3 Types Of Life-Changing Crisis That Make You Wish You Had Some Gold

Commodities / Gold and Silver 2017 Apr 20, 2017 - 10:51 AM GMTBy: HAA

Stephen McBride : On November 8, Indian Prime Minister Narendra Modi took to the airwaves to declare that Rs500 and Rs1,000 banknotes—which made up 86% of the currency in circulation—would be invalid effective from midnight. While the policy created chaos at banks, the real story lies elsewhere.

Stephen McBride : On November 8, Indian Prime Minister Narendra Modi took to the airwaves to declare that Rs500 and Rs1,000 banknotes—which made up 86% of the currency in circulation—would be invalid effective from midnight. While the policy created chaos at banks, the real story lies elsewhere.

When rumors of a ban on gold spread two weeks later, Indians began rioting. To quell the panic, the Finance Ministry was forced to release a statement saying there was “no plan to restrict gold holdings.”

So, Indians took demonetization lying down, but rioted on the rumor of a gold ban. The people of India have a deep-rooted affinity for gold. As such, they understand it is a store of wealth and intrinsically valuable. Rupees? They are just paper.

Gold is known as an inflation hedge; however, its role as a crisis hedge is even more important. Gold is antifragile, to use the term coined by risk analyst and bestselling author Nassim Taleb. When currencies collapse and economies falter, gold can ensure your survival—financially and literally.

Below are three examples of crises during which you would have been lucky to own gold.

#1: An Economic Crisis

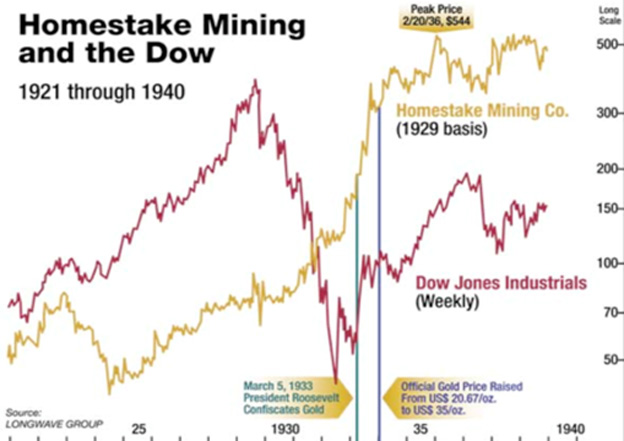

During the Great Depression, 37% of all nonfarm workers were unemployed and many families were financially destitute. Investments and economic growth were at abysmal levels: from 1929 to 1933, the Dow Jones fell by 90% and GDP dropped 30%.

Up until 1934, the US was on a gold standard, which allowed citizens to redeem paper dollars for gold. There are many indications that Americans flock to gold when economic problems begin to emerge.

After the initial crash of 1929, redemptions of paper for gold skyrocketed. Withdrawals were so large throughout 1929–1930 that interest rates had to be raised to halt outflows.

Just like Indians today, Americans understood that gold was superior to paper currency. As gold is money, it is payment in and of itself. Paper currency is simply a promise to pay.

Withdrawals eventually became so overwhelming that on April 5, 1933, President Franklin D. Roosevelt signed Executive Order 6102, which prohibited private ownership of gold. The following year, as part of the Gold Reserve Act, the government changed the gold price from $20.67 to $35 per ounce.

Another indicator of the move into gold was the performance of the largest gold mining company at the time, Homestake Mining. While the Dow Jones fell 90%, Homestake was up 474% between 1929 and 1933.

Source: Longwave Group

From increasing redemptions to investing in gold companies, the actions of Americans show that even in a deflationary collapse, gold is the “go-to” asset.

#2: A Currency Crisis

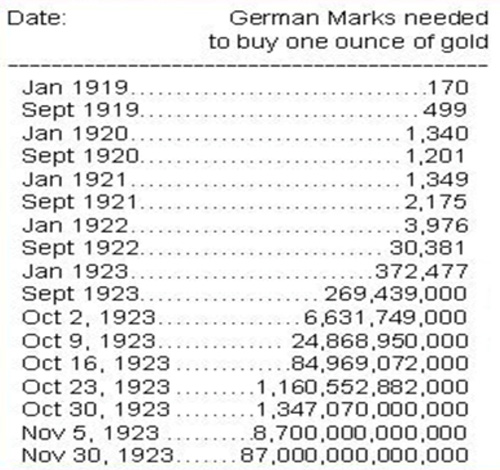

During Weimar Germany’s episode of hyperinflation, inflation peaked at 200,000,000,000% (that’s 200 billion) in 1923. Prices doubled every 15 hours. Millions of hard-working, thrifty Germans found that their life’s savings would not buy a cup of coffee.

While the German mark was being inflated out of existence, the price of gold increased exponentially. In January 1919, one ounce of gold sold for 170 marks; by November 1923, it cost 87 trillion marks.

Source: BullionMark

As in many currency crises throughout history, those who held a portion of their savings in gold escaped total wipeout.

But gold doesn’t need a full-blown currency crisis to perform well. In the two weeks in 2016 following Britain’s Brexit vote, gold priced in pound sterling rose 24%. The same happened in Russia in late 2014 when gold priced in rubles rose 79% in just three months.

#3: A Banking Crisis

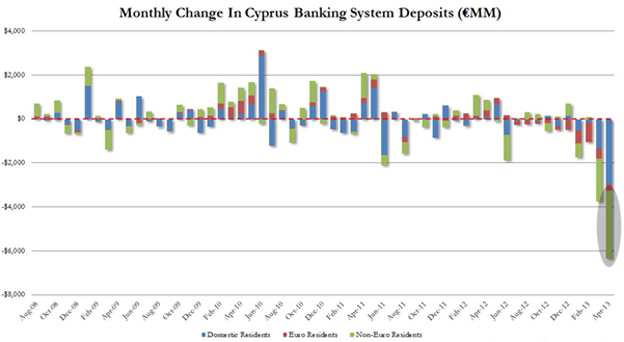

Bank holidays are directly punishing depositors and savers, as the citizens on the Mediterranean island of Cyprus discovered first hand.

Needing a cash injection to stay afloat, Cypriot banks raided customer accounts in early 2013, taking 6.75% of deposits in accounts under €100,000 and a whopping 40% in accounts over €100,000. This happened overnight, without warning.

By the time depositors pulled their money out of the banks, it was too late.

Source: Central Bank of Cyprus

Cypriots with savings outside of the banking system—such as in gold—escaped intact. During the debacle, gold priced in euros rose by around €50.

Gold has proved a useful asset to own during banking crises throughout history. Not only is it useful when thieving banks try to take your savings, gold also profits from the uncertainty that arises from these events.

Having looked at the yellow metal’s performance during different crises, what lessons can we learn?

Gold Is Crisis Insurance

Whether there’s an episode of hyperinflation or a banking collapse, gold has historically been the asset to own in times of turmoil. Given its intrinsic value and safe-haven status, there’s no doubt that gold will remain a wealth preservation tool during future crises.

The reaction of the Indian people to a potential gold ban is just the latest reminder of why owning gold is important. Crises do not come along often… but when they do, you’d better be prepared before they hit.

Get A Free Ebook On Precious Metals Investing

You want at least 10% of your investable assets to be in physical gold. However, before you buy, make sure to do your homework first. You’ll find everything you need to know in the definitive ebook, Investing in Precious Metals 101: which type of gold you should buy and which type you should stay away from, where to securely store your gold, why pools aren’t safe places, and much more. Click here to get your free copy now.

© 2017 Copyright Hard Assets Alliance - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable,

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.