3 Reasons Why “Spring Forward, Fall Back” Also Applies To Gold

Commodities / Gold and Silver 2017 Apr 25, 2017 - 02:57 PM GMTBy: HAA

Stephen McBride : Year to date, the price of gold is up 12%. This is not unusual: the yellow metal also had a strong start into 2016, rising 18% over the same period.

Stephen McBride : Year to date, the price of gold is up 12%. This is not unusual: the yellow metal also had a strong start into 2016, rising 18% over the same period.

So is there a seasonal pattern to the gold price? To answer that question, we dissected gold’s performance dating back to 1975 and identified some trends investors can use to their advantage.

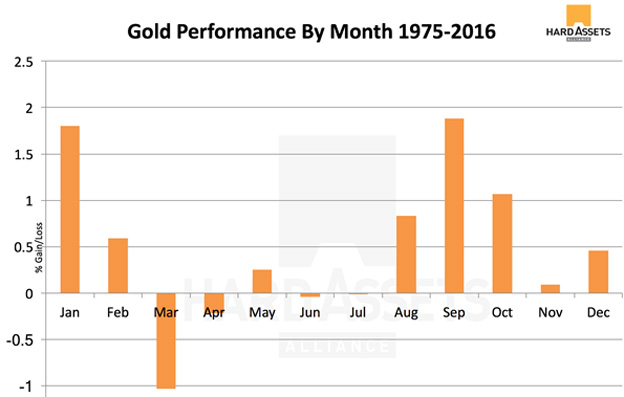

1. March/April Are Gold’s Worst Months… And The Best Time To Buy

Source: LBMA

Since 1975, March has been the worst month for gold, followed by April as the second-worst.

In contrast, September has been the best month for gold over the past 41 years. Coincidentally (or not), September is also the worst month for the S&P 500.

As the chart shows, three-quarters of gold’s top-performing months are in the latter half of the year.

Based on this, an inexperienced investor might conclude that you should sell before the bad months (March, April) and buy prior to the good months (August to October). However, as Rick Rule, CEO of Sprott Global Resource Investments, says, “You’re either a contrarian, or you will become a victim.”

So the gold price is usually at its lowest point in March and April, which makes these two months the best time to buy.

In contrast, when gold has been rising steadily through the year into October, that may be a good time to sell.

Given gold’s attribute as a long-term store of value, we don’t recommend trying to trade it. However, when you want to liquidate some of your holdings, following seasonal patterns can prove very lucrative, as the next chart demonstrates.

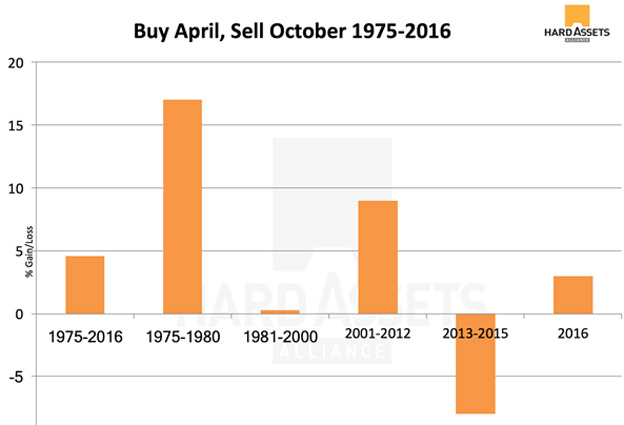

2. Buy The Spring, Sell The Fall

Source: LBMA

If you had simply bought gold on April Fool’s day and sold it on Halloween every year since 1975, you would have made an average return of 4.6%.

Not a bad return on your money for two days’ worth of work and seven months of tying up your money.

We think you should hold your gold for a lot longer than seven months. Nonetheless, this four-decade-long pattern suggests that the gold price will repeat its pattern again this year.

The next chart amplifies this point.

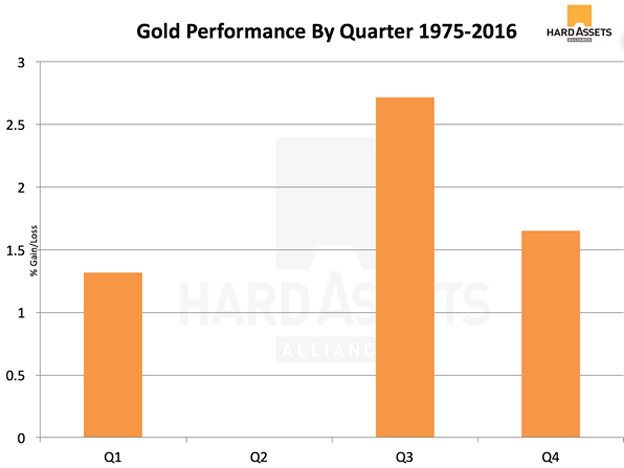

3. The Only Quarter In Town

Source: LBMA

Since 1975, the second quarter of the year has been by far gold’s worst… with returns dead flat over the 41-year period. On the flip side, the third quarter has been the best, outperforming its closest rival, Q4, by a whopping 40%.

Given the clear seasonal patterns the gold price has exhibited over the past four decades, how can investors take advantage of it in 2017?

Add Gold to Your Portfolio Now

Based on gold’s seasonal patterns, adding bullion to your portfolio sometime in the next few weeks could prove a profitable endeavor.

As stated above, gold is up 12% since the beginning of the year. This makes it one of the top-performing assets—alongside silver, which is up almost 20% year to date.

In comparison, since making multi-year highs in March, the 10-year Treasury yield (which moves inversely to its price) is down 15%. Also, after roaring higher post-election, the S&P 500 has moved sideways since late January.

Considering gold’s recent rise, many investors are waiting for a pullback. But armed with the knowledge that the lows usually occur in the spring, you can take the contrarian approach and “buy low” right now.

Given that the reflation trade is all but dead in the water, you may be able to “sell high” in the not-too-distant future.

Get A Free Ebook On Precious Metals Investing

Before you buy physical gold, make sure to do your homework first. You’ll find everything you need to know in the definitive ebook, Investing in Precious Metals 101: which type of gold you should buy and which type you should stay away from, where to securely store your gold, why pools aren’t safe places, and much more. Click here to get your free copy now.

© 2017 Copyright Hard Assets Alliance - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.