UK Financial Markets Calm in Election Storm, is the BBC Exit Poll Wrong?

ElectionOracle / UK General Election Jun 09, 2017 - 12:14 AM GMTBy: Nadeem_Walayat

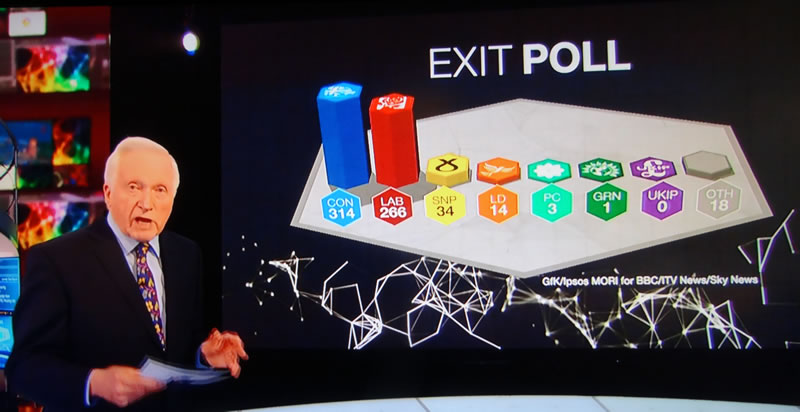

Within minutes of Britain's 50,000 polling stations closing at 10pm tonight, the BBC / ITV / Sky joint Exit Poll has been released for the UK General Election 2017 that forecasts a shock election result - Conservatives on 314, Labour on 266, Lib Dems on 14 and the SNP on 34 which implied a shock hung parliament election result that was expected to trigger market panic as happened following the EU Referendum.

Within minutes of Britain's 50,000 polling stations closing at 10pm tonight, the BBC / ITV / Sky joint Exit Poll has been released for the UK General Election 2017 that forecasts a shock election result - Conservatives on 314, Labour on 266, Lib Dems on 14 and the SNP on 34 which implied a shock hung parliament election result that was expected to trigger market panic as happened following the EU Referendum.

One would imagine that shock hung parliament would have thrown the financial markets into turmoil. However as of writing just past midnight, the expected financial markets storm triggered by the shock poll has failed to materialise!

For instance FTSE futures are only trading about 60 points lower, less than 1% lower which is hardly a polls shock market panic.

Similarly the British Pound is only off about 2 cents (1.5%) which whilst a larger reaction than that of FTSE is nowhere near on the scale of that which followed the EU Referendum when sterling literally did crash.

So what are the markets saying ?

Either that the BBC exit poll is wrong OR that the markets do not really want the Conservatives to win the election as that would make BrExit less likely.

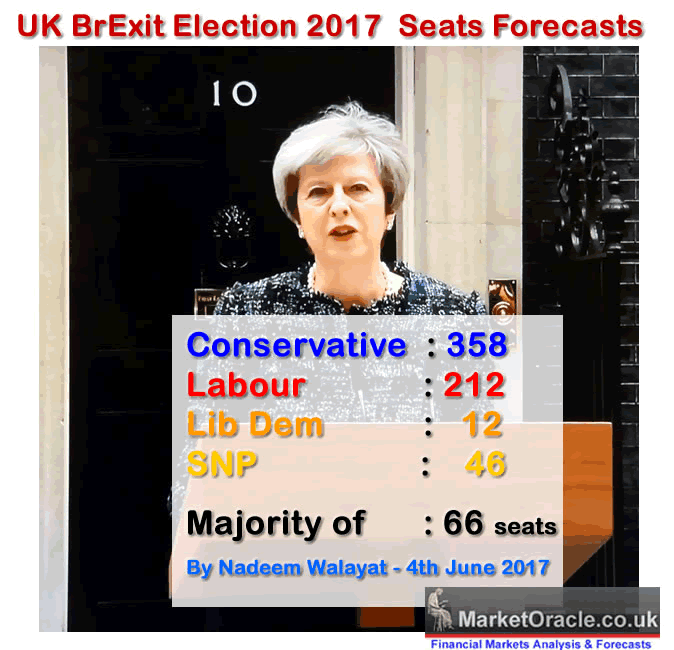

And here is the exit poll set against my forecast and the last opinion pollsters based seats forecasts.

UK General Election Final Forecasts

| Forecasts | Date | Tory | Labour | Lib | SNP |

| Nadeem Walayat - Forecast Conclusion | 4th June | 358 |

212 |

12 |

46 |

| Nadeem Walayat - House Prices | 3rd June | 342 |

|||

| YouGov | 7th June | 302 |

269 |

3 |

48 |

| Lord Ashcroft | 6th June | 357 |

|||

| Electoral Calculus .co.uk | 6th June | 361 |

216 |

3 |

48 |

| Election Forecast .co.uk | 6th June | 375 |

198 |

8 |

36 |

| Forecastuk.org.uk | 6th June | 350 |

225 |

8 |

44 |

| Spread Betting Markets (IG) | 7th June | 371 |

199 |

12 |

46 |

| BBC Exit Poll - 10pm | 8th June | 314 |

266 |

14 |

34 |

| Actual Result - 3am | 9th June |

As is usually the case most of the pollsters tend to cluster around one another, and where the betting markets just tend to follow what the pollsters are implying in terms of polling percentages converted into seats. The only real outlier for this election is YouGov which has consistently been discounting the Tory seats total by about 50 to 60 seats compared to the other polls based seats forecasts.

But YouGov being YouGov always slip in a get out of jail card for apparently they have TWO forecasts posted on their site at the same time, one as stated above and another posted just a few hours before the polling stations opened stating that they expected the Tories would be be returned with an increased majority. Which once more illustrates the point that pollsters such as YouGov are bullshit artists! How can anyone make an informed decision based on the pollsters if they are forecasting two significantly different outcomes at the same time!

Whilst here is the analysis towards my forecast conclusion:

So in summary my UK General Election 2017 forecast conclusion was for the Conservatives to win the election with a 66 seat majority by increasing their seats total from 331 to 358. Whilst I expected Labour to drop 20 seats to 212 with the Lib Dems gaining 4 to 12, and I expected the SNP to lose 10 seats, dropping from 56 to 46.

And it won't be many more hours before we find out how the BBC's exit polls compare against the actual election result. Which my earlier analysis pointed that there tends to be a 10 seat error between the exit poll and the final result.

UK General Election BBC Exit Polls Forecast Accuracy

The BBC and other broadcaster pollster based exit polls proved very accurate for the 2001, 2005 and 2010 general elections in determining the outcome in terms of which major party would form the next government, which also proved far more accurate than the opinion pollster forecasts such as that of the US election forecasting guru Nate Silver who got the 2015 UK general election badly wrong as I covered at then time - Nate Silver UK General Election Forecast 2015 as Wrong as 2010?.

However the BBC exit poll for 2015 was very badly wrong as it forecast a hung parliament when the result was for a Conservative outright election victory. And even worse was to come for the EU Referendum, though there it was not really an exit poll rather YouGov's last throw of the dice that got the result very badly wrong with all hell breaking loose on the financial markets shortly after midnight as the actual results were pointing in the exact opposite direction.

So in conclusion expect tonight's BBC exit poll to be out by about 10 seats for the Tories, i.e. if the BBC Exit poll is 340 then the actual result would be closer to 330 or 350. Which in terms of my forecast of 358 in this example the BBC would be under estimating the actual outcome.

By Nadeem WalayatCopyright © 2005-2017 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

a

a