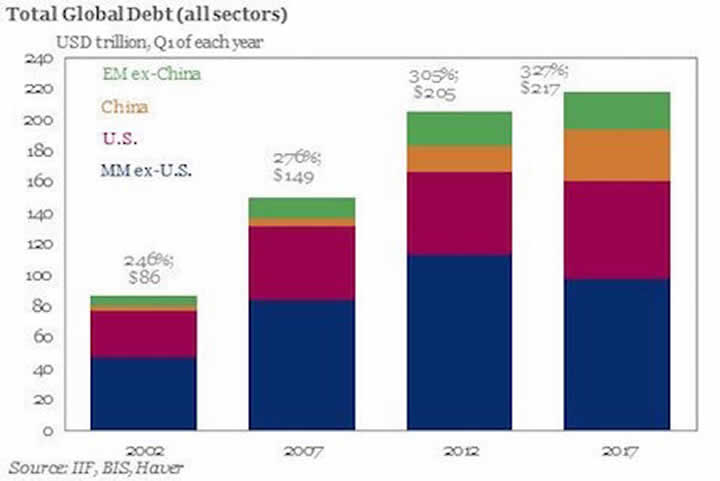

Because globally the world has packed on $68 TRILLION in debt since 2007. And ALL of this was issued based on the assumption that bond yields would be remaining at or near record lows.

The bad news?

They’re not. Already we’re beginning to see bond yields RISE.

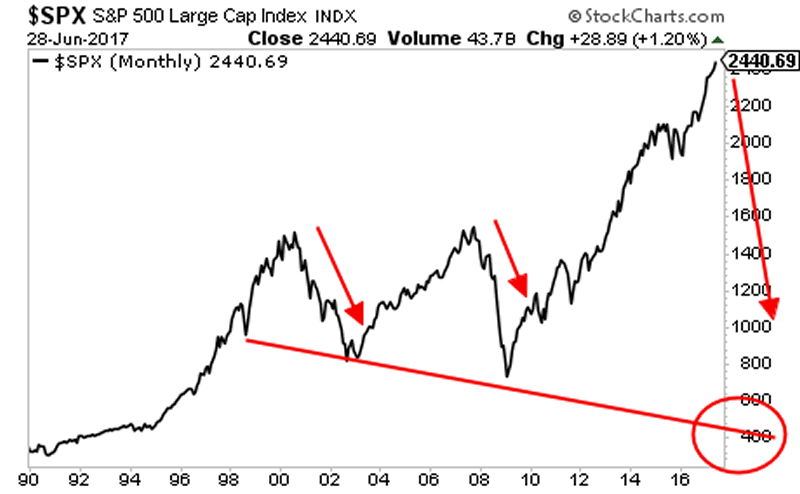

The yield on the 10-Year Treasury erupted above its long-term trendline in mid-2016. It has since consolidated and is now about to break out of a bullish falling wedge to new highs.

It’s not the only one.

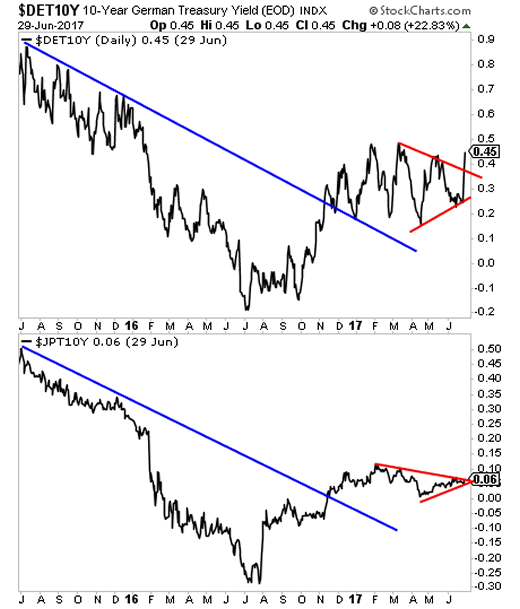

The yields on 10-German Bunds and 10-Year Japanese Government Bonds are ALSO breaking out to the upside in a big way.

Put simply, rising bond yields is a GLOBAL phenomenon. And it spells DOOM for the world’s $217 TRILLION debt bubble.

If you thought the 2007 Debt Bubble was bad… wait until you see what’s coming.

Here’s a hint…

A Crash is coming…

And smart investors will use it to make literal fortunes from it.

We offer a FREE investment report outlining when the market will collapse as well as what investments will pay out massive returns to investors when this happens. It’s called Stock Market Crash Survival Guide.

We made 1,000 copies to the general public.

As I write this, only 47 are left.

To pick up one of the last remaining copies…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.