Why Stock Market Investors May Soon Be In For A Rude Awakening

Stock-Markets / Stock Market 2017 Apr 21, 2017 - 03:47 PM GMTBy: John_Mauldin

BY PATRICK WATSON : It seems that a lot of people have missed the distinction between wishful thinking and reality lately—and I fear it’s going to hurt them badly.

BY PATRICK WATSON : It seems that a lot of people have missed the distinction between wishful thinking and reality lately—and I fear it’s going to hurt them badly.

After Donald Trump won in November, some Americans didn’t just hope for the best; they thought it was here.

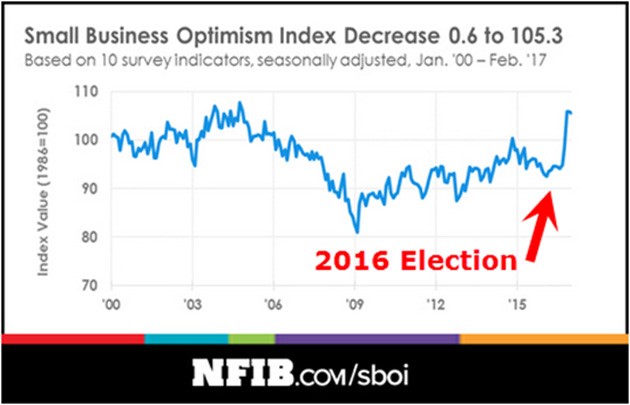

The euphoria is visible in the Small Business Optimism Index.

Confidence spiked higher following the election because surely, people thought, an all-Republican White House and Congress would waste no time ushering in business-friendly policy changes.

While that was a reasonable conclusion, now it looks like small-business owners may have let their political excitement affect their common sense.

The jury isn’t in yet on how massive the changes are going to be. And the NFIB index hasn’t pulled back much, so respondents seem to be patient so far.

You could say the same for investors. Stock benchmarks rose after the election, particularly in regulated sectors like banking and energy, because investors believed policy changes would lead to higher earnings.

I was less confident, and said so in my December letter that we’ll get some tax cuts and deregulation. But they can’t possibly do as much as some people expect for 2017.

I’m still convinced that’s true—and the "rude awakening" may be even closer now.

Is the Economy a coiled spring like it was for Reagan?

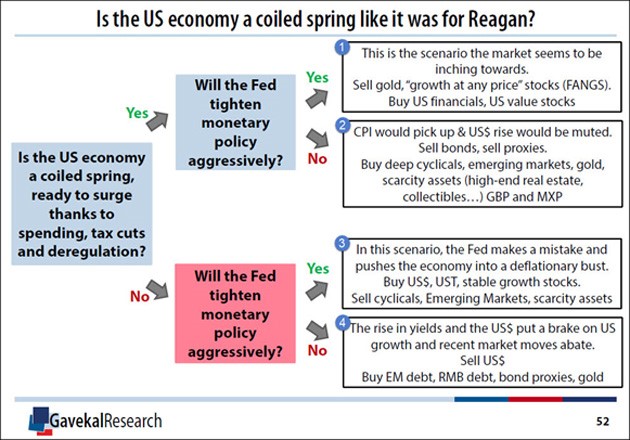

In that same issue, I showed the following decision tree from one of Louis Gave’s epic Gavekal Research presentations. Even now, it’s still a good analytical guide:

Source: GavekalResearch

Answering two questions leads you to one of four scenarios, each with a different investment strategy.

- Does the US economy have pent-up growth potential that a Trump presidency can unlock?

- Will the Fed tighten monetary policy aggressively?

Let’s think about these in order.

If the US economy is a coiled spring ready to surge, it has a strange way of showing it. Even the most optimistic projections show real GDP growth for 2017 will be little better than last year’s disappointing 1.6%.

I think our economy is the opposite of a coiled spring.

It’s been stretched past its limits by debt. Aside from insane federal, state, and local government debt, we owe trillions more in credit card, auto, student loan, and mortgage loans. That stands in the way of any meaningful expansion.

But let’s suppose for the sake of argument the economy really wants to grow, and all it needs is a little nudge from the government. Are those policy changes right around the corner?

I don’t think so.

100 Days of Gridlock

The Trump administration’s first 100 days are running out, and we have yet to see any major legislation pass.

The Obamacare repeal/replace plan is still on the table but not doing well. The GOP is divided at least three ways. Compromises that would bring more conservatives aboard repel the moderates—and vice versa.

Plus, the healthcare reform bill wasn’t just healthcare. It would have eliminated the Obamacare taxes on higher-income Americans… and its Medicaid cuts were going to offset lower corporate tax rates in other legislation. Now that’s much harder.

Scratch healthcare and tax reform off the list.

Bank deregulation? That’s going nowhere. We hear talk about amending the Dodd-Frank Act, but nothing concrete is happening.

Worse, the Trump administration still hasn’t gained control of key regulatory agencies. As of now, the Securities and Exchange Commission (SEC) only has two commissioners. One is a Democrat. The Commodity Futures Trading Commission (CFTC) is similarly split.

Banks can’t count on much administrative relief until the president gets his people in control of the regulatory agencies—and that’s nowhere on the radar right now.

Infrastructure stimulus? It’s bogged down in a debate how to pay for it. Last week, Trump told the New York Times he would consider borrowing “much more” than $300 billion for infrastructure projects.

You can imagine how GOP deficit hawks loved that idea. It won’t mesh well with their desire to cut tax rates without adding more debt.

Trump has talked about making deals with Democrats if he can’t get enough Republican votes to pass his bills. But Democrats have little reason to cooperate. Their base voters are energized against Trump and won’t stand for it.

Bottom line:

- Congress has no majority favoring any of the changes that made investors and business owners so optimistic after the election.

- The Trump White House has a lot to do and is still trying to get organized.

Instead of a unified Republican government, we have near-total gridlock.

I think the answer to our first question, “Does the US economy have pent-up growth potential that a Trump presidency can unlock?” is clearly “no.” Scratch Louis Gave’s scenarios 1 and 2 off the list.

As for the Fed…

The Fed’s “Tightening” Path

The policy-setting Federal Open Market Committee (FOMC) spent last year building up its nerve for more rate hikes. It gave us one in December and another in March, and more are coming.

The Fed is clearly on a tightening path, but is it "aggressively" so? That’s not as clear.

We saw in the March dot plots that even the most hawkish FOMC member thinks the longer-term federal funds rate will only rise to 3.75%. Other estimates came in at 3% or lower. That’s “tight” only compared to years of near-zero rates.

Of course, 3% rates might feel tight to a generation of Millennial traders who have never seen anything like it before.

But that’s not all.

The March FOMC minutes, released last week, showed the Fed is seriously considering how it will unload its bloated bond portfolio. They could start letting assets roll off without replacement later this year, which could have more impact than rate hikes.

Looking back at the decision tree, I think the No/Yes path is the most likely. The economy isn’t ready to surge, but the Fed will tighten policy anyway. Not a good combination, but I’m in the minority.

Most investors still have their bets on Yes/Yes. Some are starting to get nervous. Given events in Washington, they should be.

Here’s the Hard, Cold Reality

I am sorry to be the bearer of bad news, but here’s reality as I see it.

- There will be no tax cuts this year.

- Banks won’t get much regulatory relief.

- Obamacare will likely collapse with no replacement ready.

- Any infrastructure stimulus is way off in the future.

- The Fed is tightening because it thinks an economy that grew only 1.6% last year is overheating.

It doesn’t matter if we’d like this to happen. It is what’s coming, in my opinion.

I haven’t even mentioned other flash points: a potential government shutdown after April 28, more military action overseas, or trade conflicts with China and other countries.

I also haven’t mentioned the assorted Russia-related investigations. Whatever happened in the election, the fallout is distracting both the White House and Congress.

I’ve thought about what could possibly change all this for the better. Nothing comes to mind.

Recent reports suggest Trump wants to shake up his White House team. That may help, but he’s already lost of lot of time and political capital.

It All Depends on Q1 Earnings

To me, this situation feels like a slow-motion train wreck where all you can do is watch.

Much depends on the 1Q earnings reports that are starting to flow. Good results from high-profile companies might buy a little more time. Unexpectedly bad results from big names could put on the brakes.

Washington's monumental gridlock is on a collision course with investors' blind euphoria. We’re all on one train or the other. Hold on tight.

FREE PREMIUM REPORTS: 3 Stocks You Need (and 3 You Don’t) in 2017

Discover the best and worst stocks in 2017. This bundled series of exclusive reports reveals three companies set to soar and three you should steer clear of (one of them will surprise you). Download Three Deadly Dow Stocks and Three Top Picks for Income & Growth for free now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.