Gold, Silver Rise 2.5% and 3.2% As ‘Trump Trade’ Fades

Commodities / Gold and Silver 2017 Mar 27, 2017 - 05:03 PM GMTBy: GoldCore

Gold and silver jumped another 1% overnight in Asia, building on the respective 1.5% and 2.2% gains seen last week. The ‘Trump trade’ is fading, impacting stock markets and risk off has returned to global markets with the Nikkei, S&P 500 futures and European stocks weakening.

Gold and silver jumped another 1% overnight in Asia, building on the respective 1.5% and 2.2% gains seen last week. The ‘Trump trade’ is fading, impacting stock markets and risk off has returned to global markets with the Nikkei, S&P 500 futures and European stocks weakening.

The precious metals had their second consecutive week of gains last week. Gold rose 1.5% and silver 2% while platinum rose 0.5% and palladium surged 4.8%. Today, gold has risen from $1,247.90 to a one month high of $1,259 per ounce and silver from $17.74 to $17.92 per ounce.

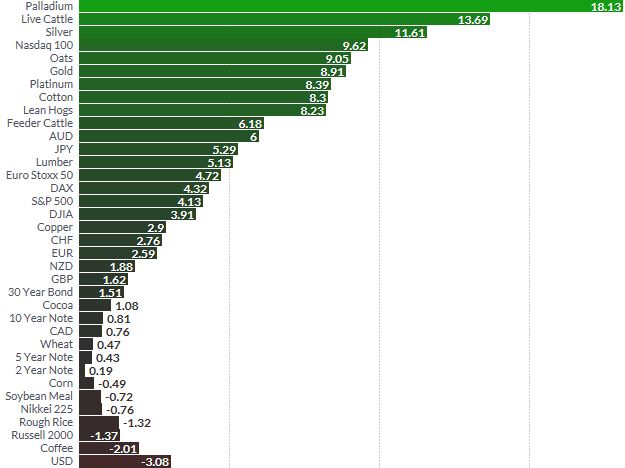

Market Performance 2017 YTD

The precious metals continue to outperform most assets in 2017. Year to date, gold is 9% higher and silver is 11.7% higher. Platinum is 8.4% higher and palladium has surged 18% to two year highs.

NOTE to U.S. Tax Residents regarding Storing Offshore

GoldCore are not restricted in dealing with US residents due to Fair and Accurate Credit Transactions Act (FACTA), as we are not deemed to be a designated financial institution.

GoldCore is not a financial institution and the primary business of GoldCore is to act as a specialist provider of gold and silver bullion coins and bars for delivery and secure storage through our partners. These are not regulated financial services activities.

Thus, GoldCore are a non-financial foreign entity (NFE) and considered a non-financial foreign entity (NFFE) by the U.S. government.

Some vault providers will not allow U.S. residents to store their bullion directly in their vaults. GoldCore provide precious metals coin and bar storage and delivery for our U.S. clients in Loomis Zurich, Loomis Hong Kong and Brinks Singapore.

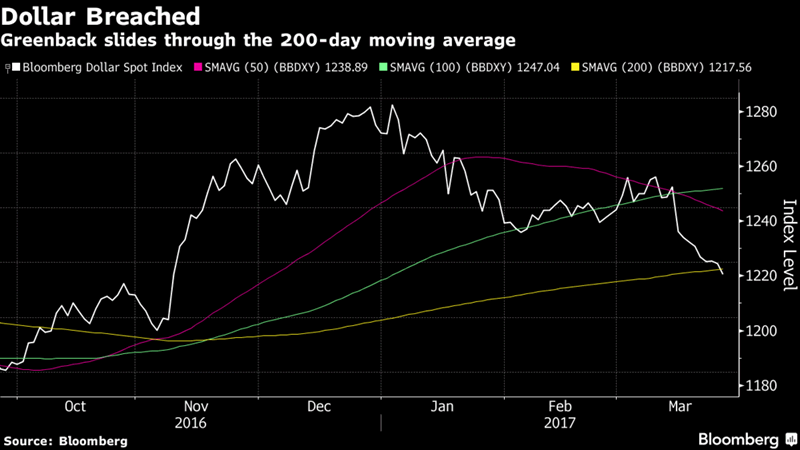

Gold and silver have eked out gains as the dollar and stocks have come under pressure after U.S. President Donald Trump failed in his attempts to abolish Obama care. Trump suffered a major political setback on healthcare reform, raising doubts about his ability to steer the economic agenda.

The dollar has fallen to the lowest level in five months and stock markets globally are seeing sharp falls today. Trump’s inability to deliver on a major election campaign promise marked a big defeat for a Republican president whose own party controls Congress, and raised doubts whether he would be able to push through tax reforms and mega-spending packages.

Growing U.S. political uncertainty is creating concerns that a recent pick-up in global business and consumer sentiment, particularly in Asia, may be impacted.

Bullion coin and bar demand remains robust. US Mint data shows that strong demand for gold and silver coins continued last week.

Sales of gold coins were the highest since the week ended February 10 and silver coin sales were the highest since the week ending January 20.

As reported by Coin News:

– Gold coins advanced by 13,000 ounces after rising by 8,000 ounces last week. Splits include 9,000 ounces in American Gold Eagles compared to 5,500 ounces previously and 4,000 ounces in American Gold Buffalo compared to 2,500 ounces previously.

– Silver coins jumped by 795,000 ounces compared to 220,000 ounces previously. And like in the last two weeks, American Silver Eagles accounted for all sales.

| US Mint Bullion Sales (# of coins) | ||||||

|---|---|---|---|---|---|---|

| Friday Sales | Last Week | This Week | Feb Sales | Mar Sales | 2017 Sales | |

| $100 American Eagle 1 Oz Platinum Coin | 0 | 0 | 0 | 0 | 0 | 20,000 |

| $50 American Eagle 1 Oz Gold Coin | 0 | 2,500 | 8,500 | 21,000 | 14,500 | 122,000 |

| $25 American Eagle 1/2 Oz Gold Coin | 0 | 1,000 | 0 | 5,000 | 1,000 | 25,000 |

| $10 American Eagle 1/4 Oz Gold Coin | 0 | 2,000 | 0 | 4,000 | 2,000 | 42,000 |

| $5 American Eagle 1/10 Oz Gold Coin | 0 | 20,000 | 5,000 | 30,000 | 35,000 | 190,000 |

| $50 American Buffalo 1 Oz Gold Coin | 0 | 2,500 | 4,000 | 15,000 | 7,000 | 54,000 |

| $1 American Eagle 1 Oz Silver Coin | 0 | 220,000 | 795,000 | 1,215,000 | 1,295,000 | 7,637,500 |

| 2017 Effigy Mounds 5 Oz Silver Coin | 0 | 0 | 0 | 19,500 | 0 | 19,500 |

Speculators became bullish on gold and raised net gold longs last week. Bullion banks, hedge funds and money managers boosted their net long positions in COMEX gold after two weeks of cuts and reduced them slightly in silver in the week to March 21, U.S. Commodity Futures Trading Commission (CFTC) data showed on Friday.

There is now the real risk that Trump becomes a “lame duck” President and that his business friendly policies struggle to be enacted. This bodes badly for stocks and the dollar and well for safe haven gold which should continue to see risk averse flows.

Gold Prices (LBMA AM)

27 Mar: USD 1,256.90, GBP 1,000.49 & EUR 1,157.86 per ounce

24 Mar: USD 1,244.00, GBP 996.20 & EUR 1,150.82 per ounce

23 Mar: USD 1,247.90, GBP 997.95 & EUR 1,157.93 per ounce

22 Mar: USD 1,246.10, GBP 999.50 & EUR 1,154.76 per ounce

21 Mar: USD 1,232.05, GBP 989.21 & EUR 1,141.37 per ounce

20 Mar: USD 1,233.00, GBP 993.92 & EUR 1,146.57 per ounce

17 Mar: USD 1,228.75, GBP 991.85 & EUR 1,140.53 per ounce

Silver Prices (LBMA)

27 Mar: USD 17.94, GBP 14.25 & EUR 16.51 per ounce

24 Mar: USD 17.63, GBP 14.11 & EUR 16.31 per ounce

23 Mar: USD 17.55, GBP 14.04 & EUR 16.27 per ounce

22 Mar: USD 17.58, GBP 14.12 & EUR 16.30 per ounce

21 Mar: USD 17.31, GBP 13.88 & EUR 16.01 per ounce

20 Mar: USD 17.23, GBP 13.92 & EUR 16.03 per ounce

17 Mar: USD 17.40, GBP 14.08 & EUR 16.21 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.