Cutting US Income Taxes Will Blow Out The Budget

Politics / Taxes Mar 23, 2017 - 12:22 PM GMTBy: John_Mauldin

BY JOHN MAULDIN : The cost of health care runs well over $1.1 trillion. Social Security is almost $1 trillion. Defense spending is $620 billion.

BY JOHN MAULDIN : The cost of health care runs well over $1.1 trillion. Social Security is almost $1 trillion. Defense spending is $620 billion.

Entitlement programs for our nation’s seniors and low-income individuals and families run $550 billion. (That includes food stamps, disability, affordable housing, earned-income tax credits, childcare tax credits, and so on.)

Where do you find $500 billion that you can take from the above items to balance the budget?

Incoherent, Contradictory, Dysfunctional Voters

Americans want two incompatible things: They want their taxes reduced, and they want more benefits. Or at least, they don’t want their benefits (or those of their parents or friends) cut.

And of course, they want more GDP growth—which is inconsistent with the growing debt.

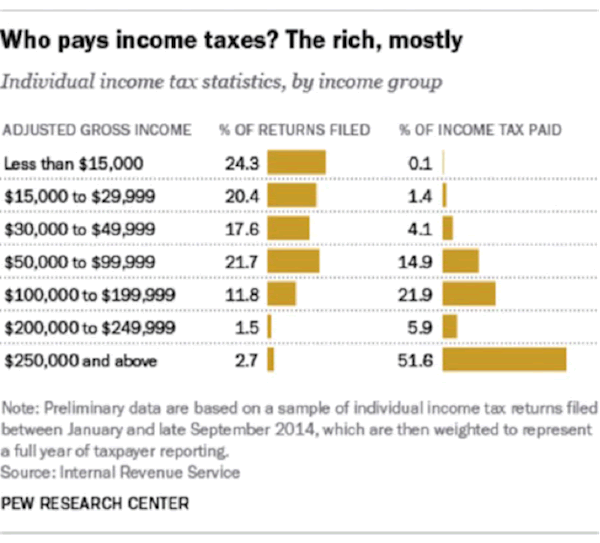

Who actually pays the income taxes the federal government collects? Look at this chart.

Almost 80% of taxes is paid by people making $100,000 or more. That means just 2.7% of the taxpayers paid 51% of the taxes. Some 62% of individual filers paid a mere 5.7% of the taxes, and their average tax rate was 4.3% (not including Social Security taxes).

The top 1% of taxpayers accounted for more income taxes paid than the bottom 90% did. If you’re going to cut income taxes, you’re going to end up cutting taxes for “the rich.”

Here is the incoherent dissonance that Republicans are afraid to address: If they’re going to balance the budget, they’re going to have to either increase revenues or cut benefits. Since cutting benefits is a political nonstarter, they’re going to have to increase revenues.

In the Best-Case, Unrealistic Scenario, We Are Still $800 Billion Short

I will give Ways and Means Committee Chairman Brady kudos for trying to do that with his border adjustment tax. Let’s look past the fact that I think a BAT will cause a global recession: Brady’s motive is good.

He certainly recognizes that in order to cut income taxes he’s going to have to go to a consumption tax of some form. Seriously, that is an extraordinarily brave position for a Republican in the House leadership to take.

That Ryan has signed on to it says that he too realizes they have to do something radical.

Yes, repealing Obamacare and really restructuring health care might save a few hundred billion here and there. Maybe. Over time. (In October, I wrote "How to Rebuild Healthcare Right.")

Great, now we’re down to needing only another $800 billion to balance the budget. And we haven’t cut personal taxes or done anything with corporate taxes. Or come up with measures to create jobs.

Wake Up, American Voter!

I would like to think that the American voter would someday wake up and become less dysfunctional. I would also like the Jobs Fairy to create another 5 million high-paying middle-class jobs.

I think both events fall in about the same range of probability… as in, not going to happen.

Clowns to the left of me, jokers to the right, and here I am, stuck in the middle with the American electorate.

Conclusion? Unless we want to blow out the debt—and we could do that (later I will talk about how we should do that if we decide to do it in my free weekly publication Thoughts from the Frontline )—we are going to have to raise revenues.

But raising income taxes is precisely the opposite of what we need to do if we want to create more jobs and investments

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.