This Is The Most Profound Shift The US Economy Has Ever Seen

Economics / Demographics Jun 08, 2017 - 03:07 PM GMTBy: John_Mauldin

By Stephen McBride : This year, the first Baby Boomers turned 70, and that spells trouble for the economy and financial markets.

By Stephen McBride : This year, the first Baby Boomers turned 70, and that spells trouble for the economy and financial markets.

Speaking at Mauldin Economics’ Strategic Investment Conference, chief economist and strategist for Gluskin Sheff, David Rosenberg, dissected the wide-ranging implications of the wave of Baby Boomers now retiring.

Fifty Million Americans Aged Over 70 By 2030

“1.5 million Boomers turn 70 [each year] for the next 15 years. This is a depressant for growth. Research has shown once you hit this age, you cut back on your spending.”

Findings from RAND Corporation show that on average, a person’s consumption drops by 37.5% when they enter retirement. Given that consumption accounts for 70% of US economic activity, this is a major deflationary force.

Rosenberg goes on to say, “what makes this situation more acute is that only half of the Boomers that would like to retire, and this is why they can’t retire, have less than $100,000 in liquidity.”

This huge funding gap in pensions has two major consequences for the economy and financial markets in the near term.

The Booming Bond Market

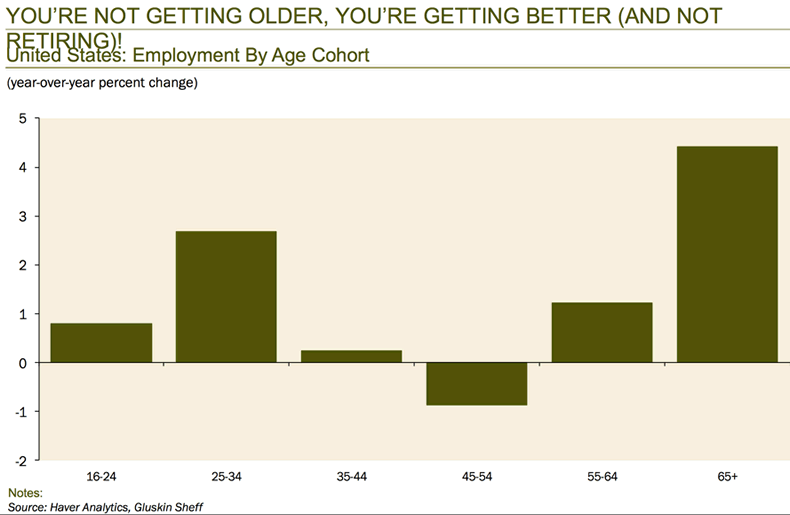

“Because [Boomers] are living longer and they need the cash flow, they’re staying in the job market longer and displacing younger workers. The fastest employment growth now is people over the age of 65.”

Source: Haver Analytics, Gluskin Sheff

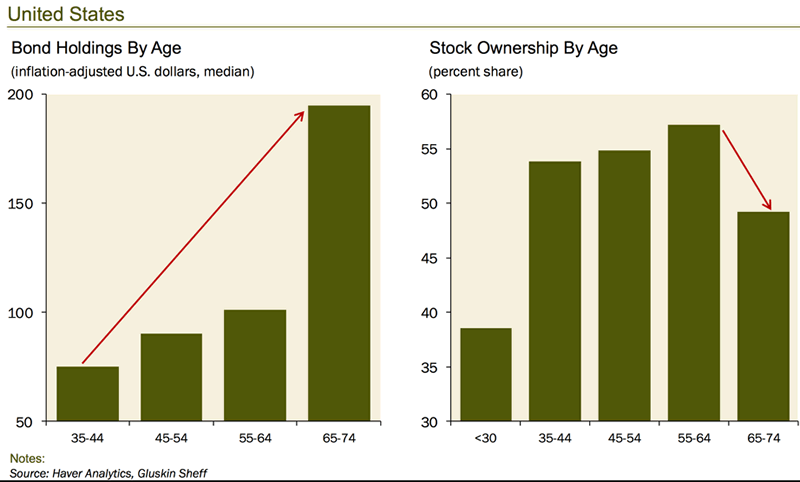

“From a financial markets standpoint, once you hit the age of 65, you go through the most profound asset class shift since you were in your 30s. You start to trim your equity and start to raise your bond exposure.”

Source: Haver Analytics, Gluskin Sheff

Dividends Are King

While cash flow will remain king for Boomers looking to plug pensions deficits, Rosenberg sees one big problem which has huge implications for asset prices going forward: low interest rates.

“The big challenge is, if this [Boomers retiring] was happening 30 years ago, you could go to the government bond market and get 4, 5, 6%. You can’t do that today.”

One consequence of record-low yields on US Treasuries is that there have been massive inflows into dividend stocks. This in turn has left valuations sky-high. However, Rosenberg thinks money will continue to flow into the “bond proxies.”

“[Low Treasury yields] are why I don’t think the dividend theme is overdone. The equity market has become a more reliable generator of the reoccurring cash flows that the Boomers need than the government bond market has.”

Which Trends Should Investors Focus on Today?

For David Rosenberg’s thoughts on the deflationary headwinds facing the US economy, Federal Reserve policy, and more, watch the full interview below.

Download a FREE Bundle of Exclusive Content from the Sold-Out 2017 Strategic Investment Conference

Get access to exclusive interviews with John Mauldin, Neil Howe and Pippa Malmgren from SIC, an ebook from renowned geopolitical expert George Friedman and bonus SIC 2017 content…

Claim your SIC 2017 bundle now!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.