Fed's Third Inetrest Rate Hike and Gold

Commodities / Gold and Silver 2017 Apr 28, 2017 - 06:36 PM GMTBy: Arkadiusz_Sieron

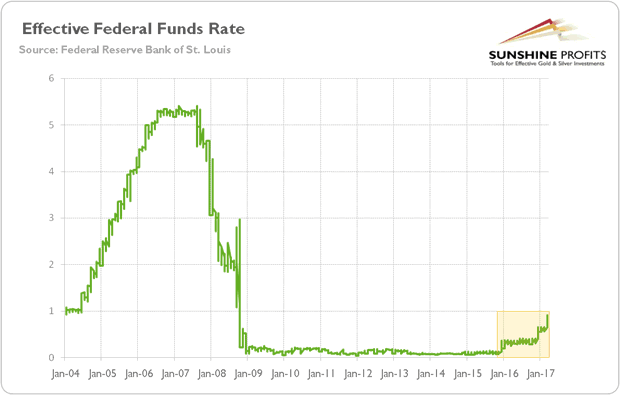

This time, the U.S. central bank did not make us wait too long for the next hike. Just three months after the hike in December, the Fed moved interest rates up again. Although the pace of the current tightening cycle is extremely gradual, the U.S. central bank is consistently moving away from the zero interest rate policy. The chart below shows the current level of the effective federal funds rate after all three hikes.

This time, the U.S. central bank did not make us wait too long for the next hike. Just three months after the hike in December, the Fed moved interest rates up again. Although the pace of the current tightening cycle is extremely gradual, the U.S. central bank is consistently moving away from the zero interest rate policy. The chart below shows the current level of the effective federal funds rate after all three hikes.

Chart 1: The effective federal funds rate after the third Fed hike in a decade.

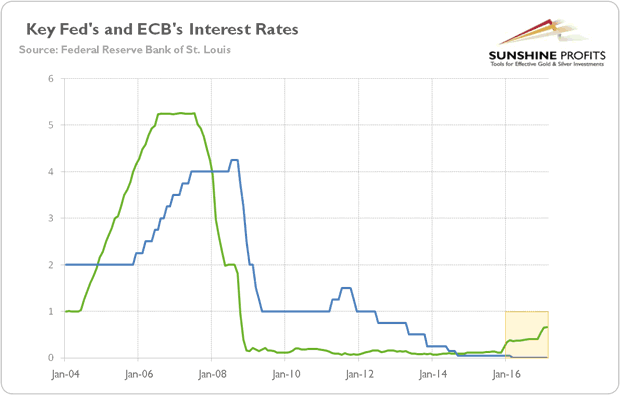

What does it mean for the gold market? Well, higher interest rates are believed to be negative for gold prices, as they make non-interest earning assets less attractive. Moreover, the hawkish Fed's stance (although gradual) widens the divergence in monetary policies among major central banks in the world. As one can see in the chart below, the ECB clearly lags behind the Fed in normalizing its monetary policy after the financial crisis. Thus, the Fed's next move should strengthen the U.S. dollar against the euro and weaken the yellow metal.

Chart 2: The Federal Funds rate (green line) and the ECB's main refinancing rate (red line) from 2004 to 2017.

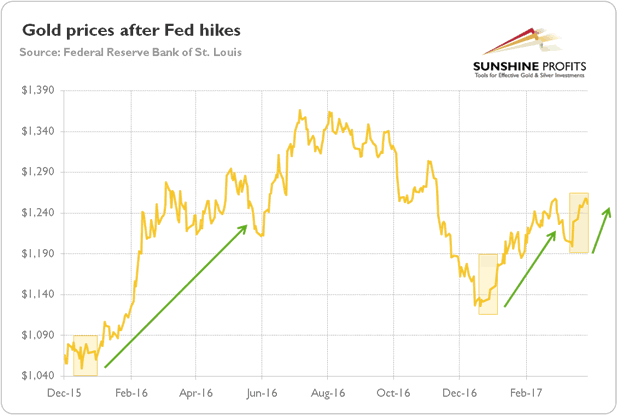

However, as the next chart shows, all three hikes in the current tightening cycle were actually positive for gold.

Chart 3: The price of gold after the Fed hikes in 2015, 2016, and 2017.

Since October 2015, the price of gold was under pressure in anticipation of the Fed's hike. It bottomed out the day after the move and started its amazing rally. In 2016, we saw a replay of the previous year: gold prices were in a downward trend before the anticipated Fed hike in December (the outcome of the U.S. presidential election also contributed to the decline). And again, the yellow metal bottomed out a few days after the FOMC meeting, then rising like a phoenix from the ashes. Also, the third lift was not negative for the gold prices, as the yellow metal replayed the previous scenario: it started to decline at the very end of February, bottomed out on March 15, when the FOMC held its meeting, and jumped upwards thereafter.

Why did gold behave like that in response to the Fed hikes? First, gold investors sold the rumor and bought the fact, preparing for the worst. But each time the U.S. central bank acted less hawkish than expected, it hiked interest rates, but with a dovish message. It turned out each time that gold was oversold, gaining after the FOMC meetings. It suggests that gold may continue its upward move until the Fed surprises markets with a really hawkish message.

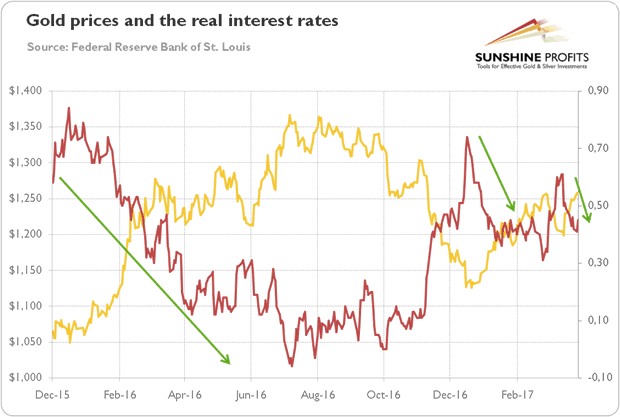

Second, the U.S. central bank seems to be behind the curve. As we have repeated many times, the real interest rates are much more important for the gold market than the federal funds rate. The chart below shows that they declined after each hike, which supported gold.

Chart 4: The price of gold (yellow line, left axis, London P.M. Fix) and the U.S. real interest rates (red line, right axis, yields on 10-year Treasury Inflation-Indexed Security) from December 2015 to March 2017.

In other words, the Fed lifted interest rates in March, but not due to a strong underlying economy (as a reminder, the U.S. central bank did not raise upwards the economic projections in March), due rather to rising inflation. Some investors are worried about inflation moving out of control, so the price of gold rose. In other words, the inflation rate has been accelerating faster than interest rates, so the real interest rates have been declining. And Trump's budget plan was dead on arrival – hence, we will probably not see any fiscal stimulus this year.

Summing up, the Fed raised interest rates for the third time in the current tightening cycle. Because investors sold the rumor and bought the fact, the move made the gold prices jump. The market expects now two more hikes this year: in June and in December. If the Fed adopts a more hawkish stance, gold may struggle. If the U.S. central bank becomes more dovish or remains behind the curve, the yellow metal may shine. However, there may be an uptick in real yields, as the commodity base effects dissipate, dampening the inflation rate. According to some analysts, real rates and the U.S. dollar are too low now, given interest rate expectations, the monetary divergence among central banks, the pace of economic growth and the tightening labor market, so they may move up in the near future, negatively affecting the gold market. On the other hand, the inability of new administration to deliver pro-growth actions (the failure of Trumpcare is a bad harbinger) is an important upside risk for the yellow metal.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.