EURJPY Moved Sideways between 122.55 and 125.81

Currencies / Forex Trading Jun 05, 2017 - 01:15 PM GMTBy: Franco_Shao

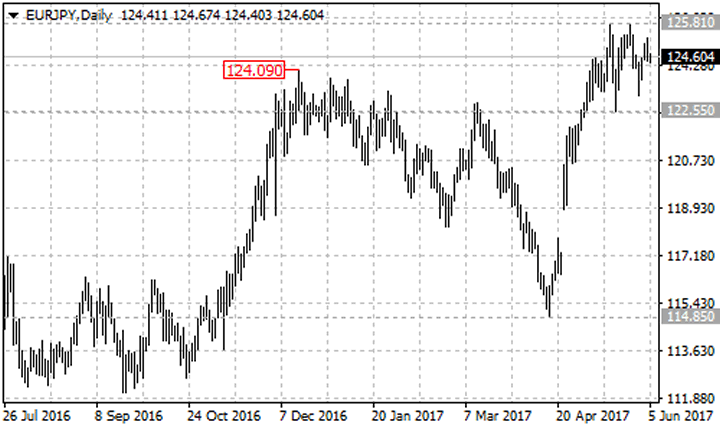

After breaking above the major resistance of the December 2016 high of 124.09, EURJPY formed as sideways movement in a trading range between 122.55 and 125.81. All we can do now is to wait for the breakout to occur.

On the upside

Near term support is at bottom of the trading range of 122.55, a breakdown below this level could take price to the next support level of the 38.2% Fibonacci retracement taken from the April 17 low of 114.85 to May 16 high of 125.81 at 121.60. As long as this support level holds, the price action of the sideways movement could be treated as consolidation of the bullish move from 114.85, and further rise towards 135.00 is still possible after the consolidation. Near term resistance is at the top of the trading range of 125.81. A break out of this level could signal resumption of the uptrend.

On the downside

A breakdown below 121.60 Fibonacci support will indicate that lengthier consolidation for the long term uptrend from the June 2016 low of 109.04 is underway, then the following correction pullback could take price back into 116.60 zone.

Technical levels

Support levels: 122.55 (near term support), 121.60 (38.2% Fibonacci retracement), 116.60.

Resistance levels: 125.81 (near term resistance), 130.00, 135.00.

This article is written by Franco Shao, a senior analyst at ForexCycle.

© 2017 Copyright Franco Shao - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.