Silver and NASDAQ Strength Will Reverse

Commodities / Gold and Silver 2017 Jun 02, 2017 - 02:53 PM GMTBy: DeviantInvestor

Bubbles come and go.

Bubbles come and go.

Silver and gold – 1980

Japanese Nikkei – 1990

NASDAQ – 2000

Mortgages and Real Estate – 2006

Bonds, Debt, Stocks, Real Estate – 2017

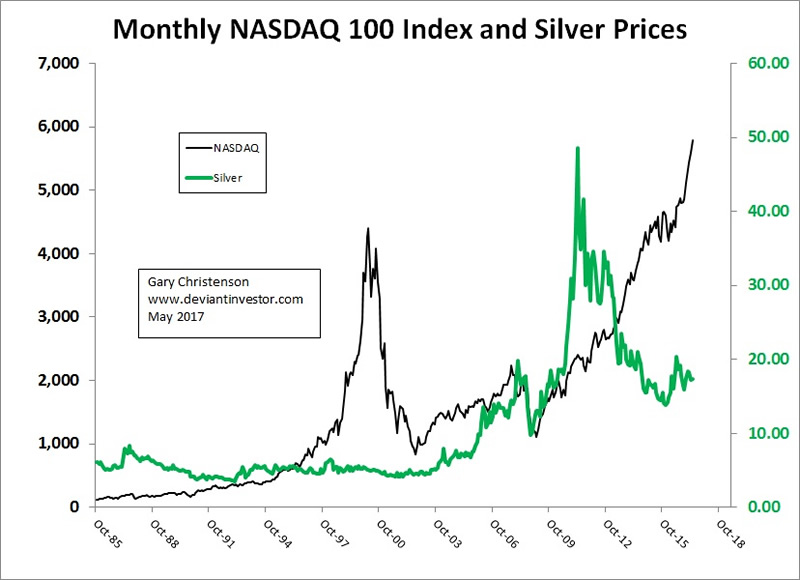

Examine the following graph of monthly data for 32 years of the NASDAQ 100 Index and Silver.

We saw the NASDAQ bubble in 1999-2000, a rapid rise for silver in 2010 – 2011 and a large rise in the NASDAQ 100 during 2009 – 2017.

Prices for both markets have often risen too far and too fast, and then corrected or crashed. The NASDAQ dropped more than 80% from 2000 to 2002. Silver dropped about 70% from 2011 to late 2015.

The NASDAQ 100 is likely to drop by a large percentage following its current run-up. Stay tuned – no correction yet.

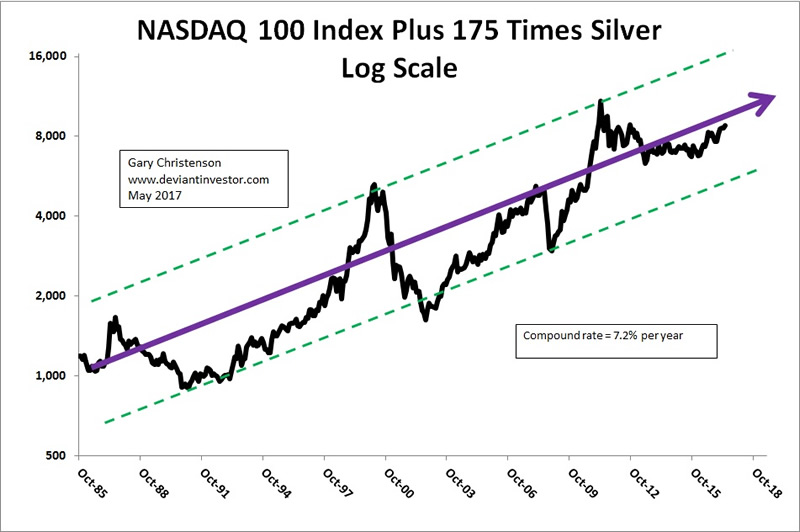

Prices for stocks and silver rise, primarily because of currency devaluations. The two markets often offset each other, which suggests we should look at their sum. Examine 32 years of the NASDAQ 100 plus 175 times silver prices, which gives both markets roughly equal weight.

Over thirty years prices have risen exponentially as the dollar has purchased progressively less. Conclusion: Prices rise exponentially and probably will continue to rise as long as governments increase debt and central banks devalue their currencies.

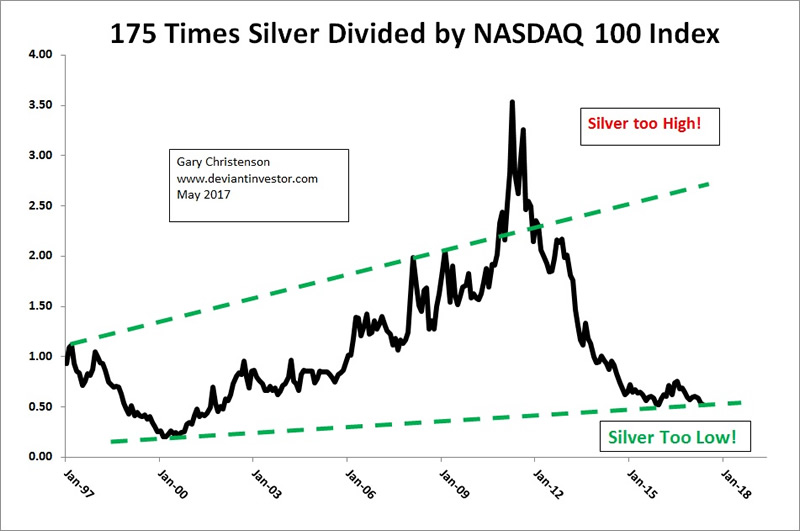

Is the NASDAQ 100 high and is silver low?

Examine the ratio of 175 times the silver price divided by the NASDAQ 100. When the ratio is high – as in 2011 – silver is relatively high. When the ratio is low – as in 2017 – silver is undervalued compared to the NASDAQ 100 Index.

How long will the ratio stay this low? Probably not much longer …

When the NASDAQ 100 top will occur is important if you are riding the NASDAQ bull market. Now is a time for caution!

How much longer silver prices will stay low is important if you are stacking silver, as I hope you are. Take advantage of these low prices!

REVIEW – and then do your own due diligence:

- Prices for silver and the NASDAQ 100 rise exponentially as unbacked paper currencies are systematically devalued.

- Expect much higher silver prices because the silver to NASDAQ ratio is too low, along with dozens of other reasons.

- Consider taking profits out of the NASDAQ to buy silver. Don’t expect to hear this suggestion on Wall Street.

- Wall Street benefits from higher NASDAQ prices. Wall Street benefits little from higher silver prices, with the exception of JPM which, per Ted Butler’s data, has accumulated a massive hoard of silver bullion. Expect Wall Street to promote buying stocks and discourage acquisition of silver, as usual.

- Silver has been money and a store of value for thousands of years. The NASDAQ stocks have existed for a few decades. In the long term, trust silver. In the short term, the NASDAQ is over-valued and silver is inexpensive. Buy Silver!

Read Gold Moves Ahead of Silver

Read “House of Cards: Netflix is One of the Poster Children for Tech Bubble 2.0”

John Mauldin quoting Jim Mellon:

“And that makes it a bit like the markets – quiet at the moment, but the mayhem is just around the corner.

Assume the brace position.”

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2017 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.