G7 Collapsing GDP Growth Mirrors Plunging Corporate Earnings

Economics / Credit Crisis 2008 Aug 18, 2008 - 10:24 AM GMTBy: Ty_Andros

Confusion reigns supreme as markets correct, in predictable manner, allowing the Main stream financial press, G7 central banks and poorly prepared investors dream of the days when the financial wind was at their backs, rather then brutally in their faces. Markets are moving in a violently countertrend manner allowing people and investors with short term memories to predict the return to happy days. Don't blink or you may miss your day in the sun as: NOTHING HAS CHANGED! Absolutely nothing.

Confusion reigns supreme as markets correct, in predictable manner, allowing the Main stream financial press, G7 central banks and poorly prepared investors dream of the days when the financial wind was at their backs, rather then brutally in their faces. Markets are moving in a violently countertrend manner allowing people and investors with short term memories to predict the return to happy days. Don't blink or you may miss your day in the sun as: NOTHING HAS CHANGED! Absolutely nothing.

Thank god for these countertrend moves as they will give you the opportunities to exercise the INDIRECT exchange, as written about by Von Mises, and convert your increasingly worthless G7 paper currencies into something which can survive the unfolding monetary debasement. The greatest transfer of wealth in history from those that hold their wealth in paper to those who don't has just moved a little closer. Brief recoveries in purchasing power must be used for your benefit and the maximum preservation of your wealth. Don't mistake it for a long term change in the fortunes of FIAT currencies. Remember, currencies don't float they just sink at different rates.

The opportunities in all markets are incredible as these unfolding REALITIES are priced into Stocks, Interest Rates, Commodities, Precious Metals, Real Estate, Natural Resources, Energy Markets, currency values, and all other markets. The only people at risk are Buy and Hold investors who do not practice risk control, which is virtually everybody in the grasp of the brokerage and banking industries. GET OUT OF THEIR GRASP! In the decade from 1998 to 2008 you are breaking even on a nominal basis, and on a real basis in purchasing power you have lost money. The S&P has returned nothing for 10 years, if you are buying and holding you will never retire and will have to work till your demise.

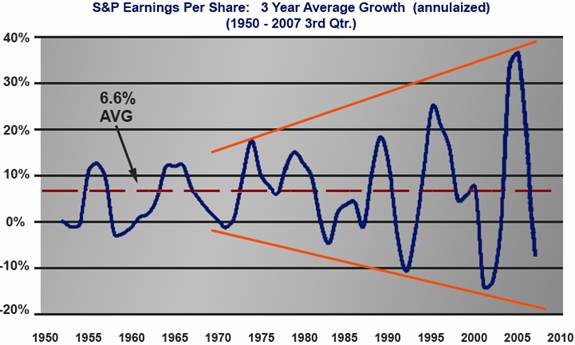

Barely one third of the unwinding banking and toxic paper carnage has been dealt with. Trillions of Dollars, Euros and G7 currencies have yet to be created out of thin air to rescue the former industrialized world's financial systems and crony capitalists (these are not capitalists, they are socialist corporatist fleecers that rely on government protection so they can give you less of everything for more money). Auto makers, insurance companies, banks, brokers, ethanol producers and subsidized businesses, all lay in the path of this tornado. Incomes are COLLAPSING, creating the need for many new rescues to emerge on the horizon . S&P 500 earnings are collapsing, ex energy they are down over 25% and project to collapse another 25%, so don't buy the dips, sell the rallies . Do you think profits can be cut in half and stocks won't? What about unemployment, which is set to skyrocket to protect the profits that remain?

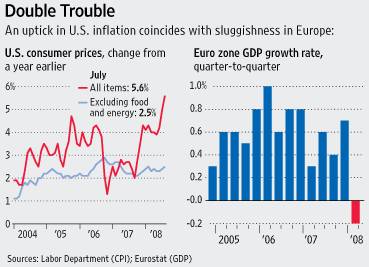

The 2008 pattern of the year: “Wolfe Wave” (see Tedbits archives for 2008 outlook at www.Traderview.com ) is setting the stage for the mother of all reflations which has already begun. To get a picture of collapsing income of the Wolfe in action let's look at the pattern next to economic grow and surging inflation which is, in purchasing power terms, the definition of loss of income:

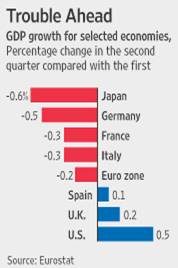

Earnings are slicing through the lows; now let's look at the reflection of this in economic growth of the G7:

Notice how GDP PEAKED at the same time as S&P profits did? They are REFLECTIONS of each other. US GDP peaked at the same time. Clear evidence of asset backed economies where RISING asset prices drive GDP. Year over year US wages are down 8 tenths of one percent; factor in real inflation numbers and income and GDP is collapsing well over 5% per year.

Let's briefly review the last two week's shenanigans as it is breathtaking. The Fannie Mae, Freddie Mac and housing rescues were rolled into one MONSTER piece of legislation and passed by the Gang of 535, aka the mandarins of Washington DC . Rolled out to the public with headlines stating a cost of $25 billion, it actually is a blank check for political constituents far and wide and although no checks have been written yet, provisions contained in it include lifting the debt ceiling of the US government by 1.2 TRILLION Dollars. And we know about government blank checks, they are ALWAYS filled in for the maximum amount and frequently MORE! Payable by whom else? The taxpayer and anyone who stores their wealth in a G7 currency or Bond. Make no mistake it HAD TO BE DONE. There was NO CHOICE as the resulting financial tumult would have DESTROYED the G7 banking systems, and central banks worldwide that hold on average 65% of their reserves in dollars and all fiat currencies.

Fannies and Freddie's collapse would have made Bear Stearns failure look like a walk in the park. But the details of the rescue are HORRID, nothing has been solved (not one issue) and the problems are only POSTPONED until later insuring even more losses when it finally does GET FIXED. There are NO Solutions in this legislation, it lowers lending requirements (3% down qualifies) rather then restoring them to sane levels, expands eligibility for Fannie and Freddie conforming loans from $350,000 to mid $600's and allows political patronage from these two to continue to flow to WASHINGTON public serpents (Fannie and Freddie are number 1 and 2 in this category).

It changes their unofficial status as Government-sponsored enterprises by changing implicit guarantees to explicit ones on $5 trillion dollars of mortgages and mortgage guarantees so now the taxpayers are formally on the hook. It leaves shareholders IN TACT after their own failure to exercise managerial supervision, socializing the losses to the public and privatizing the profits. It preserves the HUGE role they play in CAMPAIGN contributions for corrupt public serpents. It is an abomination in corrupt oversight and last but not least it requires that every credit and debit card transaction in the US be instantly available to the federal government. Financial privacy stripped away and put in the hands of public serpents!

Approximately 20% of Fannies and Freddie's liabilities are against sub prime and Alt A borrowers. And, as sure as you can say Merrill Lynch, you KNOW these are destined to decline to the value of Merrill Lynch's own Alt A and sub prime holdings which we have recently discovered is 5 cents on the dollar. Do the math, it means almost 1 trillion Dollars in losses (and money printing) lay ahead to rescue these two public servants' “Policies of Insolvency”, Government sponsored enterprises and political patronage MACHINES. Add that to the minimum 1 trillion Dollars needed to rescue the banks and 2 trillion Dollars is now on the printing schedule.

Merrill lynch beat the street to the door on their ALT A and sub prime holdings, selling $30 trillion dollars of them at 22 cents on the dollar and loaning the buyer ¾ of the money and taking the worthless CDO's (collateralized debt obligations) as collateral. Thus the buyer is actually taking a call that somehow more than 5 cents on the dollar will be RECOVERABLE. These are market clearing prices, only the markets won't clear until everyone marks to them.

Please understand that these MARKS to market spell the demise of many financial institutions who hold them on the books at far higher values. An example would by CITIGROUP which marks them 10 times higher at 52 cents on the dollar. Pension funds, institutional investors, insurance companies and investors everywhere are watching in HORROR as the value of their holdings and balance sheets VAPORIZE with this move by Merrill. Now we just wait for the announcements!! The next round of losses by the money center and investment banks just came into clear VIEW. To be followed by credit cards, autos and commercial real estate loan write downs in coming quarters.

Accordingly, the Federal Reserve's Special Auction Facilities: TSF (Term Auction facility and TSAF (Term securities auction facilities) were extended to about ninety days and expanded in size. This is where big banks and brokers park these toxic 5 cent on the dollar securities and borrow treasuries. I have predicted these facilities will expand to billions of dollars and you can bet they won't expire for YEARS.

Russia has started a war “never mentioned by the financial media” and financial markets wonder why the dollar rallied hard on the news, citing fundamentals rather then global tensions as the cause of the dollar rally. The fundamentals are TERRIBLE, if stock profits decline 50% from their highs what do you think employment will do? The answer is layoffs will accelerate . Bear markets in dollars are like bear markets in stocks: they are subject to fierce countertrend rallies. Don't be fooled, step aside as this long overdue correction unfolds -- and it could be big -- then reposition at better prices for the dollar's ultimate demise.

The Mandarins of Washington are preventing practical solutions for energy supply by BLOCKING votes on oil exploration, energy development and additional supplies, stating these solutions are years away and they need solutions TODAY. Hello, has anyone thought about LONG TERM planning and fiduciary responsibility to our children rather than solutions which only address problems for the NEXT election. They cited they are SAVING the American people; let's kill your lifestyles and economies to SAVE you. Impoverishment drives people right into their hands. They state they will create 5,000,000 high paying jobs from green energy, HOOEY, Baloney.

High paying jobs come from industries which produce more then they consume, not from industries which consume more then they produce and are subsidized by socialist central planners in Washington DC . Add the bailout to Fannie and Freddie which DOES NOT fix the problems of lending standards, to the energy policy which addresses no problems in a practical manner rather than a political one and it puts G7 public servant economic illiteracy on full display.

The Pinocchio administration's (Like Pinocchio, the Bush administration is a congenital liar in the best politically correct traditions and appears to be a puppet of others) GDP (Gross Domestic Product) was released at a 1.9% growth rate predicated on 1% inflation rate. Does anyone believe inflation in the second quarter was 1%, using their own CPI (consumer price index) of 5.6 %, year over year growth morphs in to negative 4.6%. Import inflation continued higher at a 20% year over year rate. There are no true economic measures produced by G7 government agencies only politically correct ones to mask economic mismanagement and provide the crony capitalists with the numbers they need to FLEECE you.

Clyde Harrison correctly notes “Alan Greenspan papered over long term capital management, Y2K, the NASDAQ bubble bursting and now has papered over the housing market. The Greenspan Put is being exercised once again and the US taxpayers just don't know the total amount they will ultimately pay.”

The Indirect Exchange - What is it? Why is it important? What do you do?

What is it?

It is where you exchange fiat currencies for something that can't be printed, that can hold its value during currency debasement, runaway inflation and loss of purchasing power, and will hopefully grow in value in excess of the repricing in the debasing purchasing power of the currency in which it is denominated.

First let's review the functions of money again:

- Medium of Exchange

- A Store of Value

- A Standard of Value

- Measure of Value

When money has these definitions you can store and accumulate your wealth in it. You can move wealth through time and space. It is why the bond market exists as wealthy people and institutions could buy bonds with varying degrees of safety and believe it was safe. This was when the Dollar was backed by gold, silver or commodities. Unfortunately it now only has the 1 st definition as a Medium of Exchange, it no longer functions as a store, standard or measure of value.

Why is it important?

It's important because the G7 no longer produces more then it consumes. Incomes are collapsing and so are tax revenues. The financial and banking systems are increasingly insolvent and will need to be recapitalized as their balance sheets crumble under the strain of lending to unqualified borrowers on inflated asset values, deadbeat credit cards holders, commercial real estate and construction loans, ad infinitum. The only source of income to meet government obligations and fix the G7 financial and banking systems is the PRINTING press. Thus the purchasing power of your money and bonds are STOLEN from you while it SITS IN THE BANK! Deficits are skyrocketing on all levels of government and incomes are as well: Municipal, State, and Federal, not to mention the public's personal finances. Take a look at this excerpt from a recent Free Market Gold report by James Turk ( www.fmgr.com ) to understand what's coming right behind the reflations of the financial and banking systems required directly ahead:

According to Dallas Federal Reserve president, Richard Fisher, when these Medicare liabilities are added in with those for Social Security, the unfunded liabilities grow to $99.2 trillion . After adding in the direct debt obligations from its borrowings, the total government debt is $110 trillion, which is twice the amount reported in the government's annual consolidated accounts. Here are some insightful excerpts from a speech given by Mr. Fisher in May. http://www.dallasfed.org/news/speeches/fisher/2008/fs080528.cfm

• “Let me give you the unvarnished facts of our nation's fiscal predicament.

• [in the seven years ending in 2007], federal spending grew at a 6.2 percent nominal annual rate while receipts grew at only 3.5 percent.

• The mathematics of the long-term outlook for entitlements, left unchanged, is nothing short of catastrophic.

• Critics…begin by wringing their collective hands over the unfunded liabilities of Social Security.

• The bad news is that Social Security is the lesser of our entitlement worries. It is but the tip of the unfunded liability iceberg. The much bigger concern is Medicare.

• If you wanted to cover the unfunded liability of all [Medicare] programs today, you would be stuck with an $85.6 trillion bill.

• For the existing unfunded liabilities to be covered in the end, someone must pay $99.2 trillion more or receive $99.2 trillion less than they have been currently promised.

• We know from centuries of evidence in countless economies, from ancient Rome to today's Zimbabwe , that running the printing press to pay off today's bills leads to much worse problems later on. The inflation that results from the flood of money into the economy turns out to be far worse than the fiscal pain those countries hoped to avoid.”

It is noteworthy that Mr. Fisher mentions the experience of “ countless economies, from ancient Rome to today's Zimbabwe . ” Though he doesn't actually say it, the United States is headed for hyperinflation. Its debt obligations make that outcome certain, just like it did for those other countries with fiat currency.

The federal government will not cut back on spending. There is no political will to do that, and in any case there is no need for politicians to cut back in today's monetary system. Because there is no external discipline imposed on the currency creation process as there was, for example, under the classic gold standard, its captive central bank, the Federal Reserve, will make certain that sufficient dollars will be created to meet every penny the federal government intends to spend. That is why the Federal Reserve exists – the Federal Reserve is there to make sure that the federal government's budget deficits get funded just like the central bank funded the deficits of Weimar Germany in the 1920s or today's government budget deficits in Zimbabwe which are being funded by that country's central bank .

Do you think the Dallas Federal Reserve president is exaggerating? Federal Reserve presidents are not prone to HYPERBOLE and exaggeration. Do you think James Turk's comment on government spending and the purpose of the Fed is inaccurate? My guess is NO. You can count on these things happening. Please keep in mind that FIAT G7, and all currencies for that matter, are backed by NOTHING, nothing but the full faith in government. Thus, they are redeemable in nothing but HOT air and YOUR property and holdings!

What do you do?

You use pullbacks in Commodities, Stocks, Energy and Natural Resources to maximize the purchasing power of your FIAT currencies by exchanging paper for REAL things and real businesses which will survive this debasement process by repricing to reflect the lower purchasing power of the currency in which they are denominated. As markets zoom higher and lower, huge TRADING opportunities are abundant. Learn the methods to capture them. Infrastructure companies, oil companies, virtually everything is being thrown out as poorly prepared hedge funds and investors convulse out of their trading positions and investments because they are CORRECTING in violent manner and risk control is poorly practiced.

Stocks are OVERPRICED but soon they will go on sale, wait like a cat and then pounce. Stocks are units of PRODUCTION, so look for companies that PRODUCE MORE THEN THEY CONSUME, the profitable ones. If they don't have solid franchises, profits and regular customers: avoid them like plague. Do not speculate in issues which are based upon discretionary spending or the future prospect of profits.

You can smell the coming debacle in the stock market, whether it is before the election or after. People are rotating back into paper and OUT of things that can't be printed. It allows you MORE time to get yourself positioned for the opportunities which this emerging Crack up Boom offers us all. More gold for your money, more units of production, better entries into commodities and energy investments, don't miss this opportunity. Redeem them for something that is REAL, not hot air. Units of production and real things will just REPRICE higher to reflect the deflation of the purchasing power of the paper currencies and they will preserve your wealth. There are trillions of Dollars, Pounds, Euros and many other currencies that will ultimately be chasing these things to protect the owners of them from confiscation by printing presses. Use this unfolding opportunity to exercise the INDIRECT EXCHANGE!!!

Conclusion: The policies of insolvency are spreading in ever widening circles in the G7. Socialism is on the MARCH. Weimar Republics and Zimbabwes happen when production and income collapse. Do I see the Wolfe wave unfolding? Yes. The inflation in prices of everything you use is caused by Public Servants and government. As Clyde said: The Greenspan Put is being exercised, so the governments will do as they always have done, they will PRINT THE MONEY!

Worldwide money and credit growth is north of 20% and I promise you its not going to stop with G7 economic growth in FREEFALL. Keynesian economics DEMANDS government spending and running deficits as the time tested remedy. The public serpents, er, servants will OBLIGE. Central banks are political creatures, not independent as they claim to be. You can count on this….

The greatest REFLATION in history is unfolding before our very eyes. People refer to the “over the counter derivatives” such as Collateralized Debt Obligations, Collateralized Mortgage Obligations, Collateralized Loan Obligations and Mortgage backed securities as toxic waste. That is too narrow, G7 currencies and bonds are included in that definition as well. Heavily indebted, income-short G7 governments have the printing press firmly in their plans to meet their commitments.

The public is now very much out of the commodities and precious metals investments; unfortunately for them the Dollar's long term demise is still unavoidable. The Dollar can rally and is doing so in BEAR MARKET type countertrend rally, kind of like 300 Dollar rallies in the DOW.

In the next issue we will see another installment of the Crack Up Boom series. Volatility is OPPORTUNITY for the prepared investor and it is abundant. These moves up and down are OPPORTUNITIES! These plunges in real things is just an example of throwing out the babies with the bathwater. Use your funds to buy more of EVERYTHING that is real. The world is not going to end, just change. The winners and losers will be determined by the amount of work you do and the ability to sift through FEAR (false evidence appearing real) and main stream financial media SPIN!

Please remember that subscribers receive Tedbits two to three days before it is posted on the web. Subscribers will also start getting guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.