War on Bitcoin - German Central Bank Warns Not To Use Bitcoin

Currencies / Bitcoin May 14, 2017 - 03:46 PM GMTBy: Jeff_Berwick

Central banking, which is a tenet of communism and a scheme to impoverish the many to benefit a few, is one of the evilest, most pernicious and rapacious entities on Earth.

Central banking, which is a tenet of communism and a scheme to impoverish the many to benefit a few, is one of the evilest, most pernicious and rapacious entities on Earth.

So, when a member of the German central bank, Bundesbank, warned against buying bitcoin I almost choked on my wiener schnitzel.

Having a central bank warn against buying bitcoin is like a rapist warning you that sex with your spouse isn’t as exciting as when he rapes you.

Yes, we know… and that’s why most people prefer not getting raped… and why we prefer bitcoin over any central banking scrip.

Here is what Carl-Ludwig Thiele, a Bundesbank board member said:

“Bitcoin is a means of exchange which is not issued by a central bank, but by unidentified actors. I do not see it as a currency. If you think Bitcoin would be as safe as the euro or the dollar, you have to take responsibility for it. We can only warn people not to use the bitcoin to preserve purchasing power.”

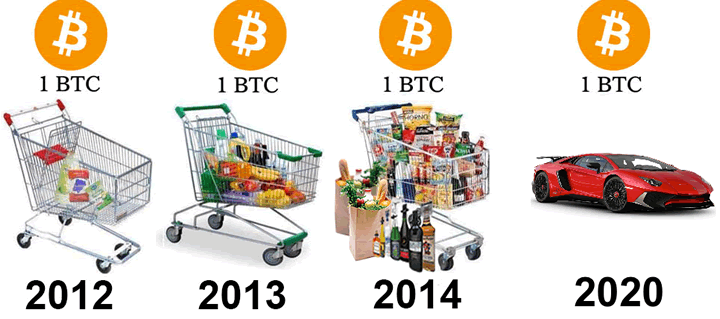

It comes as the height of arrogance to warn now, with bitcoin at all-time highs near $1,800, that bitcoin is a bad currency to “preserve purchasing power.”

If you had bought $1000 USD worth of bitcoin back in 2011 at $3, it would now be worth roughly $566,000.

If you had $1,000 USD in 2011, it would still be “worth” $1,000, but that $1,000 would only buy about $913 worth of goods. And that is when calculating the depreciation with the government’s own CPI index of 1.34% per year which has no bearing on reality. It is much higher than that.

If you had bought $1000 USD worth of euros in 2011, you’d now have $859 worth of euros considering the January 2011 USD exchange rate of .748 Euro per dollar.

So, with dollars, you would have lost roughly 1.34% per year due to inflation and with euros, you lost a whopping 5% due to the drop in the value of the euro and even more if inflation is considered. And, with bitcoin, your purchasing power increased by 56,500%.

So, clearly, you can see why the German central bank is warning against holding bitcoin. Because if everyone held bitcoin we’d all be rich and there would be no German central bank for Carl-Ludwig, that Keynesian communist, to “work” at.

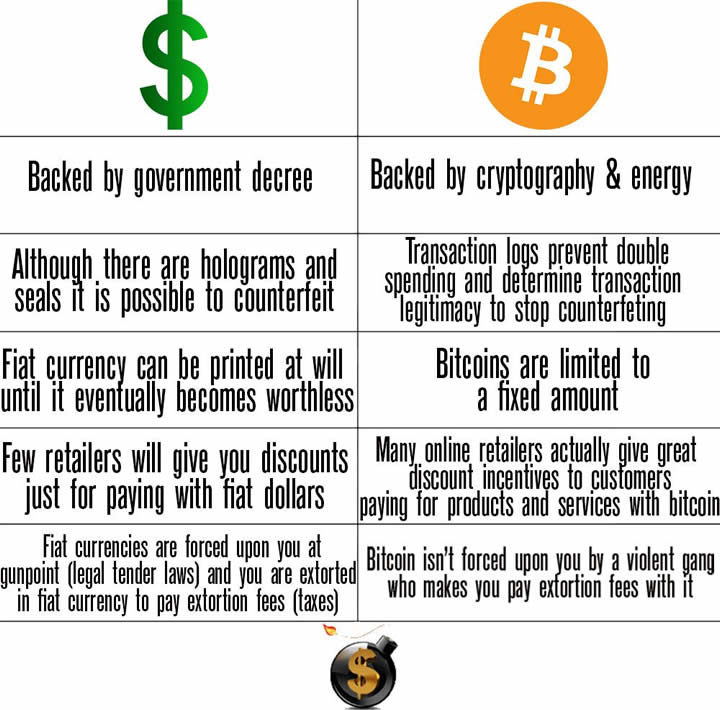

Let’s compare bitcoin to central bank issued fiat currency to show further how ludicrous Thiel’s statement is:

Minimum wage protests continue because people are finding that the central bank’s inflation has made it so they can barely afford to eat anymore.

Meanwhile, the value of bitcoin continues to increase. Had everyone had bitcoin for the last few years there’d be no poverty and no strife.

We suggest you ignore anything that the government, central banks and mainstream media tell you. All three of them are centralized and archaic and are in the midst of being washed away by a new paradigm of non-violent, decentralized systems of which bitcoin is one.

Most of the world hasn’t realized this evolution is in process, though, so you can still get in and well-positioned before the crowd and potentially realize a fortune for doing so.

You can get access to our book, Bitcoin Basics, and our newsletter that covers this ongoing paradigm shift here.

I’ll wager with Carl-Ludwig Thiele that bitcoin outlasts both the US dollar and the euro. In fact, I’ve predicated my life’s work around it here at The Dollar Vigilante.

Central banking is so 20th century. It’s time people like Carl-Ludwig Thiele disappear. In fact, why is the Bundesbank even still around? It essentially does nothing now that the counterfeiting power and interest rate market manipulation are committed by the European Central Bank.

Poor Carl-Ludwig, he doesn’t even know he is already obsolete.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.