Gold Price Cycle Low Update

Commodities / Gold and Silver 2017 May 05, 2017 - 12:03 PM GMTBy: SurfCity

Seems everyone (me included) is trying to spot when the next Intermediate Low in Gold and PMs will be. Again, one of the things I am looking for is a failed short term Trading Cycle to confirm the move into the next Intermediate Low.

Seems everyone (me included) is trying to spot when the next Intermediate Low in Gold and PMs will be. Again, one of the things I am looking for is a failed short term Trading Cycle to confirm the move into the next Intermediate Low.

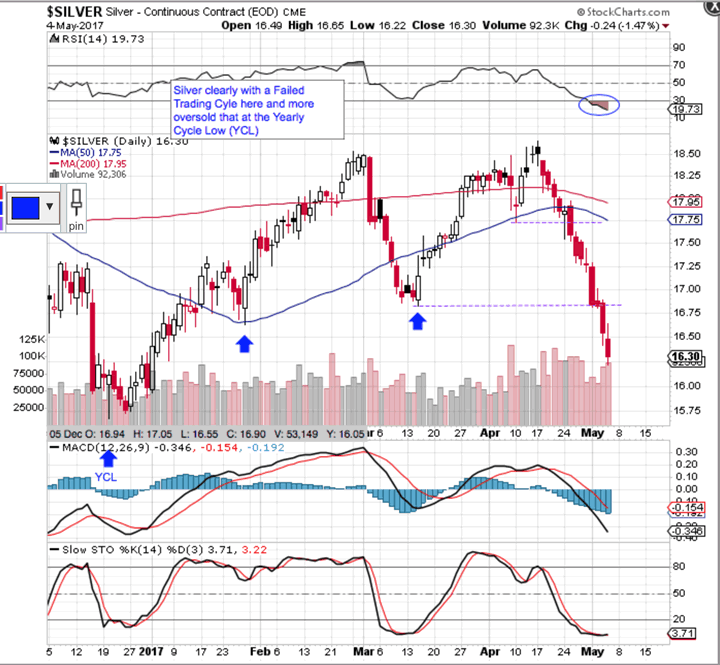

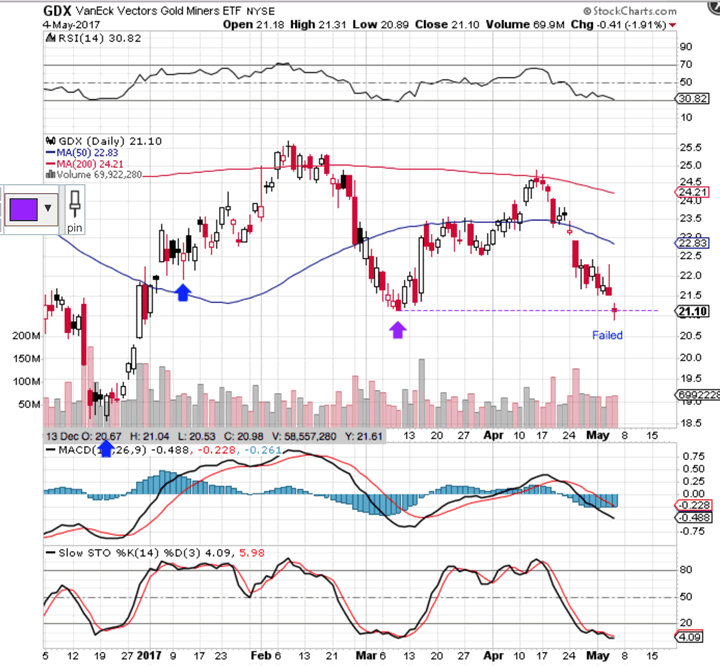

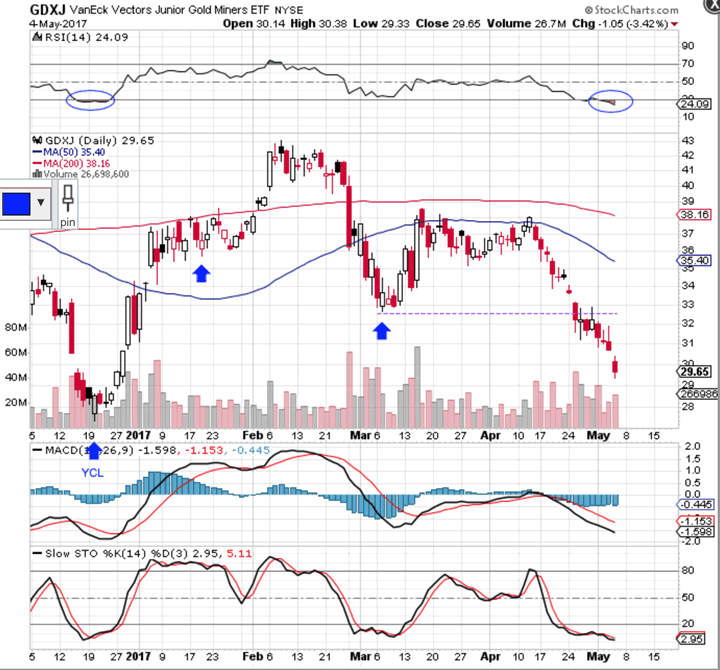

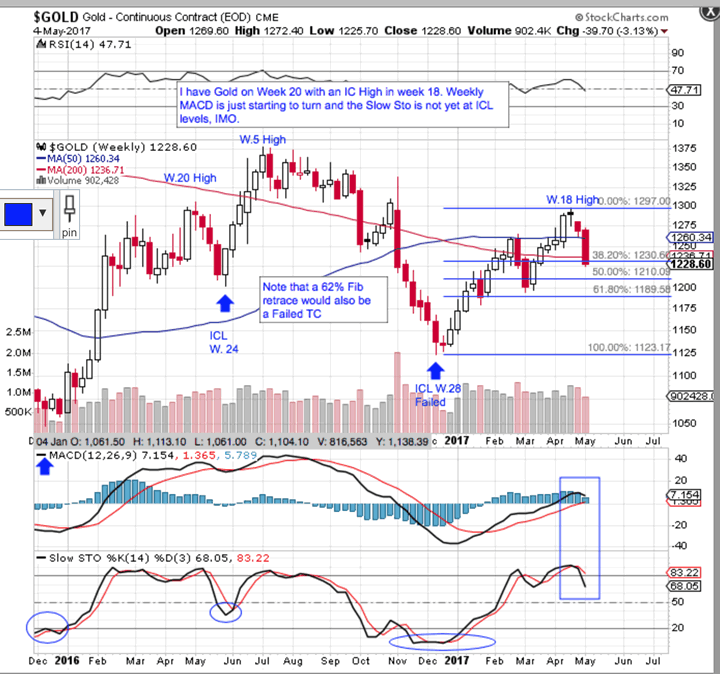

Well we now have Failed Trading Cycles in Silver and two Failed Cycles in GDX and GDXJ. Silver and the GDXJ are very oversold here so could we be nearing an Intermediate Bottom (RSI, MACD and Slow Sto are all at or approaching ICL levels)? But Gold is the Cycle driver and the Gold chart is giving me some issues (see my next section).

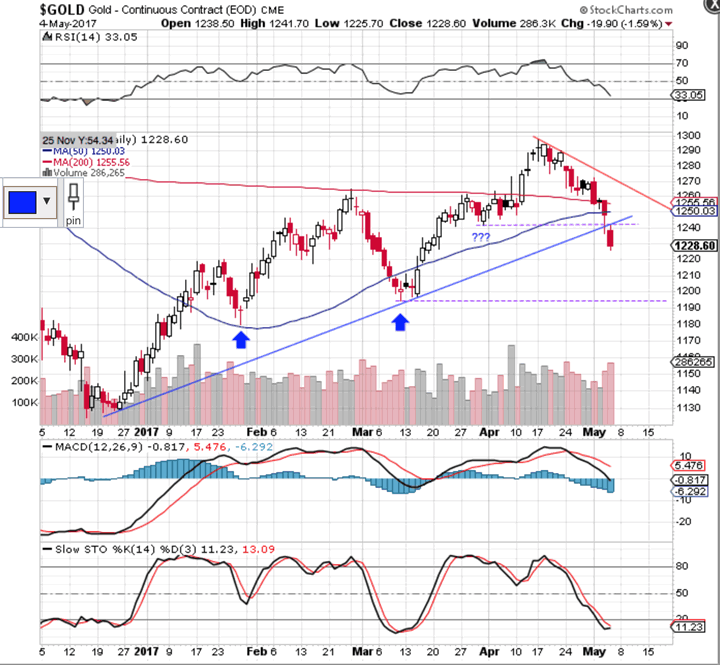

Gold Daily and Weekly charts show a different picture. Gold Daily is a maybe but on the Weekly, the oscillators are not yet at levels normally associated with an ICL. My first Daily chart shows Gold has broken its IC uptrend and may have a Failed TC if we had a stealth TC Low near day 18 (see ??? on chart). The Weekly paints a different picture but if we drop to the TC Low level below 1200, Silver and the Miners may well take out the December 2016 Lows.

Based on what I am seeing, I MAY take a long position near the next Low, perhaps next week, but with a tight stop.

By Surf City

Everything about Cycle Investing

© 2017 Surf City - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.