‘Three Wise Men’ Warn Next Crash Coming, Own Gold

Commodities / Gold and Silver 2017 Mar 31, 2017 - 04:07 PM GMTBy: GoldCore

‘Three wise men’ are warning that the next financial crash is coming and that one of the ways to protect and grow wealth in the coming crash will be to own gold.

‘Three wise men’ are warning that the next financial crash is coming and that one of the ways to protect and grow wealth in the coming crash will be to own gold.

The men who have recently warned are Jim Rogers (video below), Martin Armstrong (blog below) and Tony Robbins (video below). Each come from somewhat different backgrounds and are respected experts in their respective fields.

Each has different views in terms of asset allocation and how best to weather the coming financial storm but all are united in believing that gold will act as a wealth preservation tool and will likely rise in value when other assets fall.

Jim Rogers is a world renowned investor who co-founded the Quantum Fund with fellow investor George Soros. He is an investor, traveler, financial commentator and author who believes that this will be the ‘Asian Century.’

In his usual plain speaking, honest manner, Jim Rogers warned on Bloomberg TV that

“the Federal Reserve… has no clue what they are doing. They are going to ruin us all.”

Central banks have driven rates to all time record lows and in the process, debt has “sky-rocketed.”

Rogers slams the ‘counterfactual’ arguments that things would have been a lot worse if the Fed had not done all this, “propping up zombie banks and dead companies is not the way the world is supposed to work. … It’s been nine years and we have nothing to show for it [economically] except staggering amounts of debt.”

Rogers is pessimistic about the outlook for America and thinks that Donald Trump will see the US continue on the path to bankruptcy – a path set by Bush and Obama before him.

He concludes the Bloomberg interview ominously by saying that “this is all going to end very, very, very badly.”

In recent years, Rogers has consistently said that he wants to own more gold and silver and will continue to accumulate the precious metals on any price dips.

Watch Rogers on Bloomberg TV here

Financial analyst and trends forecaster, Martin Armstrong warned on his Armstrong Economics blog this week that governments are in increasing trouble and people will start to lose confidence in their governments:

“Gold and the stock market will take off when people realize that government is in trouble. When they lose confidence, that is when they will start to pour into tangible assets.”

Armstrong is nervous about gold in the short term and thinks it could fall as low as $1,000 per ounce prior to surging to as high as $5,000 per ounce in the coming years.

Tony Robbins, performance coach and self help guru has warned that “The Crash is Coming.”

Robbins, who is focusing more on finances and wealth in recent years and in his latest book, ‘Money: Master The Game’, says plan now for what’s to come. Things may be looking rosy on Wall Street as of late, but the crash will come.

“We are in a really artificial situation. There is a new high, on average, every month. Feds around the world have been printing money,” said Robbins in a tv interview.

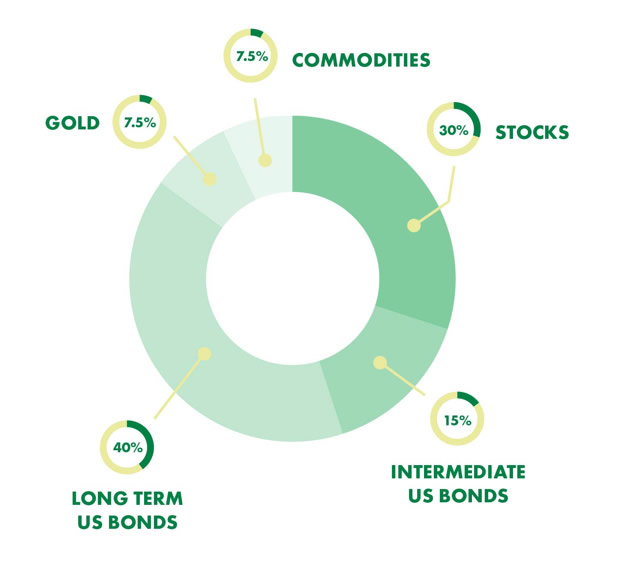

Robbins has long advocated owning gold as part of a diversified portfolio and has cited Kyle Bass, Marc Faber and more recently Ray Dalio as his financial gurus. In his recent book, Robbins cited Dalio and recommended an asset allocation strategy that involves a 7.5% allocation to gold.

All Seasons strategy via Ray Dalio via Tony Robbins

Given the increasing risks of another financial crash, the warnings from these very different three men should be taken heed of. They underline the importance of being prudent, of real diversification and of owning gold.

The smart money sees what is coming and is once again preparing.

Gold Prices (LBMA AM)

31 Mar: USD 1,241.70, GBP 9,996.46 & EUR 1,161.98 per ounce

30 Mar: USD 1,250.90, GBP 1,005.72 & EUR 1,165.34 per ounce

29 Mar: USD 1,252.90, GBP 1,007.71 & EUR 1,161.19 per ounce

28 Mar: USD 1,253.65, GBP 996.15 & EUR 1,154.49 per ounce

27 Mar: USD 1,256.90, GBP 1,000.49 & EUR 1,157.86 per ounce

24 Mar: USD 1,244.00, GBP 996.20 & EUR 1,150.82 per ounce

23 Mar: USD 1,247.90, GBP 997.95 & EUR 1,157.93 per ounce

Silver Prices (LBMA)

31 Mar: USD 18.06, GBP 14.50 & EUR 16.91 per ounce

30 Mar: USD 18.10, GBP 14.53 & EUR 16.85 per ounce

29 Mar: USD 18.13, GBP 14.58 & EUR 16.81 per ounce

28 Mar: USD 17.94, GBP 14.29 & EUR 16.53 per ounce

27 Mar: USD 17.94, GBP 14.25 & EUR 16.51 per ounce

24 Mar: USD 17.63, GBP 14.11 & EUR 16.31 per ounce

23 Mar: USD 17.55, GBP 14.04 & EUR 16.27 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.