SELL US Stocks - Massive Market CRASH WARNING!

Stock-Markets / Stock Market Crash May 26, 2017 - 10:34 AM GMTBy: John_Mauldin

By Stephen McBride : “I’m telling you right now, the US is going to have a crash and it will be massive,” asserted Mark Yusko at Mauldin Economics’ Strategic Investment Conference.

By Stephen McBride : “I’m telling you right now, the US is going to have a crash and it will be massive,” asserted Mark Yusko at Mauldin Economics’ Strategic Investment Conference.

In his keynote speech, Mark Yusko, CIO of Morgan Creek Capital Management, outlined where he sees the biggest opportunities and risks for investors are today.

Demographics Are Destiny

Mark began with the big story of the SIC 2017—demographics.

He believes that efforts to generate growth through fiscal stimulus and tax cuts will prove futile because the working-age population in the US is declining. As such, consumption—which makes up 70% of the US—will continue to fall.

Mark thinks instead of taking off, the US economy is on the cusp of a recession.

Headed for Recession

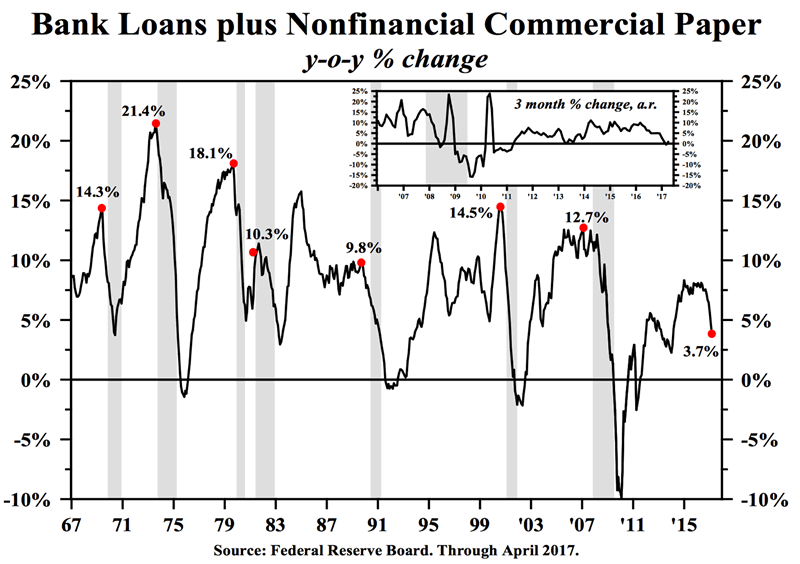

Mark points to key indicators such as credit growth and tax revenues, which are declining, as proof a recession is around the corner.

Source: St. Louis Fed

“Every time a President leaves the White House after two terms, there is a recession within the first year of the new administration. I believe this time will be no different.”

So, what does this mean for investors?

Sell US Stocks

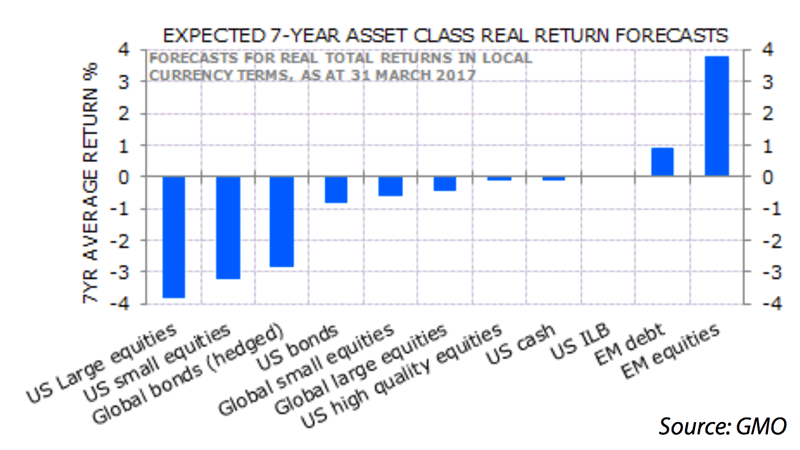

Since 2012, the earnings of S&P 500 companies have gone nowhere, yet the market is up 70%. This rise has all been multiple expansions. As such, US equities are one of the most expensive class of assets in the world today.

With the S&P 500 trading at record highs, top investment management firm GMO projects returns will be negative over the next seven years.

Source: GMO

With US markets fully priced, Mark says his firm is deploying their capital elsewhere.

European Banks Are a Buy

Despite all the hype around US financials due to “Trumponomics,” Mark points out that European financials have vastly outperformed their US counterparts since the beginning of the year.

Mark detailed that EU financials have had a decade of underperformance… and he now believes they are a buy.

Besides European financials, Mark thinks investors should be selling passive index funds and buying active ones. As correlations continue to fall, Mark says this is the best time in the past decade for stock-pickers.

Download a FREE Bundle of Exclusive Content from the Sold-Out 2017 Strategic Investment Conference

Get access to exclusive interviews with John Mauldin, Neil Howe, and Pippa Malmgren from the SIC, an e-book from renowned geopolitical expert George Friedman, and bonus SIC 2017 content…

Claim your SIC 2017 Bundle now!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.