Bitcoin Breaks the $2,000 Mark as Cryptocurrencies Continue to Explode Higher

Currencies / Bitcoin May 21, 2017 - 10:59 AM GMTBy: Jeff_Berwick

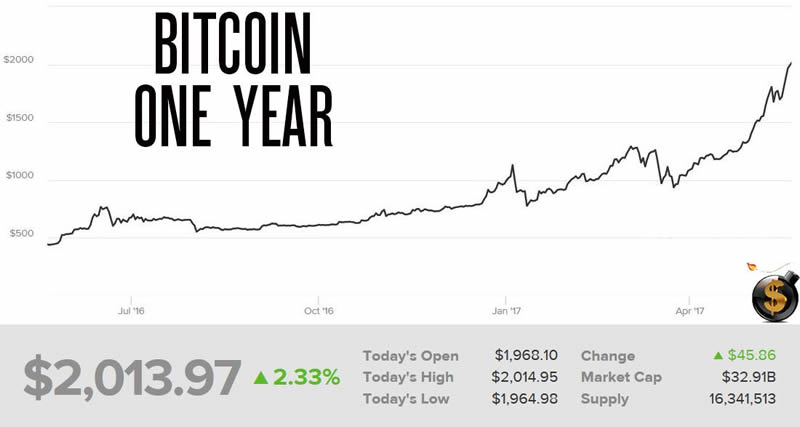

Bitcoin has just broken through the $2,000 level according to the CoinDesk Price Index.

Bitcoin has just broken through the $2,000 level according to the CoinDesk Price Index.

Of course, we’ve been talking about it since it was $3 in 2011.

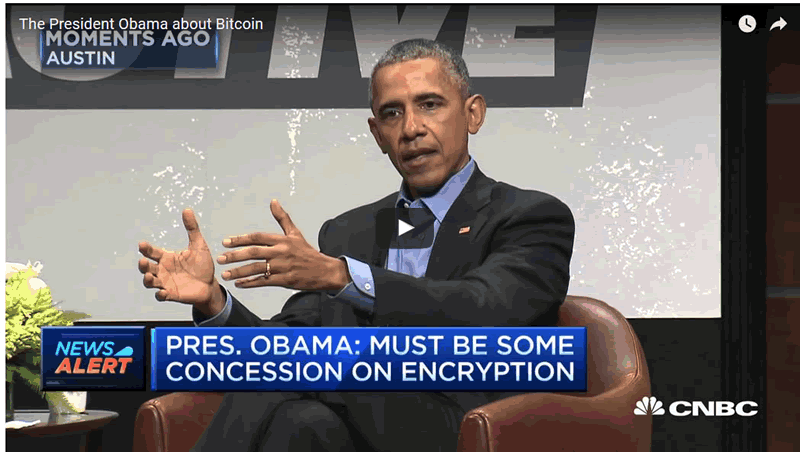

And here is a flashback from when I was on CNBC in April, 2013 when bitcoin was around $100 and had a total market capitalization of only $1 billion. As of today bitcoin has a market capitalization of over $32 billion!

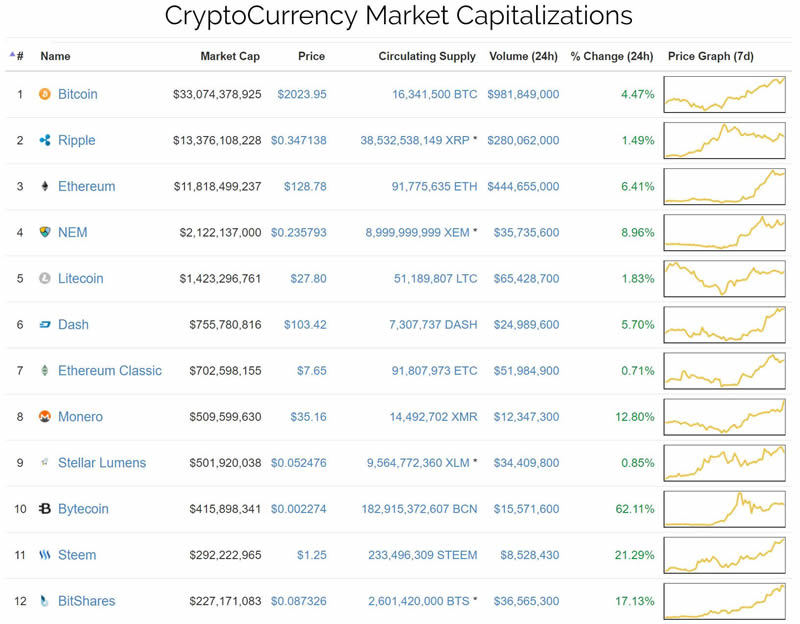

The entire cryptocurrency space continues to rocket higher as well. There is nothing but green, and big green, on the board for the top cryptocurrencies:

- Bitcoin 67,366% gain since 2011

- Ethereum 5165% gain since January 27th, 2016

- Monero 1561% since August 18th 2016

- Dash 475% since February 14th, 2017

- Steem 740% since March 29th 2017

All five of those are currently in the top 11 cryptocurrencies in the world.

And we’ve recently featured a few much smaller ones that could potentially skyrocket as well. You can get access to our latest issues of the TDV newsletter for subscribers here.

I’ve advised subscribers to be prepared for a pullback as nothing can go up forever. So, you can access my analysis and advice on what to buy and sell in the cryptospace for a discounted price here.

While we’ve made fortunes for our readers, viewers and subscribers over the years, we aren’t actually fans of cryptocurrency because of the massive gains it has offered us.

The reason we are fans is because people like Barack O’DroneBomber and the globalists that are behind all the theft, wars and poverty in the world today despise bitcoin and are flummoxed as to how they stop it.

In that video, Barack says we need to stop bitcoin to stop child pornography.

But it is him, Killary Clinton, John Podesta, globalist/zionist bankers and the Royal Family who are the biggest child traffickers in the world. Just look up Pizzagate for starters. Or Boystown.

Or hear it direct from this ex-Dutch bankster who quit when he was told to sacrifice children at an Illuminati party.

Barack then says that the reason we need to stop bitcoin is because of “terrorism”. But it is the US government, NATO, CIA, FBI, UK, Israel and other governments who are the biggest terrorist organizations in the world. 9/11 is just one of dozens of terrorist attacks committed by them.

And then Barack gets to the real reason why they want to stop it, saying, it stops them from doing “Simple things like tax enforcement. Because, if in fact, you can’t crack that all.. Government can’t get in, then everyone is walking around with a Swiss bank account in their pocket.”

And, that’s the real reason we love cryptocurrencies, because it will stop the unconstitutional extortion by the IRS of trillions of dollars per year which is funneled through to the Satanic military industrial complex at the Pentagram and the terrorists and the child molesters who operate the government and the central banks.

The Illuminati better do something soon to stop cryptocurrencies before it takes down their whole power structure and they are exposed as the criminals that they are and are made to pay for their crimes.

And there is no way to stop cryptocurrencies without turning off the internet. So, get ready for the internet kill switch soon.

Oh, what a surprise. The Prime Minister of the UK, Theresa May, came out yesterday with a new plan to get rid of the old internet and create a new internet than can be “controlled and regulated by government.”

The timing is surely a coincidence.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.