Either Bitcoin Will Fail OR Bitcoin Is A Government Invention Meant To Enslave...

Currencies / Bitcoin Jun 21, 2017 - 12:35 PM GMTBy: Jeff_Berwick

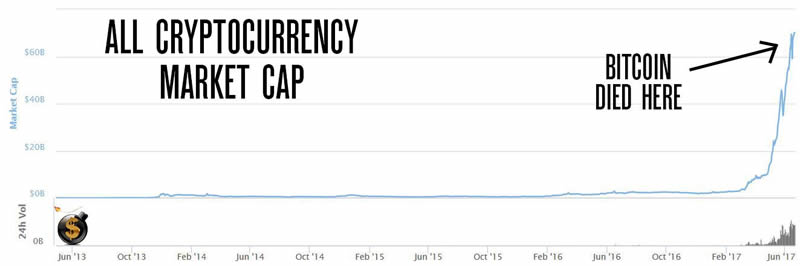

A few days ago, cryptocurrencies sold off quite dramatically.

A few days ago, cryptocurrencies sold off quite dramatically.

Bitcoin fell around 25% on average and Ethereum fell around 15% on average across major exchanges.

And as a whole, the entire altcoins market capitalization fell over 20% excluding bitcoin.

At the same time we put out our article, “The US Government Clamps Down on Ability of Americans To Purchase Bitcoin”

This was enough to get every jealous bitcoin hater out of their basement and gleefully typing that “We were right, bitcoin is a scam! Looks it’s down a few hundred dollars!”

Like this guy.

On this chart I’ve noted the small dip where Green Machine and many others proclaimed victory that all cryptocurrencies had collapsed.

But the people who hate bitcoin have to make up their mind. They seem to hold two opposite beliefs. The definition of cognitive dissonance.

Many of them seem to believe that bitcoin will fail because government will outlaw it, like this guy.

But, if you believe that to be the case then you must also believe gold and silver have the same risks. In fact, even bigger, because gold and silver are physical. And, it’s not like owning gold wasn’t illegal for four decades in the 20th century in the land of the free.

I’m not sure what the people making this argument are really trying to say.

To paraphrase them, “We are slaves and are so enslaved that our slave masters will make sure we have a hard time using bitcoin! Haha! LOLZ!”

If that’s what you really believe then why don’t you do something to get out of your bondage? Why just laugh at how enslaved you are? What kind of man sits in his basement in his underwear eating cheetos and just laughs at how enslaved he is but does nothing about it?

Not a real man is the answer, Ralph.

But, realistically, the chances of every government on Earth all outlawing bitcoin is pretty slim. It’s already been accepted and used by too many people. There’d be at least a minor uproar if the government came in with their guns and started kidnapping and extorting everyone involved in bitcoin.

And, if there was even ONE country that didn’t, that country would all of a sudden find itself receiving billions of dollars of investment into the country and thousands of very intelligent people would be moving there.

Perhaps this is why Theresa May, Angela Merkel and globalist Donald Trump all want to make “global rules” for the internet!

And this is not to mention that the more governments try to outlaw bitcoin the more the demand for bitcoin will likely increase as anyone who can still buy it will be running to get it before it is too late.

And, not to mention, it’s not very easy to track who actually owns bitcoin. If you are smart it is impossible. And there is no way to confiscate it without your keys. This is probably why Morgan Stanley recently said they want the “master keys” to bitcoin!

And, furthermore, many other altcoins like Dash and Monero are built with extreme privacy in mind. If they really manage to hamstring bitcoin then watch cryptos like Dash and Monero skyrocket in value… and there will be nothing the globalists can do.

So, all those expecting that big government will put its boot down on cryptocurrency don’t understand cryptocurrencies. It’s just math. There’s nowhere for the government boot to smash.

Those same people, though, also seem to believe that governments created bitcoin to enslave us all, like this moron:

And, this fostered countless other cryptocurrencies that are literally impossible to track like Monero?

And they did this… Why?

Even if you think they created it, it’s open source code. So anyone can see there are no government backdoors built into it. And the market has ran with it and it is now so out of the ability of governments to control that the only way to stop it is to turn off the internet.

Whoever came up with that plan for the government must’ve been fired if he did!

But, the real issue is that most of the bitcoin haters out there actually hold two totally opposite beliefs in their head.

Either the govt will destroy bitcoin by outlawing it… which I showed above is highly unlikely and even if they did it would likely drive the value of bitcoin far higher as people realized just what a prison we live in.

Or government created bitcoin to enslave us. Which, as I pointed out, doesn’t really matter if they did. The market is using the technology to free us from government and central banks.

Given how quickly these bitcoin haters declared victory when bitcoin was down slightly a few days ago, I’m going to make a guess.

I’m going to guess that these bitcoin haters are full of jealousy to those of us who saw the value of cryptocurrencies years ago and have profited massively from it. And for that reason they feel the need to try to discredit bitcoin whenever they can to feel better about their own stupidity.

That’s really no way to live. Being jealous of others who are better than you is never a recipe for success. You’ll end up how many of you are now, in your mother’s basement, single, obese and writing pathetic Youtube comments anonymously to try to make yourself feel better.

Here’s a better idea. Spend some time and learn what bitcoin and cryptocurrencies are all about. You’ll still be ahead of 99% of other people and can profit from its growth over the next few years and then laugh at the jealous trolls who try to discredit bitcoin.

You can get a start here. Anyone can. I have made a four video webinar which talks about the importance of cryptocurrencies and why they are and will be so valuable. Click HERE to find out more.

And, if you accept my offer for more information at the end I’ll send you your first $50 in bitcoin directly from my personal bitcoin wallet.

Then you can be on the right side of history and, who knows, you can maybe even get a girlfriend one day.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.