Proof That This Economic Recovery Narrative is False

Economics / US Economy Jun 24, 2017 - 12:28 PM GMTBy: Sol_Palha

A hallucination is a fact, not an error; what is erroneous is a judgment based upon it. Bertrand Russell

A hallucination is a fact, not an error; what is erroneous is a judgment based upon it. Bertrand Russell

The financial media has provided reams of data trying to lay out the case that this economic recovery is real. Many of the statistics provided do indeed support the theme that the outlook is improving. One must, however, keep these two facts in mind when looking at the data:

- The Fed poured huge amounts of money into this market. Minus the money, this so-called economic recovery would have never come to pass

- Due to the low-interest rate environment, corporation borrowed money on the cheap and poured billions into share buybacks since the crash of 2009.

Hence, while some of these statistics paint a rosy picture, the outlook is far from rosy as two key leading economic indicators have failed to confirm this recovery from the onset.

The Baltic Dry index is trading 92% below its all-time high. Now imagine the Dow was in the same position and the press instead of calling it a crash, made the assertion that we were in the midst of a raging bull market. You would think they were insane. Well, the same analogy applies today; this index clearly indicates that there is no recovery on a global basis and that hot money is creating the illusion of one. Remove this excess cash from the system, and the economy together with the stock market will collapse.

This once highly effective leading economic indicator appears to no longer work as the playing field has been altered. However, it is working, as it is indicating this recovery is nothing but a sham. It can longer be used as a tool to gauge the direction of the stock market or the strength of the economy because as stated hot money has altered the landscape.

Copper another leading economic indicator also clearly illustrates that this recovery is a sham.

Copper has been in a downtrend for the past five years. If one goes back further, one will see that copper topped around the same time as Gold back in 2011 and has been trending downwards since. However, it has experienced a little renaissance as of late, and it remains to be seen if this trend continues. Copper has attempted to break out many times over the past few years, and each attempt ended in failure. One thing to keep in mind is that the Gold market is finally showing some early signs of life and the move up in copper could be in response to future inflationary forces rather than an economic recovery.

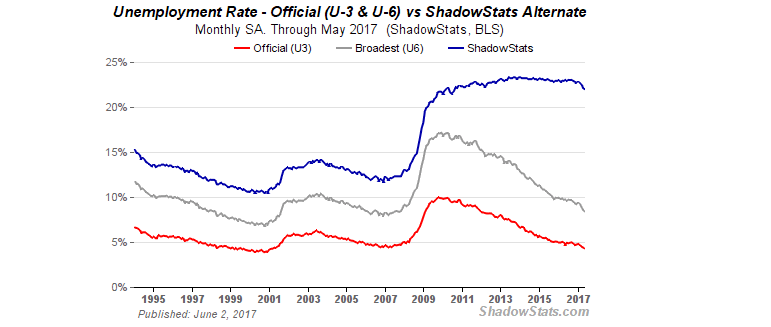

Low unemployment is one of the prerequisites of a strong economy

If you believe the data the BLS (Bureau of labour statistics) issues, the outlook is quite rosy. However, these chaps purposely omit individuals who have given up looking for a job and in doing so paint a false picture of what is going on. According to shadows Stats the unemployment rate as of May 2017 was 22%, which is in stark contrast to the Bureau of labour statistics 4.8% rate

Conclusion

If the economic recovery were real, then the Baltic Dry index would not be trading over 90% below its highs, and copper would not be trading at a price that is slightly above its multi-year lows. Additionally, the real unemployment would be low and not north of 20%. The manufactured data the BLS issues purposely omits a large section of the population and paints a false picture of opulence. Individuals usually stop looking for a job because they have been rejected so many times that they have come to believe they are worthless. There are stories of people submitting 100’s upon 100’s of resumes and not receiving even one response.

The fact that the stock market has run to such heights illustrates the power the Fed has over the economy and the markets. The saying “Don't fight the Feds” comes to mind. Thus in the interim even though there is plenty of data that illustrates this economic recovery is illusory in nature, the stock market will probably continue trending higher for a bit longer. Having said that we are witnessing the first signs of what could eventually lead to an epic meltdown. This is something that many experts were predicting from the onset and much to their dismay the market continued to trend higher. However, we are broaching this topic for the 1st time as we have noticed very subtle changes in investor sentiment, the precious metals markets and commodities in general that suggest for the first time since 2009, a historic market correction/crash could be on the horizon. Subtle signs do not mean the stock market is going to crash tomorrow, so do not run out and short this market. In a future article, we will cover this topic in more depth.

This is a very mature bull market and one that has been driven primarily by hot cash. Therefore, it would not be a bad idea if you have no position in precious metals to use pullbacks to add to your existing positions or establish one if you have none. Individuals willing to speculate can consider opening positions in some of the speculative beaten down stocks in the Gold, Silver, and energy sectors.

A dreamer is one who can only find his way by moonlight, and his punishment is that he sees the dawn before the rest of the world. Oscar Wilde

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2017 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.