Gold Will Start Heading Higher On “Dwindling” Supply

Commodities / Gold and Silver 2017 Jun 19, 2017 - 03:32 PM GMTBy: GoldCore

James Rickards via Daily Reckoning

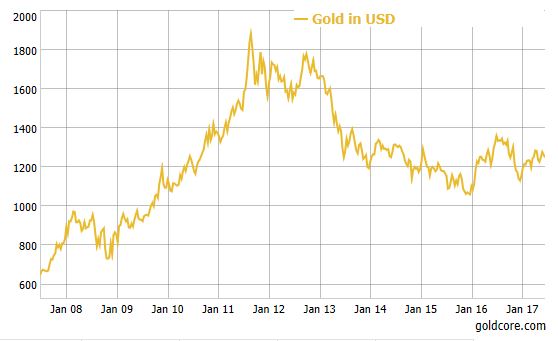

Gold was down after the Fed’s hike, but I expect it to start heading higher again. Too many powerful forces are driving it behind the scenes. Dwindling physical supply is a major one.

Gold in USD (5 Years)

On a recent visit to Switzerland, I was informed that secure logistics operators could not build new vaults fast enough and were taking over nuclear-bomb proof mountain bunkers from the Swiss Army to handle the demand for private storage.

Geopolitical fear is another. The crises in North Korea, Syria, Iran, the South China Sea, and Venezuela are not getting better. The headlines may fade in any given week, but geopolitical shocks will return when least expected and send gold soaring in a flight to safety.

Fed policy tightening is normally a headwind for gold. But, the last two times the Fed raised rates — December 14, 2016 and March 15, 2017 — gold rallied as if on cue.

Gold is the most forward-looking of any major market. It may be the case that the gold market sees the Fed is tightening into weakness and will eventually over-tighten and cause a recession.

At that point, the Fed will pivot back to easing through forward guidance. That will result in more inflation and a weaker dollar, which is the perfect environment for gold.

In short, all signs point to higher gold prices in the months ahead based on Fed ease, geopolitical tensions, and a weaker dollar.

The Fed’s Road Ahead is James Rickards latest piece for the Daily Reckoning. This is an excerpt & the full article can be read here

Gold Prices (LBMA AM)

19 Jun: USD 1,251.10, GBP 976.86 & EUR 1,117.73 per ounce

16 Jun: USD 1,256.60, GBP 984.04 & EUR 1,124.03 per ounce

15 Jun: USD 1,260.25, GBP 992.57 & EUR 1,127.67 per ounce

14 Jun: USD 1,268.25, GBP 995.83 & EUR 1,131.41 per ounce

13 Jun: USD 1,261.30, GBP 992.26 & EUR 1,125.33 per ounce

12 Jun: USD 1,269.25, GBP 998.14 & EUR 1,131.28 per ounce

09 Jun: USD 1,274.25, GBP 1,001.31 & EUR 1,139.18 per ounce

Silver Prices (LBMA)

19 Jun: USD 16.67, GBP 13.02 & EUR 14.87 per ounce

16 Jun: USD 16.86, GBP 13.19 & EUR 15.10 per ounce

15 Jun: USD 16.86, GBP 13.19 & EUR 15.10 per ounce

14 Jun: USD 16.96, GBP 13.32 & EUR 15.14 per ounce

13 Jun: USD 16.82, GBP 13.21 & EUR 15.01 per ounce

12 Jun: USD 17.13, GBP 13.50 & EUR 15.27 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.