The Silent Economic Boom

Economics / US Economy Jun 02, 2017 - 11:31 AM GMTBy: Clif_Droke

[Note: I was recently interviewed by Kenneth Ameduri who hosts the Crush The Street internet show. In it I discuss my take on gold, stocks, Trump, the economy and Bitcoin. The interview can be found here: https://crushthestreet.com/videos/live-interviews/economic-bubble-burst-trumps-watch-clif-droke-interview]

[Note: I was recently interviewed by Kenneth Ameduri who hosts the Crush The Street internet show. In it I discuss my take on gold, stocks, Trump, the economy and Bitcoin. The interview can be found here: https://crushthestreet.com/videos/live-interviews/economic-bubble-burst-trumps-watch-clif-droke-interview]

Though many Americans aren’t feeling it, the economy is quietly gathering forward momentum. With consumers gaining in confidence and real estate heating up on both the commercial and residential levels, the U.S. economy is much stronger than it may seem at first glance.

One reflection of the strengthening economy is the equity market, which is in the eighth year of a bull market since the bottom of the credit crash. The bromide, “As goes the stock market, so goes the economy,” is something that hardly needs explaining, yet so many investors lose sight of this cogent fact that it bears repeating. Rising corporate profits and efficiencies in recent years have contributed in large part to the economic improvement.

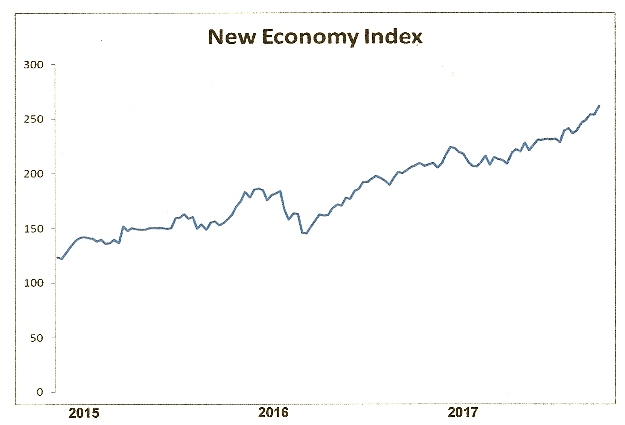

Another reflection of the recovery can be seen in our in-house New Economy Index (NEI), which combines the stock prices of the leading U.S. retail and business service stocks. The graph below shows that NEI continues to hit all-time highs on almost a weekly basis and as such is reflecting a strong consumer retail economy.

With so many indicators pointing to a strong economy, why then are so many Americans acting as if recession is imminent? That’s the question we’ll address here.

Ed Hyman is one of the most respected, and accurate, economists. As Barron’s recent observed, he has been voted Wall Street’s top economist for 36 of the past 41 years in Institutional Investor’s annual poll.

In an interview conducted by Barron’s editor Randall Forsyth, Hyman said he sees cities around the U.S. “booming,” including smaller ones away from the megalopolises on the coasts. His conclusion is that this will benefit Main Street more than Wall Street.

Hyman has a rather old-fashioned, yet highly effective, method of gathering data from which to make his forecasts. His team of researchers simply contact companies such as employment agencies, truckers, car dealerships and home builders and ask, “How’s business?” A rating scale of zero to 100 is used by respondents to describe business conditions and from this tally Mr. Hyman is able to get a good read on what’s happening in the economy.

According to Barron’s, Hyman’s surveys were trending higher well ahead of last year’s election. “At that time,” quoting the Barron’s article, “his model was forecasting real growth in gross domestic product of about 1.5%, although not as ‘uplifting’ as the recent ‘soft data,’ such as confidence surveys, indicate. Now, the model points to 3% growth, bolstered by indicators such as tight credit spreads and high consumer net worth, which accords with what he calls a ‘scientific method.’”

Ad Ed travels around the country, he’s finding that “every place is booming,” he told Barron’s. “Every major city, Chicago, Minneapolis, Kansas City, they’re doing great.” Smaller cities are also outperforming, he says.

Hyman also reports that “millennials are coming on like locusts,” as they emerge from years of living in their parents’ basements. “They’re getting jobs and apartments,” he told Barron’s. “Millennials’ employment is growing at 3% while everything else is growing 1%.”

Hyman also pointed out that many observers have undervaued the extent to which central banks around the globe “are still flooding the system every week” with liquidity, with the Bank of England and the ECB having purchased more than two trillion euros’ ($2.14 trillion) worth of bonds in less than three years. Meanwhile the BOJ and the Federal Reserve, along with the ECB, hold $13 trillion in assets, which has lowered interest rates around the globe. This, he says, explains how the Fed funds rate at just 0.80% while U.S. companies are doing so well.

If Hyman’s macro optimism is to be believed – and our indicators strongly suggest he is right – then 2017 may prove to be the year that the U.S. economy finally takes off and leaves investors with no doubts as to its latent strength and momentum.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's also a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, Mastering Moving Averages, I remove the mystique behind stock and ETF trading and reveal a simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, The Best Strategies for Momentum Traders. Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.