Cyclical Stock Market Correction Underway

Stock-Markets / Stock Market 2017 Apr 03, 2017 - 05:03 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX Long-term trend: Uptrend continues.

SPX Intermediate trend: The correction from 2400 continues,

Analysis of the short-term trend is done on a daily-basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

Cyclical Correction Underway

Market Overview

The correction from SPX 2400 is caused by intermediate cycles which will not make their lows until late April, early May. The first phase took the index down to 2323 for a seventy-seven-point loss. Last week, the next phase was a rebound of forty-seven points to 2370 which may or may not be complete. The level reached represents the lower portion of a target zone which extends to 2474 and, in spite of three separate unsuccessful attempts at exceeding 2370 and closing on its low of the day, SPX failed to give a confirmed short-term sell signal. We'll have to wait until Monday for a decision.

Of the three cycles, the one which just reversed is the most reliable, so the others will have to prove themselves. However, structure appears to point to more correction ahead. In spite of last week's rally, the daily indicators are still in a sell mode, and the weekly indicators have turned down but are only correcting and have not given a sell signal at the weekly time frame.

When this correction began, I indicated that I did not expect a major decline. Last week's rally has already shown that it will be in the form of an intermediate consolidation/correction. Nevertheless, we should expect new lows to be made before it is over. And, with the final low not scheduled for a few more weeks, we could enter a volatile period over the immediate future.

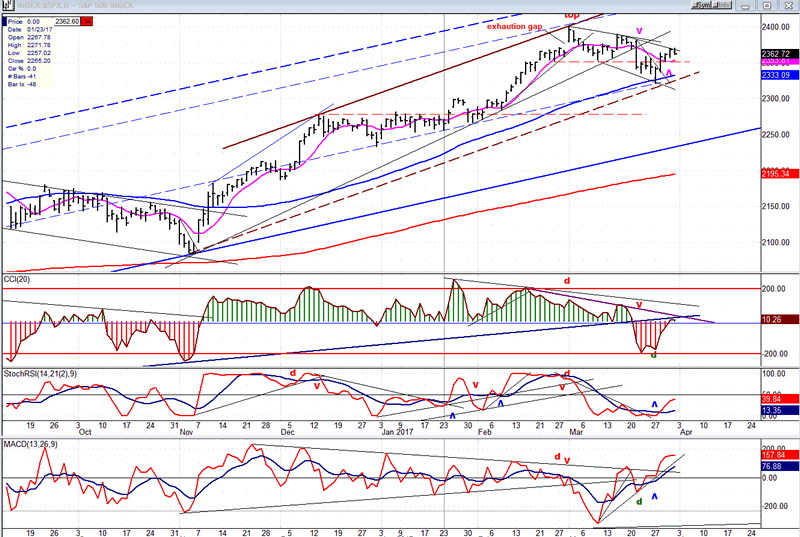

Daily chart

As I discussed in the past issue, although the current uptrend started a little over a year ago at 1810, this corrective action is only for the rally which started at 2084, and is contained in the brown channel which has a dashed line for the lower channel line. The larger (blue) channel delineates the action from 1810. After this correction is over, we should make a new high to complete the larger structure, and then challenge the bottom line of the blue channel. This will bring a much more severe corretion than the one we are currently experiencing, but it is too soon to consider a potential bull market top.

The first (a-b-c) phase of the correction ended on the blue (55-d) moving average which coincides with the lower channel line. 2325 had been the projection derived from the distribution which formed before we broke the trend line. The 2323 low was right in the ball park.

Instead of an immediate break through the bottom of the brown price channel, phase two could, after a short retracement, extend to a new correction high before we start on phase three. In any case, if the entire correction is a larger a-b-c pattern, phase three should break below both the dashed trend line and the blue 55-d MA and make a new correction low at a level which will be determined by the amount of distribution prior to the reversal.

A look at the oscillators makes it clear that the daily trend is still down. Until we have a significant break above the downtrend lines of the top oscillator sustained by strong upside momentum, we are still in a downtrend. Last week's rally was extensive enough to reverse both lower oscillators. All three will be expected to turn lower as the next correction get underway, but perhaps not before they first develop some negative divergence.

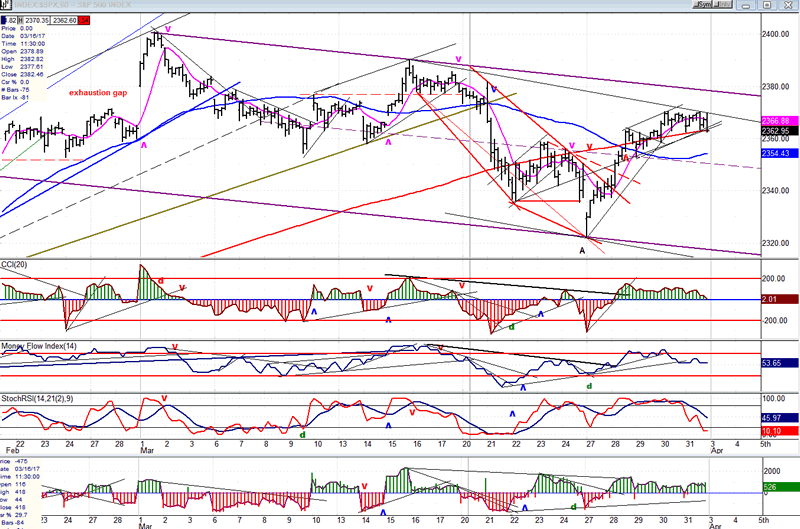

Hourly chart

The consolidation/correction remains confined to a broad, but shallow channel, indicating that it should not be all that severe for the rest of its duration (with the end expected to still be several weeks away). And if we are forming another a-b-c second phase, we will most likely penetrate the top of the channel with the minor c-wave before starting on the major C-wave decline.

I may have drawn a secondary channel prematurely since a minor top of the move from 2323 has not been confirmed. As mentioned above, the projection target was 2370-2374, and although the lower level stopped the index on four separate occasions, there is no certainty that we won't try for 2374 before minor a-wave is over. Prices have been gyrating along the red (233hr) MA for the past week, and the close on Friday was right on it, as well as on an internal trend line from which additional support could be derived. Trading below that level is required to confirm the start of minor b-wave.

Neither has the top oscillator nor the lower one (A/Ds) gone negative, which is essential for a sell signal to be given. The SRSI is the only one which has clearly entered a downtrend and, since it is always an early bird, the others could follow on Monday to give us the small b-wave of the second phase.

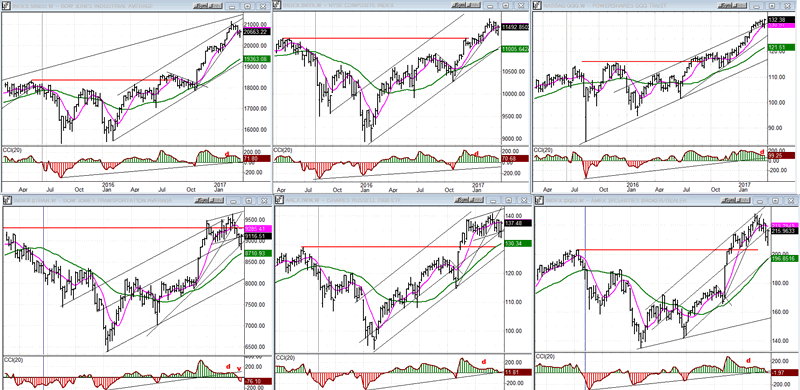

An overview of some important indexes (Weekly charts)

The top tier is the strongest by far and shows no sign of long-term deceleration.

TRAN (bottom left) continues to be the weakest index and is the only one which has given a mild weekly sell signal. It deserves continued monitoring because of its historical pattern of giving warning long before long-term reversals occur. The total group gives no indication that the long-term is in imminent serious jeopardy.

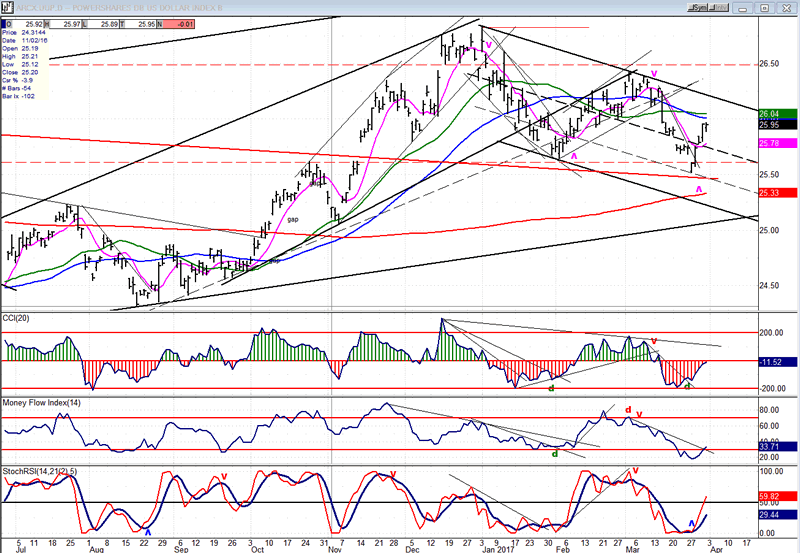

UUP (dollar ETF)

UUP is getting back into an uptrend, possibly after completing a long-term wave 4 consolidation. If so, after a short consolidation, it should continue its uptrend, and eventually make a new high which is expected to be a long-term top followed by a significant correction.

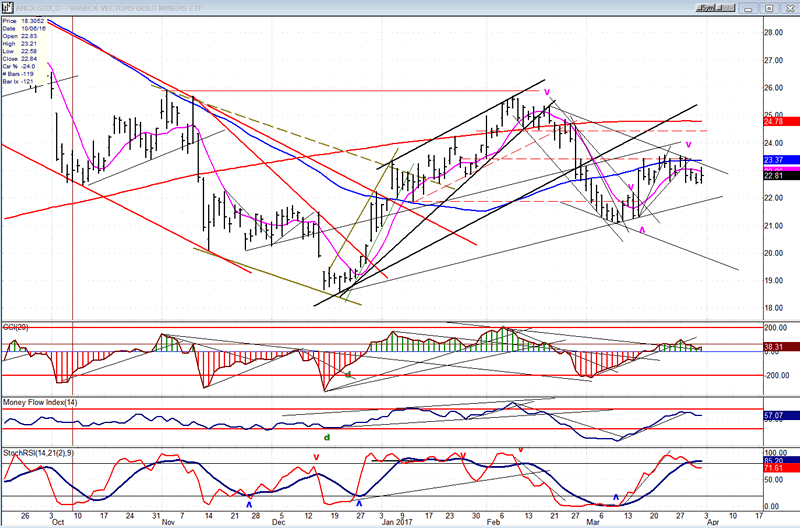

GDX (Gold Miners ETF)

GDX continues to move in a sideways pattern which should eventually resolve itself into some additional downward correction over the next few weeks. The index may remain under pressure until UUP has made its final high, or is close to it.

Note: GDX is now updated for subscribers throughout the day, along with SPX.

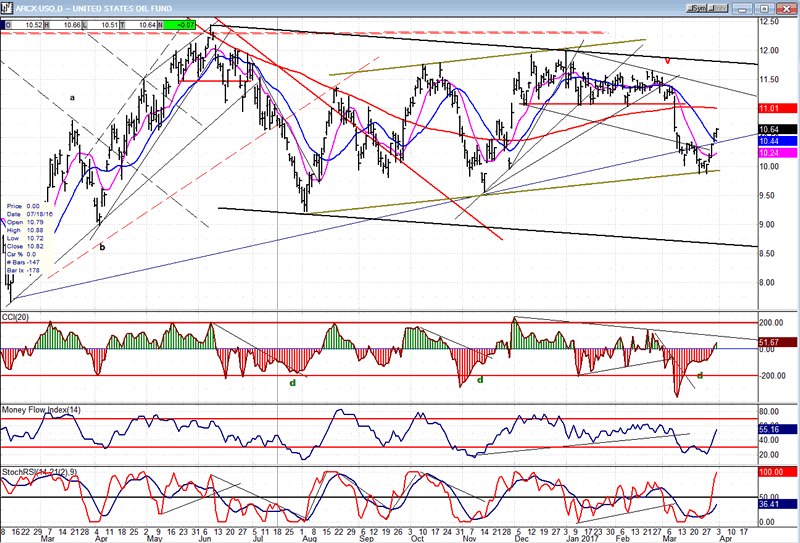

USO (U.S. Oil Fund)

USO found support on its bottom channel line and had a good bounce. Its action should continue to mimic that of the overall market as it extends its short-term base in preparation for another attempt at moving above the recent tops. Note how positive divergence in the top indicator continues to warn of a trend reversal.

Summary:

The correction from 2400 is expected to continue in a relatively shallow manner until the intermediate cycles have all made their lows. This could still take several more weeks.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.