The Fake US Economic Recovery May Be Ending

Economics / US Economy Apr 04, 2017 - 04:58 AM GMTBy: Chris_Vermeulen

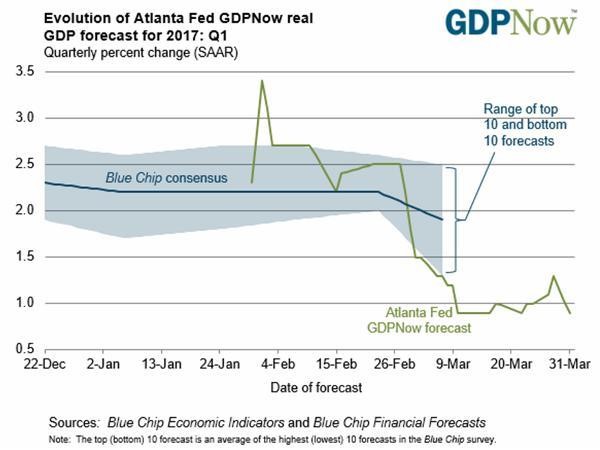

The “real” Atlanta Fed’s reading of Q1 GDP went off a cliff to less than 1%:

The “real” Atlanta Fed’s reading of Q1 GDP went off a cliff to less than 1%:

No one has the slightest idea of what is happening as insane levels of debt distort the model’s which economists use to forecast the future economic trends. From here on out, there will be unpleasant surprises all the way around. According to shadow stats, the GDP is in contraction at the rate of -2%.

The New Normal & Disconnect:

The FED and other agencies have taken on new responsibilities for managing systemic risk since the financial crisis of 2007.

What grade have they earned? The impact of implemented low-interest rates for savers has made them poorer. All pension plans, college endowments, and state retirement plans have been diminished and devastated by low-interest rates. Savers have suffered and will continue to do so because of ‘financial repression’.

Furthermore, because low-interest rates make savers poorer, the contracting economy has limped along with anemic growth rates. Low-interest rates have had a negative impact for almost everyone.

Preparing For The Big Crunch!

The FED will respond with even more aggressive money printing — which will then cause the entire monetary system to implode some day. Money is not wealth, but rather it is merely a claim on wealth. Debt is a claim on future money. The only way to have faith in our current monetary policies is if one believes that we can grow our economy and GDP out of this massive debt that we have created. The U.S. is already insolvent, meaning liabilities exceed assets. The U.S. has been spending, far beyond its’ means, for multiple decades while amassing tremendous amounts of public debt, private debt and entitlement liabilities.

The Austrian economist Ludwig von Mises said, “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

U.S. economic growth began slowing down due to its’ acceleration of ‘too much debt’. Instead of allowing natural market forces to clear out the excessive debts, the Federal Reserve chose to go into overdrive to ‘remedy’ the problem. Its’ remedy? Drive interest rates to 0% to reduce the service burden of those debts and print trillions of fresh dollars which, in turn, would fund new borrowing.

Of course, no true ‘solution’ for resolving debt involves piling up even more of it. The only path that history has shown that works involves fiscal austerity and reducing debt. The only real solution is “a voluntary abandonment of the credit expansion”.

The only possible solution for recovery, today, is if the economy suddenly returns to an extremely rapid economic growth over an extended period of time. If during such a period of rapid growth does occur, we must use that windfall to pay down the outstanding debts! The intent of the FED treading into the never-before-tried ZIRP and NIRP waters was to ignite more borrowing, not more spending!

Pension plans have been ultimately decimated by these monetary policies!

Pension funds across the U.S. are desperate to overcome low interest rates and return to the time when future retirees were entitled to and could receive their full benefits. Pension funds which so many depend upon for their retirement security will lose trillions of dollars which will result in the depletion of receiving their benefits!

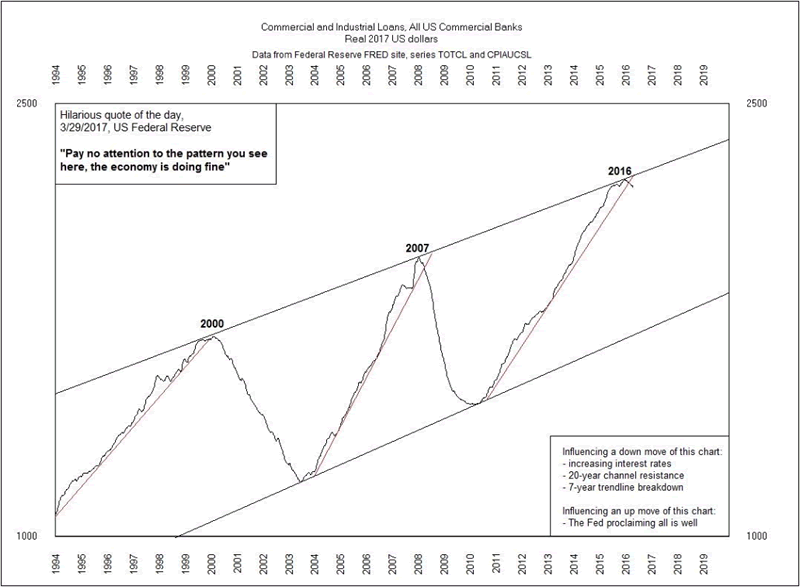

The chart below reflects the last two times that industrial and commercial loan contracts crashed which were in 1999 and 2007!{25 year chart} of all American Bank Commercial and Industrial Loans.The last 2 times loans contracted and broke down was 1999 & 2007

Making Real Profits!

Want to gain the edge you need to beat the markets? Or Better yet, profit during the next market correction through the use of Inverse Exchange Traded Funds?

Take advantage of my insight and expertise as I can help you grow your trading account. Tune in every morning for my video analysis and market forecasts at TheGoldAndOilGuy.com on all ‘asset classes’ and new ETF trade opportunities.

I am currently in a gold related trade. The last gold trade that I provided, returned a trade with NUGT resulting in an 112% Profit From Dec – Feb.

We use a combination of traditional technical analytical tools, Elliot Wave Counts and investor sentiment! This makes for Killer Trades with oversized Profits!

We always take half off of the table on all positions to lock in quick solid gains and then we ride the other half for much higher returns! We reduce our risk while keeping our gains!

It looks as though we are a couple of days away from the next major trade setup which could last several months with the potential for a 51-55% return. Be sure to keep informed by reading my newsletters and get my stock trades and leveraged ETF trades at www.ActiveTradingPartners.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.