Stocks Have Partied Hard Since Election Night… Now Comes the Hangover

Stock-Markets / Stock Market 2017 Mar 25, 2017 - 05:20 PM GMTBy: Graham_Summers

The market is now on very thin ice.

Yesterday worked off some of the “oversold” status for stocks, but we are in extremely dangerous territory today.

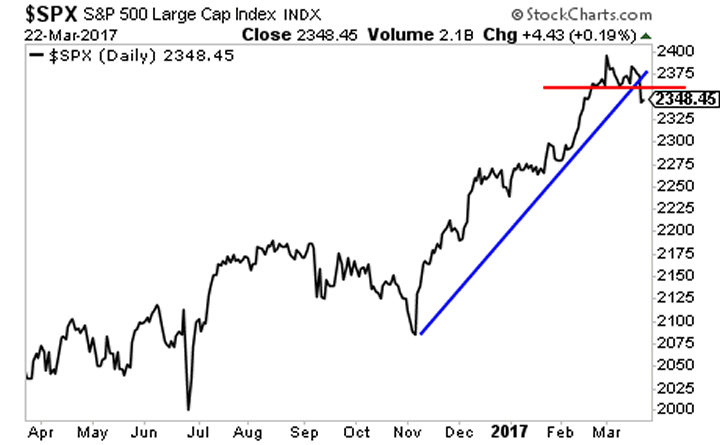

The S&P 500 has taken out critical support (red line) as well as the bull market trending running back to early November (blue line).

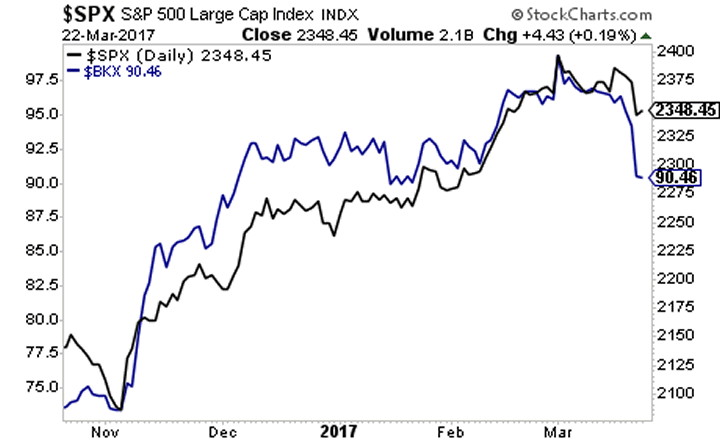

More concerning for the bulls: bank stocks, which lead to the upside, are now leading to the downside. It looks as though the ENTIRE move in the markets since election night is going to unwind.

This is a major wake up call, I hope you’re paying attention. The markets have rallied on hype and hope of the economy roaring back to life… but that’s not coming for another 12 months (at the earliest.

Stocks partied hard starting election night. Now comes the hangover.

And Private Wealth Advisory subscribers couldn’t be happier.

In the last two years 125 out of 146 have been winners.

That’s correct, we’re sporting a winning rate of over 86%.

Subscribers are pouring into this newsletter, to get these kinds of gains.

However, I cannot maintain this kind of track record with thousands of investors following our recommendations.

So tonight at midnight, we are closing the doors on our offer to try Private Wealth Advisory for 30 days for just $0.98.

This is it… no more extensions… no more openings.

To lock in one of the remaining slots…

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.