The American Dream, Twice Removed

Politics / Social Issues Apr 02, 2017 - 05:23 PM GMTBy: Raul_I_Meijer

Nicole Foss is in Christchurch, New Zealand right now for the Living Economies Expo, and sent me, I’m still in Athens, Greece, a piece written by yet another longtime Automatic Earth reader, Helen Loughrey (keep ’em coming!), who describes her efforts trying to find a rental home in Fairfield County, Connecticut.

Nicole Foss is in Christchurch, New Zealand right now for the Living Economies Expo, and sent me, I’m still in Athens, Greece, a piece written by yet another longtime Automatic Earth reader, Helen Loughrey (keep ’em coming!), who describes her efforts trying to find a rental home in Fairfield County, Connecticut.

The first thing that struck me is how effortless and global sending information has become (category things you know but that hit you anyway occasionally, which is a good thing). The second is that the fall-out of the financial crisis has followed the same path as the information ‘revolution’: that is, it’s spreading faster than wildfire.

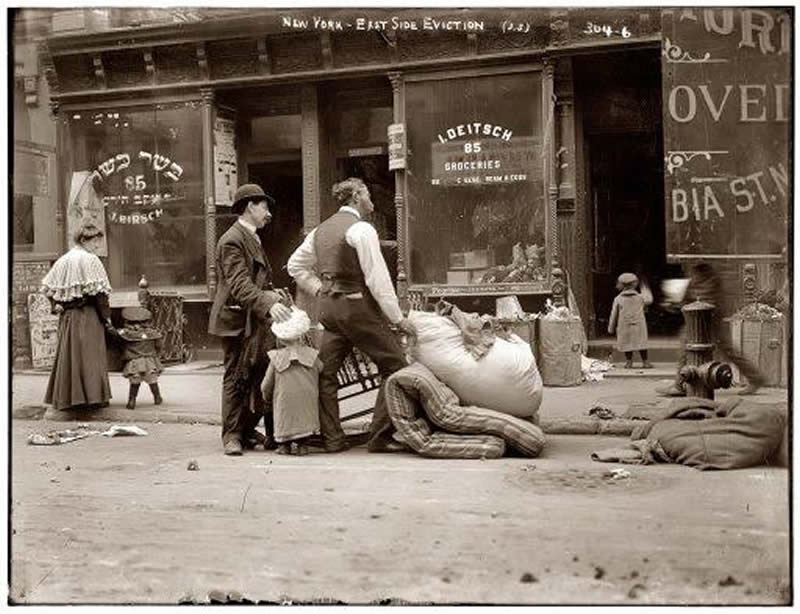

And I can’t avoid linking that to earlier periods of American poverty (see the photos), times in which ‘leaders’ thought it appropriate to let large swaths of the population live in misery, so everyone else would think twice about raising their voices. A tried and true strategy.

But of course there are large differences as well today between the likes of Greece and Connecticut. In Athens, there’s a poverty problem. In Fairfield County, there’s a (fake) ‘wealth problem’. Ever fewer people can afford to buy a home, so the rental market is ‘booming’ so much many can’t even afford to rent.

We can summarize this as ‘The Ravages Of The Fed’, and its interest rate policies. Or as ‘The Afterburn of QE’. That way it’s more obvious that this doesn’t happen only in the US. Every country and city in the world in which central banks and governments have deliberately blown real estate bubbles, face the same issue. Toronto, Sydney, Hong Kong, Stockholm, you know the list by now.

Helen’s real-life observations offer a ‘wonderful’ picture of how the process unfolds. The demise of America comes in small steps. But it’s unstoppable. The same is true for every other housing bubble. When no-one can afford to buy a home anymore but a bunch of Russians and Chinese, rental prices surge. And then shortly after that the whole thing goes up in smoke.

Here’s Helen:

Helen Loughrey: I am getting a reminder about class systems and downward social drift while searching for a rental in Fairfield County, Connecticut.

First of all, I realize I am extremely lucky to be able to afford a home at all. More and more Americans increasingly cannot. I am very aware that my current socioeconomic status could be gone in an instant. And so I am more inclined to notice class issues. There, but for the grace of GDP, go I.

And as one who studies the economy, I know we are all destined to go ‘there’ in the not-so-distant future. Owners are downsizing to become tenants, occupancy rates may rise to depression era levels, and homelessness will continue to rise up through the social fabric like water wicking up a paper towel.

This week, I rejected an unoccupied split level rental for the dilapidated condition of the heavily scuff-marked and dingy old wall paint and dirty carpets and peeling deck paint. The house screamed “I do not care about my tenants’ quality of life.” I told my real estate agent that it indicated the landlord would not be responsive to tenant needs. He replied, “Well, after all, it’s a *rental*.”

And that statement in its conventional wisdom summed up class assumptions: buyers deserve better than renters. Yet landlords expect renters to deposit $8,000 to $10,000 of their savings, to maintain excellent credit ratings, to pay more than they would for a monthly mortgage, and to increase payments over time by $100/month every year without commensurate capital improvements to maintain the quality of the premises.

I replied, “Well, renters are people too.” I was facing the fact that despite having been a conscientious homeowner and model tenant, I had lost significant socioeconomic status by becoming a renter.

Another anecdote: Our current rental is likewise being shown to potential tenants. This week an until-recently wealthy, brand new divorcée with a pre-teen visited while I was here. She needs to switch her daughter from private school to the public schools and to quickly obtain a separate town residence in order to register her daughter.

I spiffed up the place for my landlord, put fresh flowers on every table, and told the prospect how marvelous it was to raise our daughter in this school district with the backyard pool available to her new friends, how the third bedroom was a cozy office/family room. She listened politely but she visibly recoiled at the drop in living standards that comes with renting after a divorce. Welcome to the Greenwich renters club, my dear.

I remember despairing in our 2013 rental search that we would not find a decent home by the time we had to register our daughter in the Greenwich school system. We had compromised on this residence. Granted, the New York regional prices are stratospheric compared to our southern Maryland experience. You must DOUBLE your housing costs and even then you get much less square footage for the money.

Second, even though Greenwich is notoriously about rich and famous estates in “back country”, nevertheless like any city there are a lot more resident middle class people in average homes and even less well-off poor living in lower quality public housing apartment complexes.

The options in our price range were deplorable when we arrived here. So we paid a lot more than we thought we could afford only to share a portion of a 1950’s era non-updated house with the resident owner living in the in-law apartment.

I tried not to compare it to the larger modern house we had owned in Maryland but on my depressed days, I let my mind wander through our old home for old times’ sake. (But even there during the real estate boom years, I remember thinking we could not afford to buy again in our own neighborhood.)

In 2013 we had offered less than the listed price for our current Greenwich rental but past the top of our affordability. We rationalized that there was a swimming pool bonus for our daughter to invite new friends over. Our offer was accepted. We incorrectly assumed that over the years, the monthly rent would not rise much.

The list price should have been a clue to us that the landlord would attempt to increase the price back to their higher monthly income expectations. Plus the landlord retired from his job and took out a home equity loan a year later.

G. G. Bain Eviction in an East Side neighborhood of New York 1908

Four years later, the time has come for us to balk at any further increases. This 3 bedroom 2 bath “tear-down” house apartment now is listed at $5500 and in three years the landlord likely expects rent creep to provide the $6000 they want in monthly income. Well, good luck to the next tenant. So we are house-hunting again. We no longer require the public school system, but since we are paying cash now for college, our options are still limited. (I could write another essay about skyrocketing college costs.)

We recently concluded that we are now priced-out of the Greenwich rental market for what we are seeking: my husband needs a home office. I want to get moving finally on a productive food garden and starting a Permaculture Design school home business.

Convincing a potential landlord to allow me to convert costly wasteful lawn space into productive perennial food garden space; and to accept all my pets, a well behaved 6 pound lapdog plus 24,000 to 140,000 honeybees …. does not endear me to the real estate agents here. (I could write another essay on entitled and controlling listing agents.)

Other factors also place upward pressure on rental pricing: The sales market is in a longterm slump. Fewer potential buyers qualify to enter the market because they have recently lost their life savings in the housing slump themselves or they are too young to have acquired any.

Bank lenders expect larger down payments than in the recent past, amounts which I expect will be forfeited to the banks anyway when the economy tanks and more “homeowners” are thrown out of work. (Tanked economy, thanks in part to those same banks betting their depositors money in declining real estate.)

Renters risk losing their deposits to unscrupulous thieving landlords but nothing beats a thieving bankster. That down payment you saved? Kiss it goodbye, you are very likely never getting it back. And banksters know this. It is why they demand high down payments.

They’re counting on the eventuality that a good portion of current mortgagees will have to forfeit in a depressed economy. But you would not know there is a sales market slump, let alone another looming crash, by reading glowing real estate -sponsored newspaper articles. It is no wonder many sales are for cash not lien, to wealthy foreign buyers.

Anyone buying housing today should expect an asset value loss to occur when the real estate market adjusts downward again. (Which is another reason we are not buying in this market.) However sellers, listening to advice from hopeful real estate agents and pollyannish economists, are holding out for *higher* prices to return.

They eventually remove their properties from the sales market in order to rent them after they still cannot find a buyer even though dropping the price continuously for two years. And because fewer people can afford buying than renting, the price of rentals is rising now while the price of real estate is dropping.

Landlords who are strapped with high mortgages from the boom years, and other landlords who may have owned their older houses outright but then took out home equity loans to finance eventual roofing or HVAC expenses, and even to afford replacement cars or family vacations, are placing expectations on their tenants to provide the income to pay for those bank loans.

Meanwhile town zoning laws still prevent the tenant cost savings of subletting; and prevent owners from contracting with simultaneous multiple tenants. Yet the pool from which to draw tenants who can afford a whole house or 3/4 of one is still shrinking.

Renters like us may eventually opt (and perhaps should be opting now) for smaller square footage multiple family apartment complexes. (But no food gardening amenities? Rental managers take note.) Whole houses, with high mortgages to cover, will remain vacant and become foreclosed.

And I get it, owning a mortgaged property is also costly. But while renters are seeing standards of living drop now, so too will landlords when their properties sit vacant due to aggregate inability of renters’ incomes to afford to support the mortgaged landlords in the manner to which they had once become accustomed.

There will be a resurgence in foreclosures. And then, if they are lucky to still have a job income, we’ll also welcome them to the renters club.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2017 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.