Odd, Ominous Economic Trend in the US That Is Not Seen Anywhere Else in the World

Economics / US Economy Apr 05, 2017 - 03:38 PM GMTBy: John_Mauldin

I’ve written about this previously, but there are 10 million American men of prime working age (25 to 54) who have simply dropped out of the workforce. And most of them have not only dropped out of the workforce, they have also dropped out from any commitments or responsibilities to society.

I’ve written about this previously, but there are 10 million American men of prime working age (25 to 54) who have simply dropped out of the workforce. And most of them have not only dropped out of the workforce, they have also dropped out from any commitments or responsibilities to society.

It is not just the labor force they are not participating in; they are not participating in the normal ebb and flow of community life.

This is not a recent phenomenon, but few talk about it.

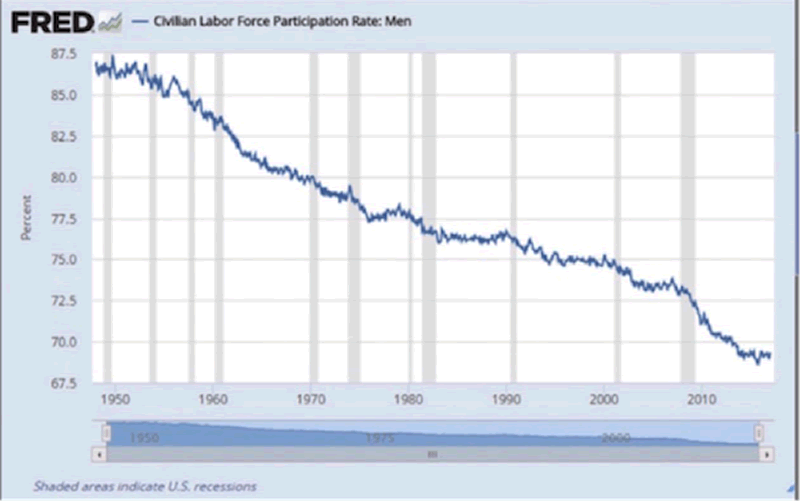

Male Participation in the Civilian Labor Force Has Been Steadily Dropping for 60 Years

Male participation was on a downward spiral through boom and bust years, periods of inflation and deflation, Republican and Democratic administrations, and congressional control; the trend seems to be relentless—except that it has been accelerating since 2009.

The trend was in place long before automation began to really impact the manufacturing workforce or jobs began to shift to China and other countries with lower labor costs.

What I find odd and even more disturbing is that this seems to be a uniquely American trend.

Death Rates Among 45–54 Aged Men Are Growing

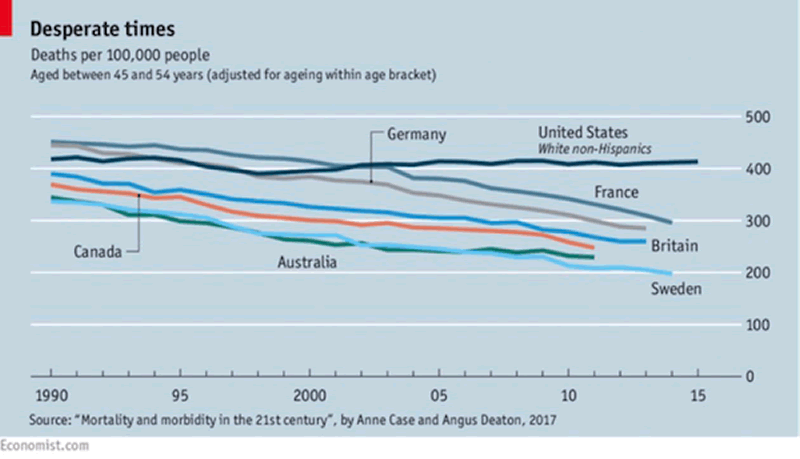

Further, this is not just about men not participating in the labor force. “Deaths of despair” among middle-aged white men are increasing at an alarming rate.

The Economist highlighted this problem with a great chart that compares the US and other developed countries.

AMERICAN workers without college degrees have suffered financially for decades—as has been known for decades. More recent is the discovery that their woes might be deadly.

In 2015, Anne Case and Angus Deaton, two (married) scholars, reported that in the 20 years to 1998, the mortality rate of middle-aged white Americans fell by about 2% a year.

But between 1999 and 2013, deaths rose. The reversal was all the more striking because in Europe, overall middle-age mortality continued to fall at the same 2% pace.

Where Will the Growth Come From?

There are only two ways for an economy to grow. That’s it. If you don’t have these two elements, you’re not going to have economic growth.

One way is the workforce increases, and the other is that you increase productivity

If Larry Summers is right, one-third of working-age males are essentially going to drop out of the workforce by 2050. Couple that with Baby Boomers retiring in the coming decades, and we can forget the increase in GDP that normally comes from growth in the workforce.

Plus, it is really hard to increase productivity in much of the service sector. How much more productive can a bartender or a cashier be? Or a taxi driver? Yes, we can eliminate their jobs with technology, but that just reduces the workforce side of the equation.

This whole workforce issue is forcing me to rethink a great deal about how the economy is likely to behave and how successful investing will be done in the future.

I cannot remind you strongly enough that past performance is not indicative of future results.

I don’t see us turning the workforce situation around unless we somehow manage to transform our negative imagery about immigrants and start to aggressively seek out productive young, educated immigrants from around the world.

I am not going to hold my breath on that one.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.