US Budget - There’s Almost Nothing Left To Cut

Politics / Government Spending Mar 23, 2017 - 06:30 PM GMTBy: John_Mauldin

Every politician in every campaign talks about getting rid of government fraud and waste.

Every politician in every campaign talks about getting rid of government fraud and waste.

If we could only cut out all of that wasted spending, we would have money either to lower taxes or to spend on something more useful.

Except there is nothing to cut that is of any meaningful consequence.

An Exercise for Every Politician

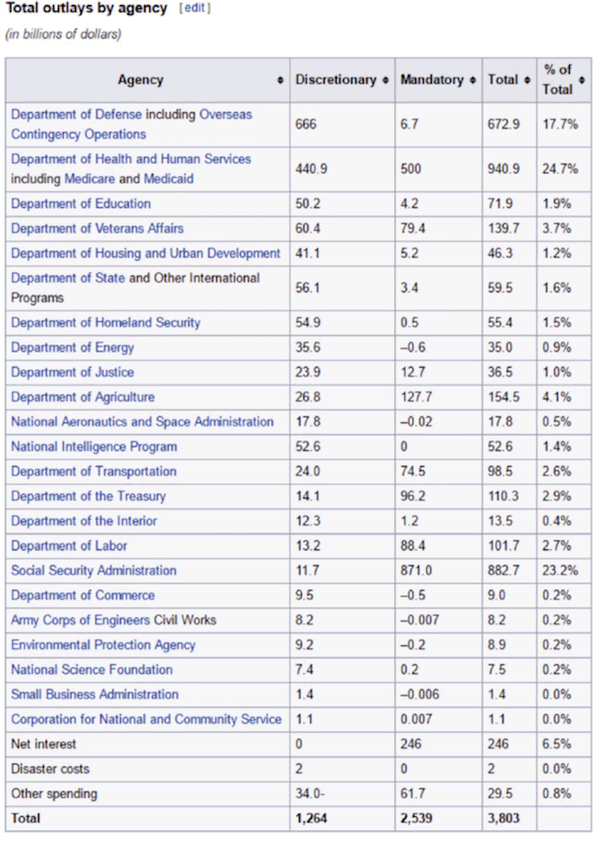

Here is a list from Wikipedia of the total outlays by agency and the percentages of the budget they make up.

Take a bit of time to go down through the list. See what small percentages most of the discretionary spending represents. Then remember that we already have a 15% budget deficit.

You could cut a dozen whole departments and still not get a balanced budget. Try to find a dozen departments you would like to eliminate. Not one or two or three, but a dozen.

Cutting their budgets by 20% gets you only about one-quarter of the way there. And do you really want to cut veteran’s benefits by 20%? Or slash space and technology R&D by 20%?

If we are going to put more immigration officers into the field, that means a budget increase—oops. And Trump wants to increase defense spending.

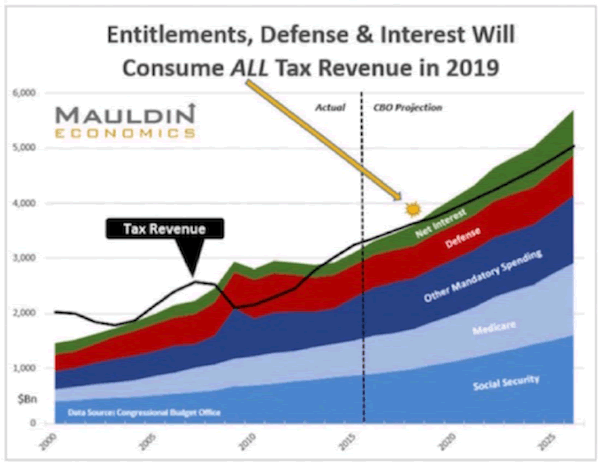

Entitlements, Defense, and Interest Will Take All Tax Revenue in 2019

Look at this chart. Under current assumptions, entitlements, defense, and interest will take 100% of tax revenues in 2019.

Which means that every penny we spend above that level will have to be borrowed, or taxes will have to be increased.

And those current assumptions? They’re optimistic.

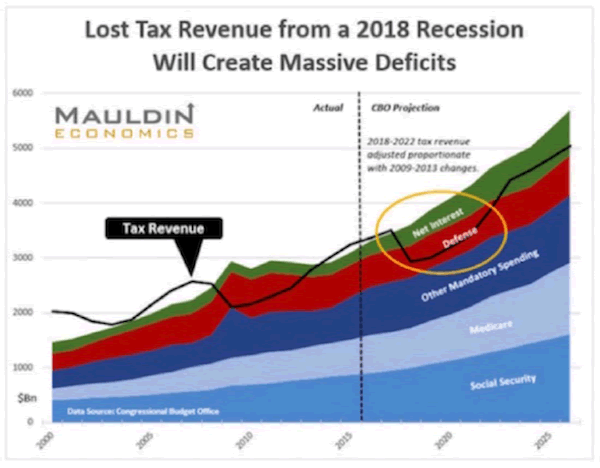

Another Recession Will Add Another $6 Trillion to the National Debt

Here’s what we got when my staff replicated the 2008–2009 Great Recession’s drop in tax revenues and assumed a recession in 2018.

First, the resulting figures have the budgeted deficit approaching $2 trillion. The off-budget deficit would be at least $500 billion and probably much more.

After a recession, we could absolutely see $6 trillion added to the national debt in three years—under an optimistic scenario.

Investors Are Expecting a Miracle

We are deep into the third-longest “recovery” since World War II. Our GDP growth is less than we have seen in previous recoveries. And that’s in part because of the size of our debt.

It is imperative to avoid a recession. Not just for the usual political reasons, but because it would truly blow out the budget, deficits, and debt. It would suck us into a downward spiral that would leave us with no good choices.

But as I wrote about in October of last year, how realistic is it to expect no recession in the next several years?

The market expects nothing less than a miracle from the coming tax and regulatory reforms, which we’ve discussed in detail. Some regulatory reforms can be done quickly, and others are going to take quite some time. It will take years for the overall effects to have an impact.

If the tax reforms end up falling short of expectations, the market will turn on a dime; and the Trump bull market will suddenly become the Trump bear market.

The Republicans simply have to deliver if they want to stay in power in two years—not to mention see Trump returned to the White House in four years. As we all know, his margin of victory was thin.

Grab the Exclusive Special Report, The Return of Inflation: How to Play the Bond Bear Market, from a Former Lehman Brothers Trader

Don’t miss out on this opportunity to cash in on the coming inflation.

Jared Dillian, the former head of Lehman Brothers’ ETF trading desk, reveals why inflationary price increases could be much higher than 1% or 2% and how you can position yourself for big profits as the bond market falls.

Download the special report now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.