2 Choke Points That Threaten Oil Trade Between Persian Gulf And East Asia

Commodities / Crude Oil Apr 20, 2017 - 10:26 AM GMTBy: John_Mauldin

BY GEORGE FRIEDMAN : The flow of international trade has always been subject to geopolitical risk and conflicts. At all stages of the supply chain, trade inherently faces challenges posed by the geopolitical realities along a given route.

BY GEORGE FRIEDMAN : The flow of international trade has always been subject to geopolitical risk and conflicts. At all stages of the supply chain, trade inherently faces challenges posed by the geopolitical realities along a given route.

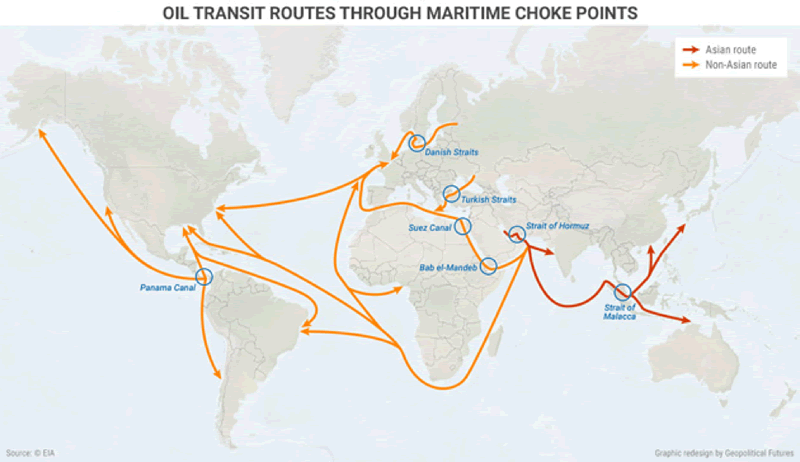

Some routes are more perilous and harder to navigate than others. One such trade route is the maritime path for transporting oil from Persian Gulf exporters to East Asian consumers. This route faces two major choke points that are unavoidable given geographic constraints.

The Persian Gulf is a leading oil-producing region. It accounts for 30% of global supply. Meanwhile, East Asia is a major oil-consuming region. It accounts for 85% of the Persian Gulf’s exports (according to the Energy Information Administration (EIA)).

The two straits are geopolitical choke points because geographic limitations and political competition threaten access.

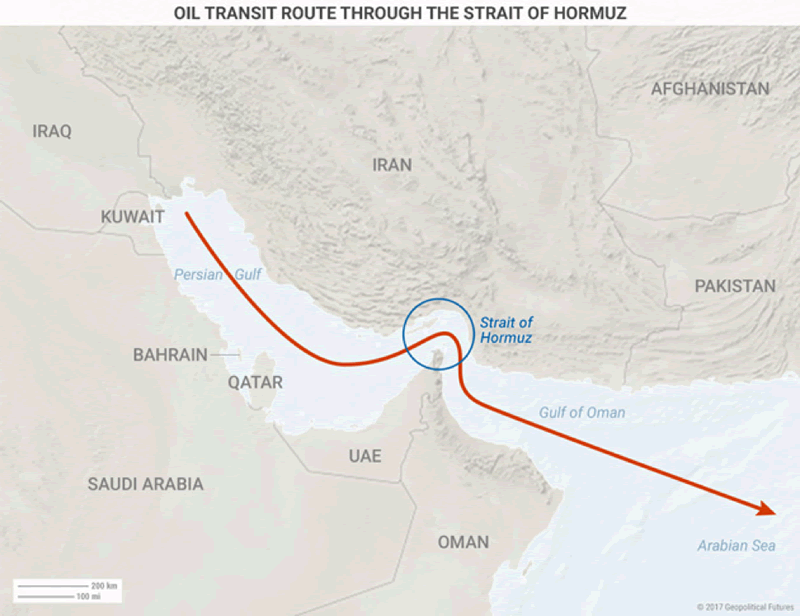

Choke Point #1: The Strait of Hormuz

The Strait of Hormuz is the main maritime route through which Persian Gulf exporters (Bahrain, Iran, Iraq, Kuwait, Qatar, Saudi Arabia, and the United Arab Emirates) ship their oil to external markets. Only Iran and Saudi Arabia have alternative access routes to maritime shipping lanes.

The strait is 21 miles wide at its narrowest point, bordered by Iran and Oman. The EIA estimates that approximately 17 million barrels of oil per day—about 35% of all seaborne oil exports—pass through the strait.

This path is also the most efficient and cost-effective route through which these producers can transport their oil to East Asia. Persian Gulf countries depend heavily on revenue from these exports.

That’s why passage through the Strait of Hormuz is both an economic and a security issue. A disruption in the strait would impede the timely shipment of oil.

This would cause exporters to lose significant revenue, and importers would face supply shortages and higher costs. The longer the disruption, the greater the losses.

Disruptions could take place when Sunni and Shiite countries threaten to deny each other passage through the strait.

Shiite-majority Iran has threatened to close the strait and plant naval mines to assert its power over Saudi Arabia and other Sunni states. Saudi Arabia and its allies have conducted naval drills to show their willingness and ability to retaliate should Iran follow through.

Persian Gulf countries that depend on oil revenues have tried to mitigate this risk in two ways.

First, they’ve established alternate export routes. But the pipeline capacity is not enough to relieve dependence on the Strait of Hormuz.

Second, Persian Gulf countries have built security alliances with countries that have a vested interest in keeping the strait open. These alliances often involve the United States.

In 2016, the US received 18% of its oil imports from the Persian Gulf. As such, the US wants to maintain safe passage of exports through the strait.

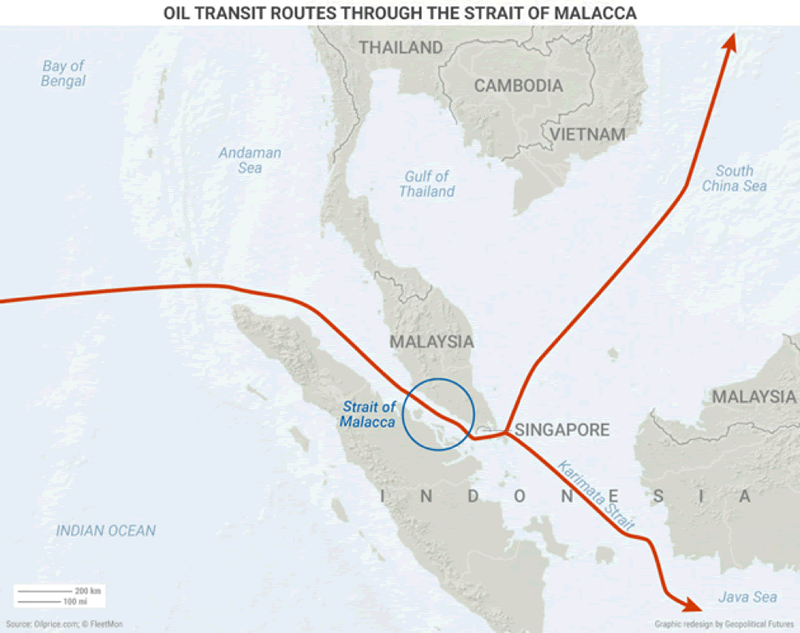

Choke Point #2: The Strait of Malacca

The Strait of Malacca is the shortest sea route to move goods from the Persian Gulf to Asian markets. It is over one-third shorter than the closest alternative sea-based route.

Roughly a quarter of all oil transported by sea (more than 15 million barrels per day) passes through the Strait of Malacca. This makes it second only to the Strait of Hormuz in oil transport by volume.

The Strait of Malacca is 550 miles long and runs past Indonesia, Malaysia, and Singapore. At its narrowest point, the strait is a mere 1.5 miles wide. This makes ships more susceptible to piracy (which is prevalent in the area) and blockades.

Both Japan and China’s economies rely heavily on oil imports that pass through the Strait of Malacca. Over 80% of China’s oil imports (by sea) and around 60% of Japan’s total oil imports currently pass through the strait.

That means open access through the strait is key to their economic security.

Japan and China have a long history of animosity and war in their attempts to be the dominant geopolitical power in the region. But, for one of them to block access to the strait would be a double-edged sword.

On one hand, restricting trade flow through the strait could be a way to inflict economic pain on a rival. This could lead to an economic downturn and subsequent domestic political problems for the rival.

On the other hand, this type of action could set a precedent for other countries to vie for control of the strait. This could put either Japan or China’s access at risk.

To secure their economic stability, Japan and China have pursued means to guarantee safe passage of oil through the strait.

Like Persian Gulf countries, Japan relies on its alliance with the US to guarantee free navigation of goods by sea. Since the Pacific Coast of the US conducts a significant amount of trade with East Asia, the US relies on its alliance with Tokyo to offset China’s power and any other potential threats in the region.

China’s strategy involves strengthening its military and political ties in the region. Beijing has forged strong political and economic relations with the countries that surround the Strait of Malacca, particularly Indonesia.

It is also in the process of building a large navy. Its goal is to gain more control of its surrounding seas.

Mitigating Risk

For both Persian Gulf exporters and East Asian consumers, the free passage of oil shipments is vital. But, two geopolitical choke points threaten this.

In the Strait of Hormuz, the main risk comes from the conflict between Sunni and Shiite powers in the region. In the Strait of Malacca, it is the regional rivalry between China and Japan.

All of these countries must take measures to mitigate their risk and secure free passage through the respective straits. Geopolitics not only explains why such measures are necessary, but also which of them are most suitable for the countries involved.

Grab George Friedman's Exclusive eBook, The World Explained in Maps

The World Explained in Maps reveals the panorama of geopolitical landscapes influencing today's governments and global financial systems. Don't miss this chance to prepare for the year ahead with the straight facts about every major country’s and region's current geopolitical climate. You won't find political rhetoric or media hype here.

The World Explained in Maps is an essential guide for every investor as 2017 takes shape. Get your copy now—free!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.