Bitcycles - Does BitCoin Have Cycles?

Currencies / Bitcoin May 14, 2017 - 06:49 PM GMTBy: SurfCity

Not sure if anyone has been following Bitcoin lately but it tracking the Price and Volume action over the last 6 months has been fascinating.

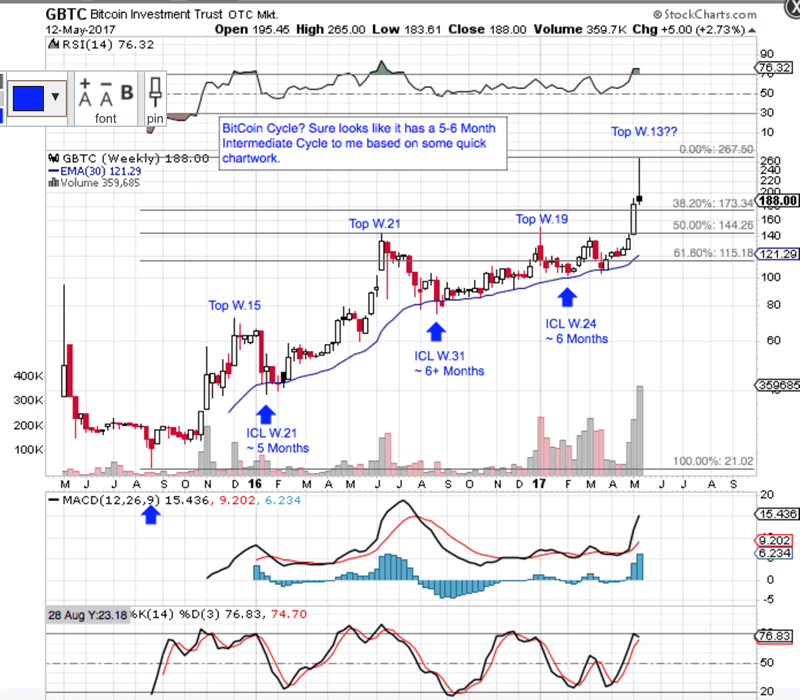

Here are some charts (one and two year charts of GBTC, (the BitCoin Trust) along with some other links. Sure looks like the recent Parabola cracked late last week so based on the chart, we may see a buying opportunity once RSI drops to the 40s or 30s…

Lets get a discussion going. What do you know about BitCoin? Any other symbols that you know of that can be tracked and charted? Please use the comments section .

Some related links of interest:

https://cointelegraph.com/news/bitcoin-price-surge-due-to-rise-in-institutional-investors-cnbc-analyst

https://cointelegraph.com/news/bitcoin-traded-at-high-premium-of-1835-in-japan-reasons-trends

So does BitCoin have an Intermediate Cycle where Price finds a major Low every 5-6 months? BitCoin has had one hell of a run since mid-March, more than doubling in price. Looks like the parabola, however, may have cracked last week (see the Blue Parabola in my 2nd chart below). If so, when will BitCoin find its next major Cycle Low?

Here is a quick and dirty analysis of a 2 year Weekly chart of GBTC that shows it seems to have a 5-6 month Intermediate Cycle just like everything else I track. Note that out of the last Yearly Cycle Low (YCL) in Aug 2015, I show three Intermediate Cycles that vary in length between 21 to 31 months, with tops in weeks 15-21.

If I am correct that the break in the Parabola (see the 1st of my two charts below) last week is the top of the current Intermediate Cycle, then this would be the earliest top we have seen in any of the Intermediate Cycles since the last YCL. Again, if I am correct and cycles to apply to BitCoin, then it would seem that we should now expect 7-17 weeks or so of downside price action.

If so, it will be interesting to see if the 62% Fib retrace level will hold at the next Intermediate Cycle Low.

By Surf City

Everything about Cycle Investing

© 2017 Surf City - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.