Competition Forces Ebay to Cut Fees By 70% Whilst Insiders Exercise Options

Companies / Tech Stocks Aug 21, 2008 - 07:35 AM GMTBy: Mike_Shedlock

Competition for customers between eBay (EBAY) and Amazon (AMZN) is heating up. In an attempt to win market share EBay Cuts Fixed-Price Fees More Than 70% , Maintains Forecast.

Competition for customers between eBay (EBAY) and Amazon (AMZN) is heating up. In an attempt to win market share EBay Cuts Fixed-Price Fees More Than 70% , Maintains Forecast.

EBay Inc., the world's largest Internet auctioneer, lowered fees for listing fixed-cost items by more than 70 percent to attract additional sellers and compete with Amazon.com. EBay said the changes won't affect its annual earnings projection.

Sellers will pay 35 cents to list multiple quantities of the same item for 30 days, the San Jose, California-based company said today in a statement. Previously, sellers paid between 35 cents and $4 per item listed for seven days.

Chief Executive Officer John Donahoe's strategy of removing most upfront fees is designed to boost listings and grab market share from Amazon.com, the world's largest online retailer. EBay's sales growth in the second quarter slowed the most since 1998 as consumers, hurt by rising energy and food costs, reduced purchases. The new prices take effect Sept. 16.

"The news signals EBay's renewed focus on competing with Amazon.com and other e-tailers in fixed price," said Benjamin Schachter, a New York-based analyst with UBS Securities LLC. "While these changes will increase listings, impact to the demand side of the equation remains to be seen."

EBay also eliminated the use of check and money orders and shifted to electronic checkout solely through its PayPal service. Last month, Amazon.com introduced an electronic-payment system to compete with PayPal. Demand For Junk Is Waning

It's no surprise, at least in this corner, that sales growth at EBay has slowed the most since 1998. After all, the Future Is Frugality . (And That Future Is Now).

Somehow EBay wants investors to think that it can slash fees and make up for it on the back end and/or by stealing market share from Amazon. Is Amazon supposed to sit back and let this happen? Will lower fees even boost sales? I believe answer is no to both.

This is not the "gotta have it now" mentality of the past few years to say the least.

EBay Monthly Chart

Interestingly, EBay exploded higher in 2003 exactly coinciding with the peak of silliness in the housing boom. This should not be surprising. People were looking to unload garbage from their old house and/or find stuff for their new house, or simply to shed some accumulated junk for money.

While those looking to shed accumulated junk is likely rising, willingness for buyers to purchase said junk is waning faster.

A quick check on Yahoo!Finance shows EBay to be sporting a PE of $65.59 with a market cap of $32 billion. Is Ebay a value play? A growth play? The answer is neither.

Insiders Bailing As Fast As Possible

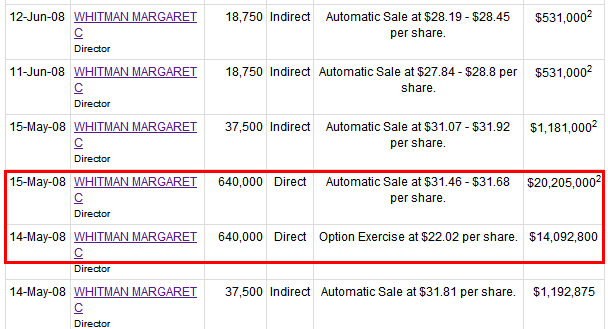

Margaret Whitman is bailing as fast as humanly possible.

Shareholders of Ebay have lost money for three straight years, while insiders grant themselves massive amount of options, only to bail on the the second they acquire them. In one paired transaction on May 14-15 2008, Whitman made a cool $6+ million in a day.

Since January 2005, Ebay has fallen from $59 to $25, a drop of 57.6%. Sadly, the stock is still massively over-priced given that it is neither a value play or a growth play. Worse yet for Ebay is that consumer sentiment towards consumption has hit a secular peak. The bottom in sentiment is years, perhaps even a decade away.

This is not a recommendation to sell or short Ebay. My interest in this is from a macro perspective. From that perspective, frugality has hit Ebay and profits have only one way to go, and that is down. This is just as one would expect in deflation.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.