Commodities Asset Classes: Energy, Minerals and Agri-Foods

Commodities / Resources Investing Aug 19, 2008 - 04:26 PM GMTBy: Ned_W_Schmidt

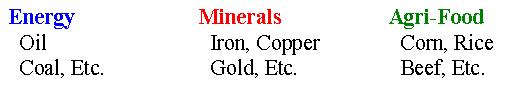

Ever since paper oil prices broke, journalists around the world have been brutally attacking keyboards in a rush to declare the end to investing in commodities. Business media anchors keep asking the same question, “Are commodities done?” While teaching a journalist is the equivalent of attempting to train a cat, we continue to remind all of one simple message. Commodities is not a homogeneous asset class. It is comprised of three distinct groups, as listed below.

Ever since paper oil prices broke, journalists around the world have been brutally attacking keyboards in a rush to declare the end to investing in commodities. Business media anchors keep asking the same question, “Are commodities done?” While teaching a journalist is the equivalent of attempting to train a cat, we continue to remind all of one simple message. Commodities is not a homogeneous asset class. It is comprised of three distinct groups, as listed below.

Do the same motivations for buying coal cause someone to buy rice? Does a consumer choose between buying beef or copper ? Will the Chinese economic miracle end the day after the Olympics? Will those 1.3+ billion Chinese consumers continue to eat? As we learned in the Internet stock bubble, do not let the media manage your wealth.

This week's chart is of U.S. cash corn prices, right axis, along with a stochastic, left axis. Corn prices did become over bought during the paper oil mania. That situation has been replaced by an over sold condition. Prices seem to have bottomed with this over sold situation, as was case last year. Competition for corn, from ethanol producers to hog and cattle feeders, is to keep global corn market tighter than ever in history.

According to The Financial Times ( Allidina, 17 July 2008,22) approximately ¾ of growth in 2008 non-OPEC supply of fuels came from biofuels. Do not let the factory mentality slip into your consideration of Agri-Food investments. All the corn that will exist in North America until 2009 is either in the field or in a bin.

The Chinese economy is going to produce a long series of Gold medals for investors in the next two decades, and many of them will go to Agri -Food.

By Ned W Schmidt CFA, CEBS

Copyright © 2008 Ned W. Schmidt - All Rights Reserved

AGRI-FOOD THOUGHTS are from Ned W. Schmidt,CFA,CEBS, publisher of Agri-Food Value View , a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To review the most recent issue go to http://home.att.net/~nwschmidt/READFOOD.html

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.