Euro-zone Crisis - Deposit Bail In Risk as Spanish Bank’s Stocks Crash

Stock-Markets / Financial Crisis 2017 Jun 06, 2017 - 05:32 PM GMTBy: GoldCore

– Deposit bail in risk as stocks and bonds of Spanish bank – Banco Popular – crash

– Deposit bail in risk as stocks and bonds of Spanish bank – Banco Popular – crash

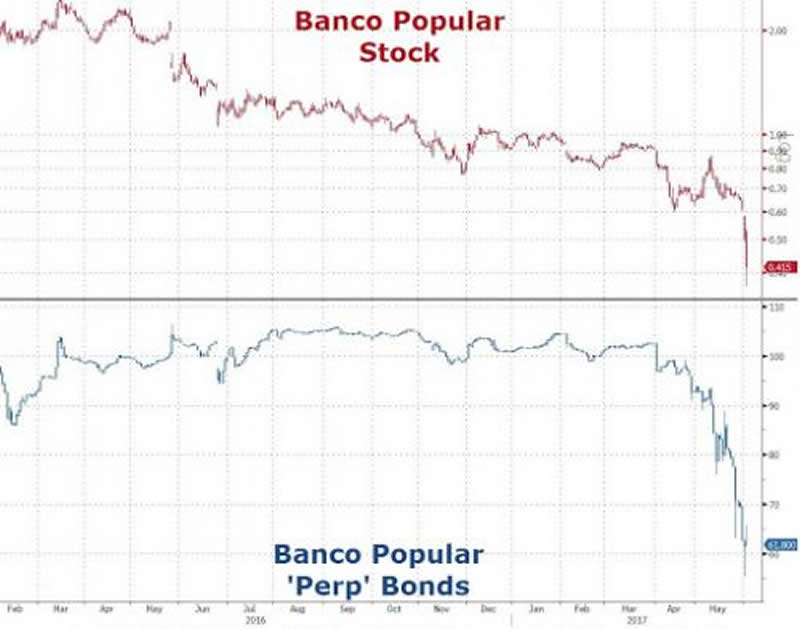

– Banco Popular stock crashes most on record – down 63% this year to 34 euro cents

– Spanish bank tells employees – “Don’t panic”

– Risk of Spanish banking crisis as Banco Popular credit curve inverts

– Banco Popular needs to find at least €4 billion more capital – analysts

– Deposits over €100,000 (euro) vulnerable to bail-in

– EU, U.S., UK push for bank ‘bail-ins’ poses risks to depositors

Source: Google

Banco Popular’s shares crashed another 17 per cent yesterday to record lows amid concerns the Spanish bank may have to be “wound down” and could see bail-ins of investors and depositors.

There are increasing fears that there is no buyer for the bank and this saw its share price dropped to €0.34 (34 euro cents). The bank’s stocks had already fallen nearly 50 per cent in the last week and is down 63% this year.

Shares also fell sharply last Friday as hoped for buyers dropped out of the Banco Popular auction process. Final bids are due this week and international publications have reported that Spanish banking rivals BBVA and Bankia had been interested.

Source: Zero Hedge

Analysts estimate that the bank needs at least €4 billion more capital and it is burdened with a likely insurmountable €37 billion pile of toxic property loans and assets.

Banco Popular is Spain’s sixth-largest bank and there is a debate as to whether it is systematically important. It likely is as it has the largest amount of small business customers in Spain. These companies are the backbone of the Spanish economy and now vulnerable to having their deposits over €100,000 confiscated in bank bail-ins.

The bank is also used by many of Spain’s wealthy catholic individuals and institutions including one of Spain’s most influential institutions – Opus Dei.

The badly debt laden bank may have to liquidate as neither a buyer nor a new capital raise appear likely. It now looks possible that Spain may be the first nation to have the EU’s new BRRD “bail-in” insolvency directive involving bank “resolution” imposed on it.

According to Bloomberg:

“Resolution is the process of restructuring a bank that’s too systemically important to be liquidated in a normal insolvency process. If a supervisor determines that a lender is failing or likely to fail, it gets turned over to the resolution authority.

For major banks in the euro area, that’s the Single Resolution Board, led by Elke Koenig. The restructuring of the bank is supposed to be funded primarily by imposing losses on creditors, including senior bondholders if necessary.”

It also involves depositors of up to €100,000 suffering “haircuts” and having their deposits bailed-in.

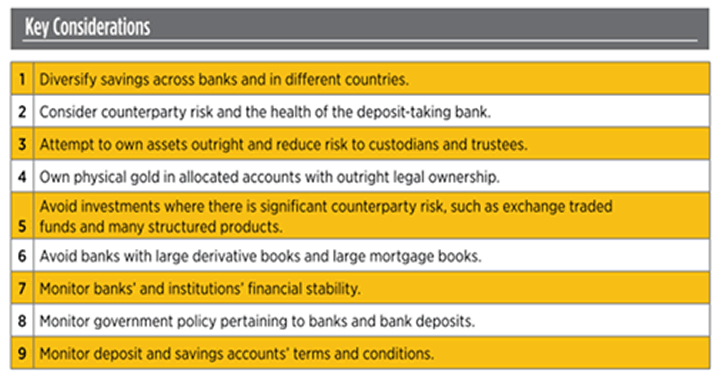

Deposit bail in is one of the greatest financial risks to investors, savers and indeed companies internationally today. Yet it remains the most poorly covered financial risk and is largely ignored by financial advisers, brokers and not surprisingly governments and banks.

The bail-in regime and confiscating deposits, especially from job creating companies, would be extremely deflationary and would likely contribute to severe recessions. This is something we warned of when we conducted our extensive research on the developing global bail-in regimes after the Cyprus bail-ins in 2013.

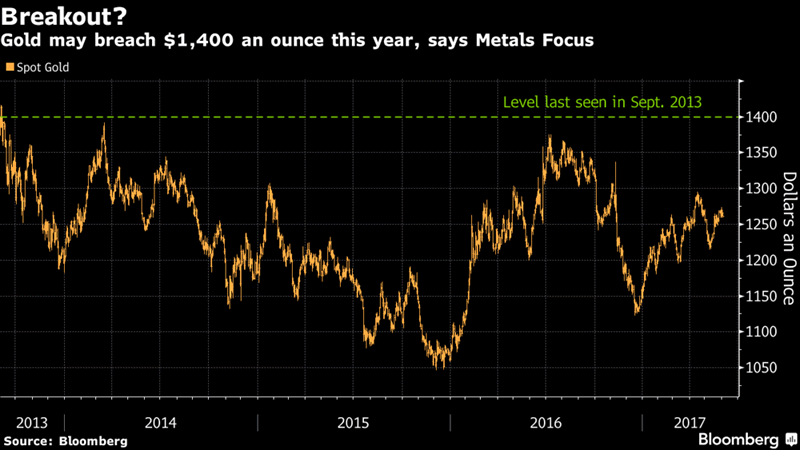

Diversification of deposits remains vital and another important way to protect against deposit bail in is diversification into physical gold. Owning gold bullion coins and bars in allocated and segregated storage in the safest vaults in the world is prudent given the deposit bail in risk.

Gold Prices (LBMA AM)

06 Jun: USD 1,287.85, GBP 997.31 & EUR 1,144.77 per ounce

05 Jun: USD 1,280.70, GBP 992.41 & EUR 1,136.88 per ounce

02 Jun: USD 1,260.95, GBP 980.39 & EUR 1,123.88 per ounce

01 Jun: USD 1,266.15, GBP 984.81 & EUR 1,128.01 per ounce

31 May: USD 1,263.80, GBP 987.79 & EUR 1,129.96 per ounce

30 May: USD 1,262.80, GBP 982.46 & EUR 1,132.23 per ounce

26 May: USD 1,265.00, GBP 983.41 & EUR 1,127.87 per ounce

Silver Prices (LBMA)

06 Jun: USD 17.56, GBP 13.61 & EUR 15.62 per ounce

05 Jun: USD 17.52, GBP 13.58 & EUR 15.59 per ounce

02 Jun: USD 17.19, GBP 13.37 & EUR 15.33 per ounce

01 Jun: USD 17.13, GBP 13.33 & EUR 15.26 per ounce

31 May: USD 17.31, GBP 13.48 & EUR 15.43 per ounce

30 May: USD 17.27, GBP 13.42 & EUR 15.49 per ounce

26 May: USD 17.29, GBP 13.45 & EUR 15.41 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.