Gold Market in Q1 and the Outlook for 2017

Commodities / Gold and Silver 2017 Apr 07, 2017 - 02:07 PM GMTBy: Arkadiusz_Sieron

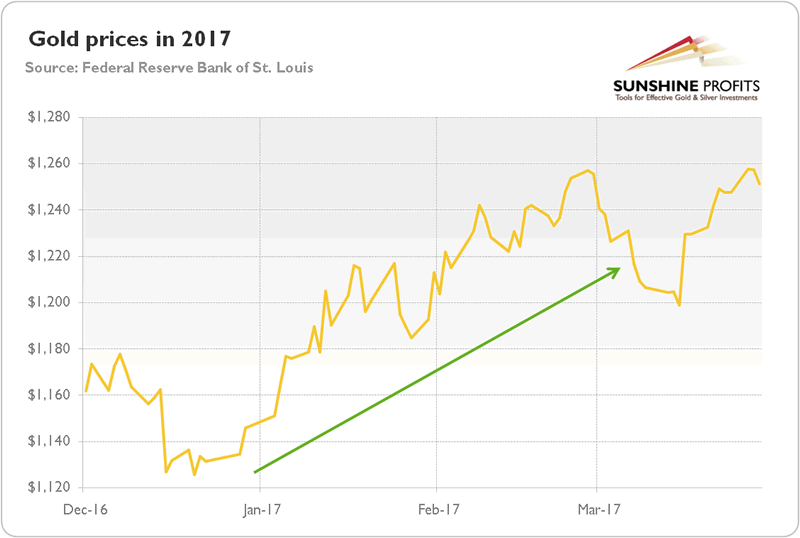

Gold performed really well in the first quarter of 2017. As the chart below shows, the rally started at the end of December 2016. The yellow metal bottomed at $1,125.7 on December 20, just a few days after the FOMC meeting and the second interest rate hike for almost a decade. Since then, the shiny metal gained about 11 percent.

Gold performed really well in the first quarter of 2017. As the chart below shows, the rally started at the end of December 2016. The yellow metal bottomed at $1,125.7 on December 20, just a few days after the FOMC meeting and the second interest rate hike for almost a decade. Since then, the shiny metal gained about 11 percent.

Chart 1: The price of gold in U.S. dollars in 2017 (London P.M. Fix).

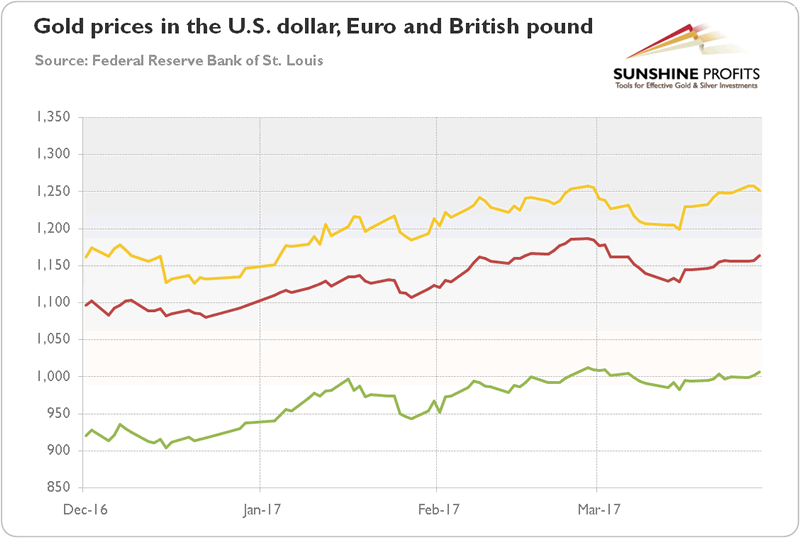

As one can see below, the price of gold expressed in euros and British pounds developed in a similar way to the U.S. dollar-denominated price. However, on a relative basis, the price of gold gained more in the greenback than in these two currencies (the bullion gained about 7 percent in euros and almost 11 percent in the British pound since the December lows), which seems to reflect an appreciation of the common currency against the U.S. dollar.

Chart 2: The price of gold in the U.S. dollar (yellow line), the euro (red line) and the British pound (green line) in 2017 (London P.M. Fix).

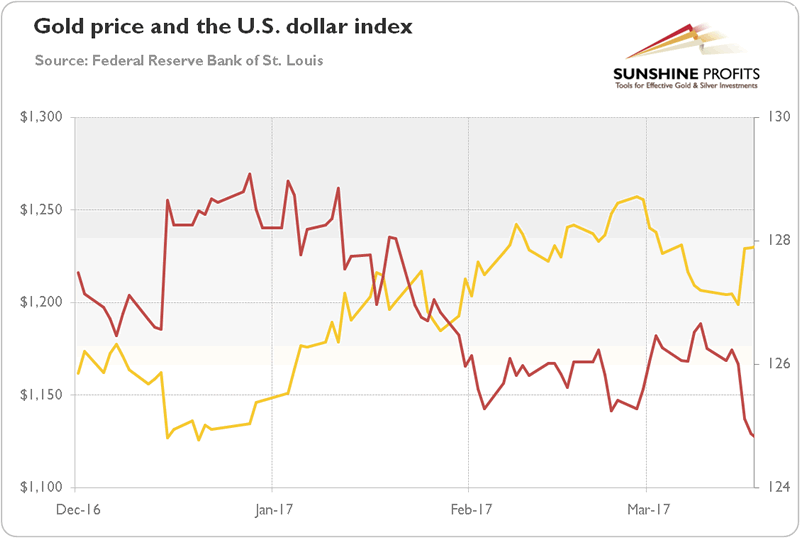

Indeed, the greenback was one of the main drivers of the gold prices in the third quarter of 2017. As usual, there was a strong negative correlation between these two safe-haven assets, as the chart below shows.

Chart 3: The price of gold (yellow line, left axis, P.M. London Fix) and the U.S. dollar index (red line, right axis, Trade Weighted Broad U.S. Dollar Index) in 2017.

After the December Fed hike the U.S. dollar surged while the price of gold bottomed out. However, as investors called the Fed hawkishness into question, the greenback declined, while the yellow metal shined. Other important drivers of the gold rally and dollar weakness were uncertainty about Trump's policies and comments from Treasury Secretary Steve Mnuchin that the American currency is too strong. In March, gold went south, while the greenback jumped, anticipating the next hike at the FOMC meeting. Indeed, we saw a classic “sell the rumor, buy the fact” scenario in the gold market (with a “buy the rumor, sell the fact” scenario in the U.S. dollar), as the expectations surrounding a rate hike were actually much worse than the actual hike.

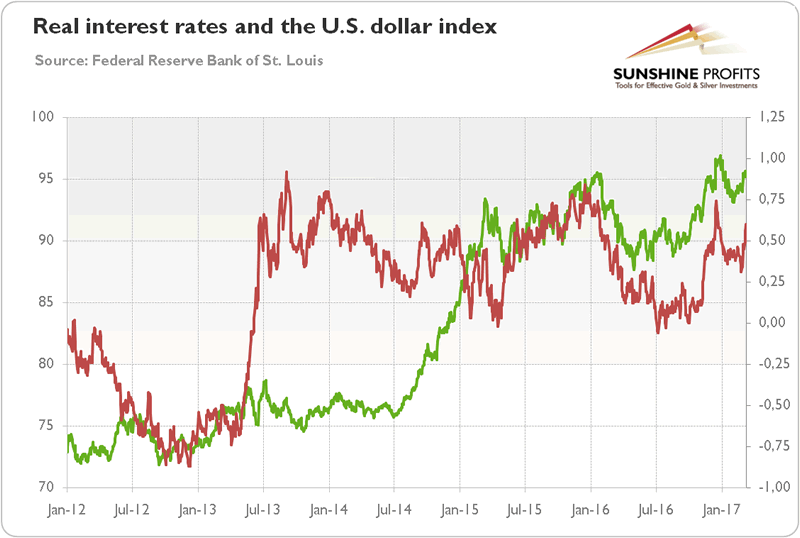

Now, the key question is what's next for the yellow metal. Given the strong relationship with the greenback, the issue boils down to the outlook for the U.S. currency. Well, we believe that the medium-term trend in the greenback is higher, despite the pullback in the first quarter of 2017. As one can see in the chart below, the U.S. dollar has been in an upward trend since 2014. We have also seen an uptick in the real interest rates since the mid-2016.

Chart 4: The U.S. real interest rates (red line, right axis, yields on 10-year Treasury Inflation-Indexed Security) and the U.S. dollar index (green line, left axis, Trade Weighted Major U.S. Dollar Index) over the last five years.

The dollar simply has stronger fundamentals than its major rivals. The U.S. economy should still develop faster than Europe's (or Japan's). And the Fed is likely to continue its much more hawkish policy than the ECB(or the BoJ). Consequently, the yield differential between the dollar and the euro should continue to widen, supporting the U.S. dollar. Hence, the greenback continues to be the prettiest of the ugly sisters, offering higher and growing yield.

It's true that the euro gained after the Mario Draghi's hawkish comments in March. However, the euro should remain in its long-term downward trend, at least until the ECB ends the quantitative easing and starts hiking interest rates. It would be a long road towards normalization of rates – as a reminder, the Fed started its hikes after the asset purchases were first tapered and finally completed. And the elections in France and Germany are big headwinds for the common currency, as investors are likely to sell the euro, preparing for the worst. Of course, there will be ups and downs, but the Euro area (and its currency) is simply more fragile and less resilient to negative shocks than the U.S.

To sum up, in 2017 the price of gold has risen about 9 percent. Although there was a pullback in the greenback and the real interest rates in the first quarter of the year, we believe that the dollar bull market will remain intact, at least until investors shift their focus from the U.S. towards the monetary policy in the Eurozone and Japan. By that time, the Fed interest rate hikes should only strengthen the greenback. The appreciation of the U.S. dollar is traditionally bearish for gold. On the other hand, the failure of introducing Trump's pro-growth and the resulting end of the reflation trend could send the greenback down for a while, supporting the gold price.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.