The Reason for US Dollar Strength

Currencies / US Dollar Aug 18, 2008 - 02:19 PM GMTBy: Black_Swan

If you’ve been wondering why the dollar has rallied so sharply, then stop wondering. The kind folks over at the Wall Street Journal have framed up the situation rather well. We’ve been keeping our Members up to speed on the relative game playing out in the currency market. Basically, even as the US economy fails to show any absolute improvement, the relative weakness from its competitors (primarily Europe and the United Kingdom) is driving their respective currencies lower and sending investment capital into the buck.

If you’ve been wondering why the dollar has rallied so sharply, then stop wondering. The kind folks over at the Wall Street Journal have framed up the situation rather well. We’ve been keeping our Members up to speed on the relative game playing out in the currency market. Basically, even as the US economy fails to show any absolute improvement, the relative weakness from its competitors (primarily Europe and the United Kingdom) is driving their respective currencies lower and sending investment capital into the buck.

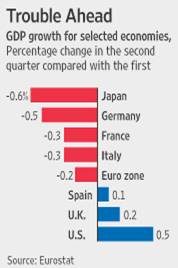

Here’s what we found over at WSJ online ... we think it’s a nice little snapshot highlighting the broad, relative shift that’s moving in the US dollar’s favor:

Here’s what we found over at WSJ online ... we think it’s a nice little snapshot highlighting the broad, relative shift that’s moving in the US dollar’s favor:

The second quarter was a tough one for all the economies in the graphic at the left. Notice though how the US showed the best quarter‐over‐quarter GDP growth.

This shift lends itself to become a major influence on the currency markets simply because of the way it might shift global monetary policy conditions.

In this relative game, the dollar’s yield (central bank‐ determined interest rate) disadvantage is beginning to narrow with some currencies. And the potential for the disadvantage to shrink with other countries is a big buoy for the buck.

Jack Crooks

Black Swan Capital LLC

http://www.blackswantrading.com/

Black Swan Capital's Currency Snapshot is strictly an informational publication and does not provide individual, customized investment advice. The money you allocate to futures or forex should be strictly the money you can afford to risk. Detailed disclaimer can be found at http://www.blackswantrading.com/disclaimer.html

Currency Currents is available for only $49 per year. Just visit the sign-up page on our website to subscribe: http://www.blackswantrading.com/Currency_Currents.html

Black Swan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.