US Housing Market Mortgage Delinquency Rates Increase & 3X ETFs

Housing-Market / US Housing Apr 17, 2017 - 06:17 PM GMTBy: Chris_Vermeulen

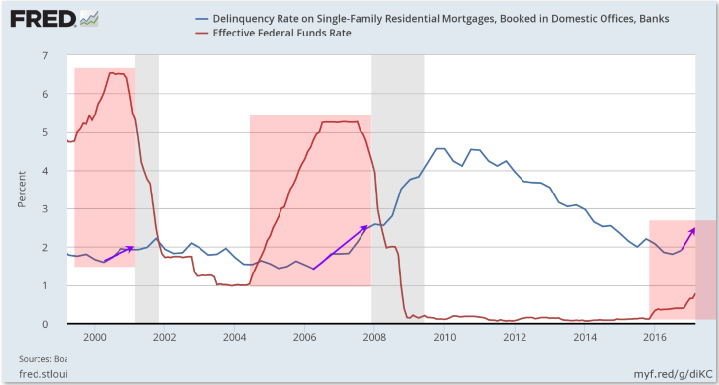

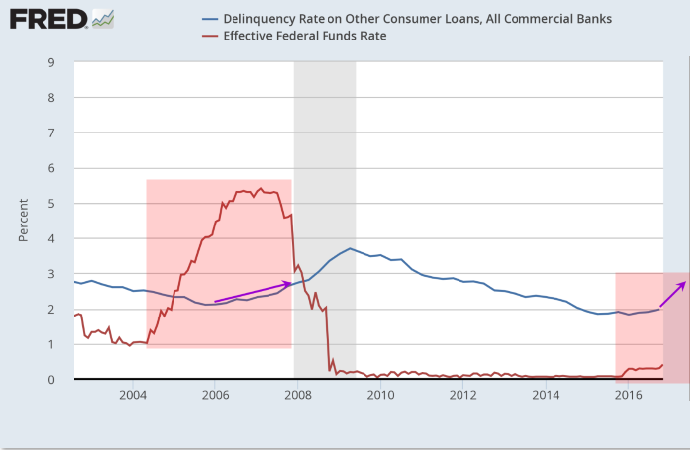

Delinquency rates in Single Family Residential Mortgages and other Consumer Loans began to climb through the later half of 2016 and early 2017. The timing of this delinquency rate increase coincided almost identically with the Fed increases in their Funds Rate. Additionally, commercial loan origination stalled for the first time since 2008-2011 (prior to that was a stall in 2000).

Delinquency rates in Single Family Residential Mortgages and other Consumer Loans began to climb through the later half of 2016 and early 2017. The timing of this delinquency rate increase coincided almost identically with the Fed increases in their Funds Rate. Additionally, commercial loan origination stalled for the first time since 2008-2011 (prior to that was a stall in 2000).

As you’ve been likely been following our daily video market analysis, you’ll know that we believe the market is still in a bullish trend and that we expect this upward price action to continue for a while.

These early warning signs that the Fed rate raises may be pushing other factors of the US economy should be viewed as just that – early warning signs. It also means that Financial and Banking stocks may find some downward price pressure over the next few months. And protection assets (Gold/Silver and related ETFs) may see continued upward price movement as cash migrates from traditional financial assets into more protectionist asset classes.

Single Family Mortgage Delinquency Rate

The two charts below show the rate of mortgages defaulting. Additionally, real estate asset classes may start to see increased volatility as this segment of the economy struggles and has to deal with delinquencies. The US Fed is attempting to raise rates enough to allow for more normalized economic functions without disrupting the stability of the global markets. It is our opinion that these efforts by the US Fed will provide substantial rotation in certain sectors of the US markets that skilled traders will be able to profit handsomely from these moves.

All Other Consumer Mortgage Delinquency Rate

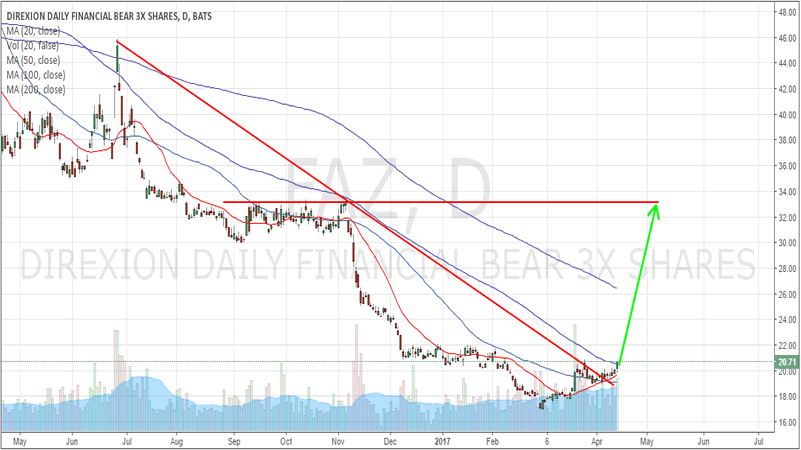

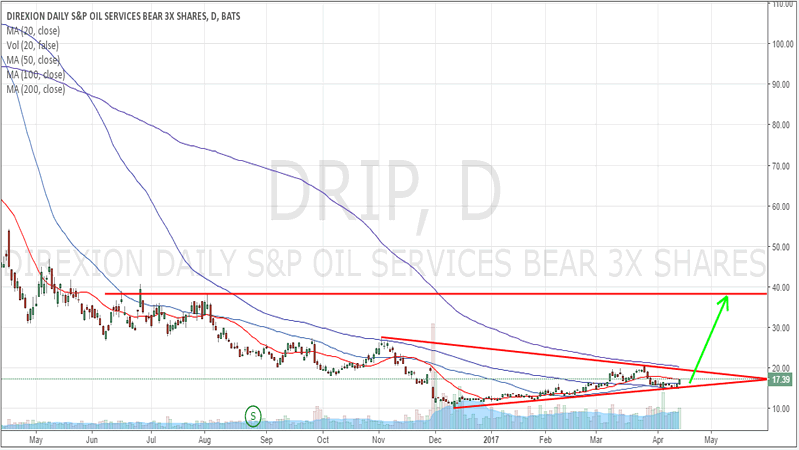

In particular, 3x ETFs may provide unique opportunities for profits. Let’s review a few potentials…

Throughout all of these charts, I expect you’ll notice a similar setup with regards to Financials, Oil Services and Real Estate. The Fed easing over the past 6+ years has driven asset prices to near all-time highs (or above all-time highs in some cases) and the recent oil price recovery has driven the oil service industry to near term recent highs.

The examples we are illustrating today are all contingent on the US Fed continuing to raise rates, as planned this year, which may put further pressure on these segments of the markets as well as potentially increase delinquency rates for residential, commercial and other consumer loans. In other words, we are expecting some moderate price rotation in the markets over the next few months and we are poised to take advantage of these moves if and when a setup occurs.

3x ETF: FAZ – Financial Sector Bear Fund

3x ETF: DRIP – Oil Services Bear Fund

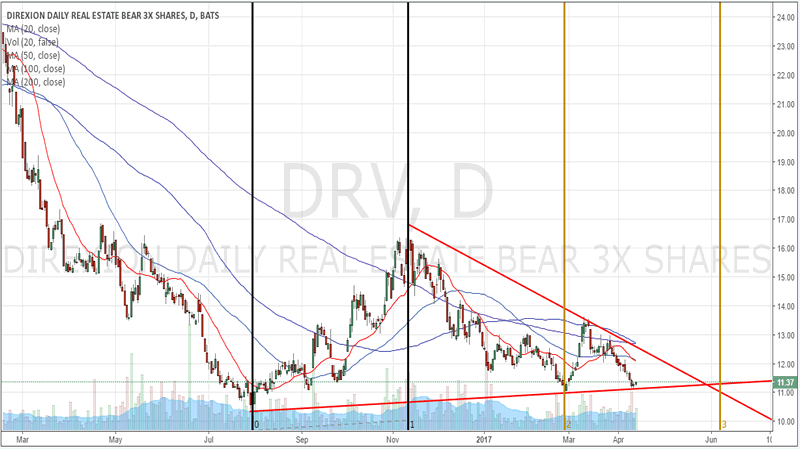

3x ETF: DRV – Real Estate Bear Fund

We deploy our specialized Momentum Reversal Method (MRM) trading strategy to identify exactly when to enter and exit our trades and to find appropriate trading opportunities. The MRM method is unique and proven. Our clients are able to take advantage of our specialized MRM trading strategy and receive timely and accurate trading signals from our web site, ActiveTradingPartners.com. Many of our recent trades have resulted in tremendous gains for our clients.

We want to alert you to the large potential price rotation we are expecting in the immediate future and to alert you to the unique opportunities this type of price rotation will present. Remember, well over 2 months ago we warned of a VIX SPIKE that was likely between March 15th and April 24th of this year.

Take a quick look at the VIX Daily chart to see our prediction

We urge you to consider this information in your trading decisions as well as consider using our stock and 3x ETF trade alert service to further your trading success. Again, the trading opportunities we are presenting today are not trading signals. We are waiting for our MRM strategy to issue the trade trigger, then all our clients will be alerted to the signals.

Chris Vermeulen

www.TheGoldAndOilGuy.com – Daily Market Forecast Video & ETFs

www.ActiveTradingPartners.com – Stock & 3x ETFs

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.