De-leveraging of America Does Major Technical Damage to Gold

Stock-Markets / Financial Markets Aug 16, 2008 - 09:55 AM GMT

Doubling down on bad bets is taking place on the public pension level. It appears that they believe the worst is over and are willing to send good money after bad. What seems to be happening is a scramble to make up for the poor performance of these funds in the last 12 months. The unfortunate problem is that they are heading in uncharted water in the name of “diversification.”

Doubling down on bad bets is taking place on the public pension level. It appears that they believe the worst is over and are willing to send good money after bad. What seems to be happening is a scramble to make up for the poor performance of these funds in the last 12 months. The unfortunate problem is that they are heading in uncharted water in the name of “diversification.”

The De-leveraging of America .

This week the Federal Reserve lent $50 billion of 28-day loans and $25 billion of 84-day loans through the Term Auction Facility (TAF) in order to loosen the purse strings of banks to start lending money again. Their effort may have been fruitless, since the cost of the London Interbank Offer Rate (LIBOR) has widened since then, signaling a further tightening of credit . In other words, the stimulus is not working. Instead, banks are becoming even more distrustful of one another. They are simply raising cash and not lending it. This is a far cry from a year ago, when “cash was trash.” Banks were eager to lend with no thought for tomorrow, since idle cash was considered a burden. How times have changed!

The commercial banks' unwillingness to buy back their auction-rate securities in January was just a foretaste of what's to come. The Fed said this week in its quarterly lending survey that banks tightened credit standards for consumers and business borrowers since April as defaults and delinquencies on home loans climbed. About 75 percent of U.S. banks surveyed indicated they increased standards on prime mortgage loans, up from 60 percent in the previous survey, the Fed said.

The loan survey ``was pretty scary,'' wrote former Fed Governor Laurence Meyer , now vice chairman of Macroeconomic Advisers LLC, in a note on Aug. 11. ``Given how much bank credit is tightening, and given that it shows no signs of stabilizing, one has to believe that the risk of a more abrupt slowdown is considerable.''

Inflation: Should we be worried?

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in July, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The July level of 219.964 (1982-84=100) was 5.6 percent higher than in July 2007.

The alarming part of this report is the acceleration of inflation in the past 3 months. While the unadjusted rate for the past 12 months was 6.2%, the 3-month annualized rate of increase was 11.9%. It should not be news to anyone trying to buy groceries and gasoline that prices have dramatically increased. Inflation is a symptom of easy money. When it affects the price of our stocks or our home, we don't mind it a bit. But it has a habit of affecting the cost of food and fuel. That is when we pay the piper, especially when our home values and stock portfolios are going down.

Rally over?

Consumers are still gloomy , despite the lower price of oil and the higher prices in stocks, according to the University of Michigan/Reuters consumer sentiment index released today. The reason? “ Consumers' judgment on the current economy fell from 73.1 to 69.3, the second lowest reading in 28 years.”

The lack of confidence may spread back to the markets, as investors eye the meager rally thus far. In addition, through the month of August we've had the three worst months of stock market performance for the year. How much worse can it get?

Treasury bonds have more foreign purchasers.

Foreigners bought a net of $51.1 billion in U.S. assets in June, up from $12.3 billion in May, according to the Treasury International Capital, or TIC, report released Friday.

Foreigners bought a net of $51.1 billion in U.S. assets in June, up from $12.3 billion in May, according to the Treasury International Capital, or TIC, report released Friday.

The huge decline in commodities seems to have put a fire under the bond market, as capital flows out of oil and gold and looks for a safer home. Lower commodity prices stoked speculation that inflation may be easing and would reduce the likelihood of a rate hike in the near future.

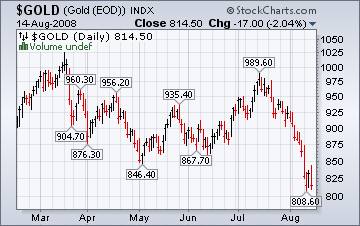

Major technical damage done to gold.

Gold futures tumbled Friday to trade below $800 an ounce for the first time this year, as strength in the U.S. dollar set gold prices up for a weekly loss of almost 9%.

Gold futures tumbled Friday to trade below $800 an ounce for the first time this year, as strength in the U.S. dollar set gold prices up for a weekly loss of almost 9%.

Last week I suggested that, “ the ultimate support for gold is in the $845-850 range. Now that it is broken, gold may plummet to even deeper lows. What seems odd is that many gold newsletters have not budged from their bullish opinions…a bad sign for gold.

The Nikkei is on the edge.

The Nikkei slumped badly on Wednesday on news of the largest bankruptcy in Japan to date. On Friday, the Nikkei recovered a bit, led by shipping companies that had successfully put through a rate increase. The speculation is that China's appetite for commodities will continue to increase, keeping the shippers profitable.

The Nikkei slumped badly on Wednesday on news of the largest bankruptcy in Japan to date. On Friday, the Nikkei recovered a bit, led by shipping companies that had successfully put through a rate increase. The speculation is that China's appetite for commodities will continue to increase, keeping the shippers profitable.

Is Shanghai stepping closer to a free market?

Shanghai should offer tax breaks and investment quotas if it wants to attract buyout firms away from Tianjin , Beijing and Hong Kong to become China's private equity center , firms including Bain Capital LLC and TPG Capital Ltd. say.

Shanghai should offer tax breaks and investment quotas if it wants to attract buyout firms away from Tianjin , Beijing and Hong Kong to become China's private equity center , firms including Bain Capital LLC and TPG Capital Ltd. say.

Shanghai imposes tax rates of up to 35 percent on private equity and venture capital firms under limited partnership structures and charges 20 percent on capital gains earned by non- executive partners, according to new rules announced yesterday. In Hong Kong , capital gains are exempt from taxation and the corporate tax rate was cut to 16.5 percent in October.

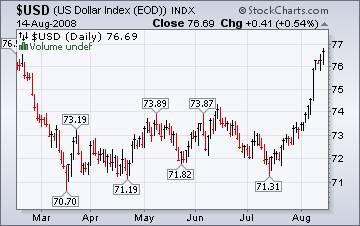

A new awakening for the U.S. Dollar.

The dollar headed for a fifth straight weekly gain against the euro as economies in Europe slow. Gold generally moves in tandem with the euro as an alternative to the dollar. The metal plunged into a bear market this week, declining as much as 25 percent from a record $1,033.90 an ounce reached on March 17.

The dollar headed for a fifth straight weekly gain against the euro as economies in Europe slow. Gold generally moves in tandem with the euro as an alternative to the dollar. The metal plunged into a bear market this week, declining as much as 25 percent from a record $1,033.90 an ounce reached on March 17.

Experts are still not convinced that the U.S. dollar can stage a meaningful rebound. At these levels, a lot of commodities are looking attractive, according to one specialist. As they say, the market climbs a wall of worry. Folks, we're not there, yet.

Coming to a neighborhood near you…

Banks repossessed almost three times as many U.S. homes in July as a year earlier and the number of properties at risk of foreclosure jumped 55 percent as falling prices made it harder to sell or refinance.

Banks repossessed almost three times as many U.S. homes in July as a year earlier and the number of properties at risk of foreclosure jumped 55 percent as falling prices made it harder to sell or refinance.

Bank seizures rose 184 percent to 77,295, the steepest increase since reporting began in January 2005, RealtyTrac Inc., an Irvine, California-based seller of foreclosure data, said today in a statement. More than 272,000 properties, or one in 464 U.S. households, got a default notice, were warned of a pending auction or foreclosed on.

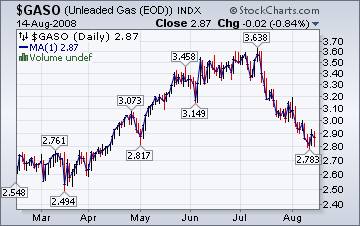

Driving less…for good?

The Energy Information Administration's This Week In Petroleum tells us that; “If you feel like you've been economizing by driving less and adjusting your thermostat more, you're not alone. Total U.S. petroleum consumption reported in today's Weekly Petroleum Status Report (WPSR) is once again lower than the same week last year. Average monthly total petroleum consumption has now declined for 12 consecutive months when compared with the same month the year before.”

The Energy Information Administration's This Week In Petroleum tells us that; “If you feel like you've been economizing by driving less and adjusting your thermostat more, you're not alone. Total U.S. petroleum consumption reported in today's Weekly Petroleum Status Report (WPSR) is once again lower than the same week last year. Average monthly total petroleum consumption has now declined for 12 consecutive months when compared with the same month the year before.”

How do you spell relief?

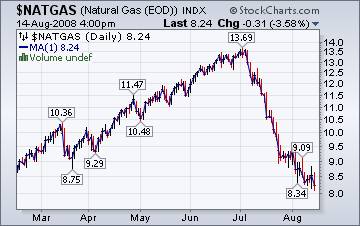

The Energy Information Agency's Natural Gas Weekly Update tells. “he price declines over the period likely can be attributed to the restoration of natural gas production in the Gulf of Mexico and the delayed return to operation of the Independence Hub in the wake of Tropical Storm Edouard, moderating cooling-demand for natural gas, falling crude oil prices, and the strengthening U.S. dollar, which gained about 3 percent against the Euro and about 1 percent against the Canadian dollar since last Wednesday, August 6.”

The Energy Information Agency's Natural Gas Weekly Update tells. “he price declines over the period likely can be attributed to the restoration of natural gas production in the Gulf of Mexico and the delayed return to operation of the Independence Hub in the wake of Tropical Storm Edouard, moderating cooling-demand for natural gas, falling crude oil prices, and the strengthening U.S. dollar, which gained about 3 percent against the Euro and about 1 percent against the Canadian dollar since last Wednesday, August 6.”

Our country's mortgage woes are far from over .

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.